Nvidia: $5,000 Bitcoin Could Be a 2023 Black Swan (NVDA)

by Martin Nancekievill/iStock via Getty Images

Black Swan events and thesis

Recently, Eric Robertsen, head of research at Standard Chartered Bank, made a list of a few black swan events that could happen in 2023. At the top of the list is the possibility of Bitcoin (BTC-USD) prices drop another 70% to around $5,000. And at the same time, gold prices will rise by about 30% (and full disclosure, I don’t have Bitcoin exposure, but I do have some gold exposure). His reasons are quoted below, and I see them as quite plausible:

Eric Robertsen stated in the note that considering a number of factors such as insufficient funds or bankruptcies resulting in several crypto service providers packing up, more investors are likely to start developing cold feet and will continue to withdraw their assets. This, he said, will most likely lead to investors’ attention being directed to the good old gold. Robertson predicted that the price of gold could rise to around $2,250 an ounce, which is about a 30% increase.

The rest of this article focuses on the effects of such a black swan event on Nvidia (NASDAQ:NVDA). Black Swan events, by definition, are difficult or impossible to predict, but generate sequential events, which I believe is exactly what NVDA is facing here in terms of its Bitcoin exposure.

NVDA used to report its crypto mining exposure. But it has stopped reporting it recently. Management repeatedly emphasized that cryptomining no longer generates a significant impact on NVDA in its earnings reports in recent quarters, while acknowledging that there are a number of mechanisms for potential impact. The following exchange taken from the earnings report for the third quarter of 2022 is a good example. The quotes are slightly edited with emphasis added by me.

Question from Joseph Moore of Morgan Stanley: Wonder if you could talk to looking back on the crypto effect. It’s obviously gone from your numbers now, but do you see any potential for decommissioning GPUs that are in the mining network, any impact going forward? And do you envision blockchain being an important part of your business at some point down the road?

Answer from Jensen Huang (CEO of NVDA):We do not expect to see blockchain be a significant part of our business. There is always a resale market. If you look at some of the major resale sites, such as eBay, there are used graphics cards for sale all the time. And the reason for that is because a 3090 that somebody bought today is upgraded to a 4090 or the 3090 they bought a couple of years ago is upgraded to a 4090 today. The 3090 can be sold to someone and enjoyed if sold at the right price. And so the volume of — the availability of pre-owned and used graphics cards has always been there. And the inventory is never zero. And when inventory is higher than usual, like all supply demand, it will likely drive lower price and affect the lower end of our market.

Admittedly, it is difficult to estimate the impact. But I will still try in the rest of this article. And my conclusion is that NVDA management probably underestimated the impact of a crypto crash. As you will see next, I still see large crypto effects on both the prices of NVDA (reflecting psychological influence) and also the profitability of NVDA (reflecting fundamental influence).

Historical Perspective: 2018 Crypto Crash

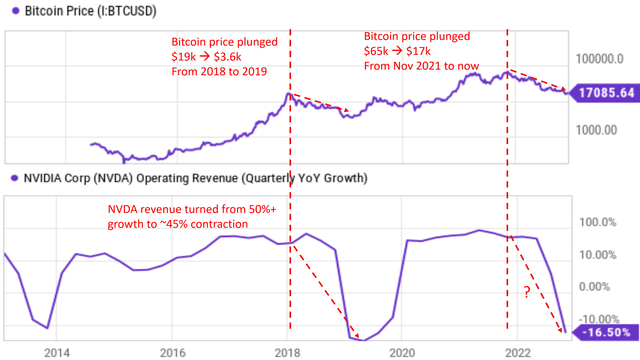

The last time we experienced a similar cryptocurrency crash dates back to 2018, as shown in the charts below. As you can see from the top panel, Bitcoin USD prices fell from ~$19k to ~$3.6k in about 1 year, which means an annual decline of 81%. And at the same time, the growth rates for NVDA’s operating income (on a quarterly basis) reversed from approx. +50% to -45%. At the time, NVDA was still reporting its exposure to crypto mining. Specifically,

quoting from NVDA’s own estimates: its crypto-related sales were around $0.6 billion (about 5.7% of total sales of $10.6 billion. While other independent analysts (such as Mitch Steves at Business Insider) gave a much higher estimate of $1.95 billion of crypto/blockchain-related revenue (about 18.4% of its then-total revenue) at the time.

Source: Author based on Seeking Alpha data

How about now?

As previously mentioned, NVDA stopped providing breakdowns of its crypto-related revenue. But my view is that management is still underestimating the impact today, just as it did in 2018, for at least two reasons as detailed below.

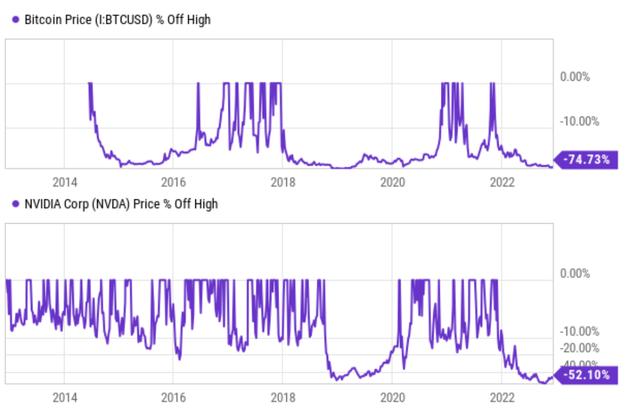

First, the stock prices of NVDA are still closely correlated with Bitcoin prices. Of course, correlation does not reveal causation. And as a result, such correlation is best interpreted as a psychological influence. But nevertheless, psychological influences are as important as fundamental effects of investing. So far since 2022, Bitcoin prices have undergone a similar correction as they did in 2028. As seen from the bottom panel of the chart above, Bitcoin prices regressed from a peak of ~$65k in late 2021 (in November) to ~$17.1k now, about 1 year to go. Such a decline translates to an annual decline of 74%, close to the 81% decline in the 2018 episode. Meanwhile, you already know what’s happened to the NVDA stock price: it corrected about 52% from its peak in about a year straight.

Source: Seeking Alpha data

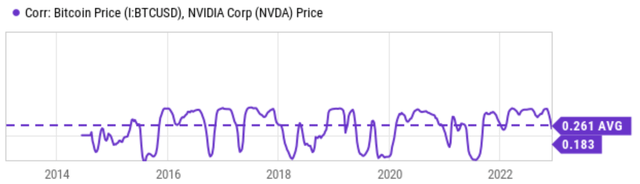

The above correlated movements are also observed over a wider time frame as shown in the next image below. This chart shows the correlation between Bitcoin price movement and NVDA price movement over the past ten years since 2014. As seen, the average correlation is positive 0.26 in the past and current establishment is positive 0.183.

Source: Seeking Alpha data

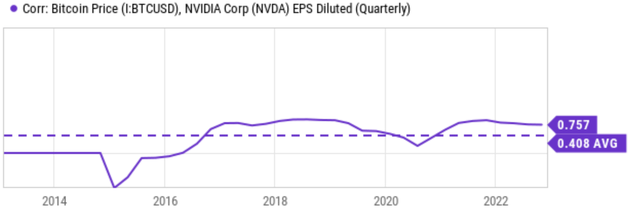

Second, the revenue of NVDA is also positively correlated with Bitcoin prices. The next chart illustrates the correlation between Bitcoin prices and NVDA’s diluted EPS on a quarterly basis. As you can see, the average correlation is even stronger at 0.408 over the last ten years. And currently the correlation is hovering around 0.757, a pretty strong level.

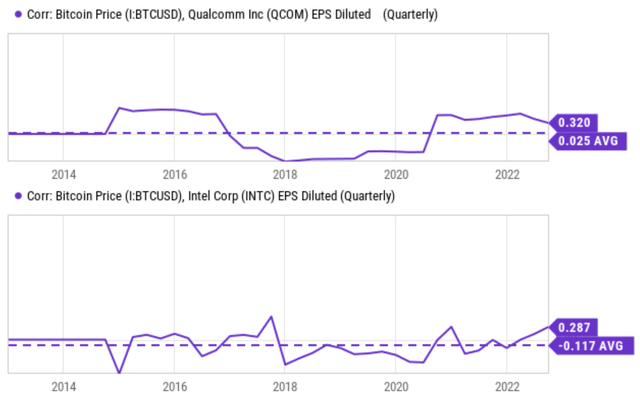

But of course correlation always equals causation. But in this case, I suspect there’s a good chance it does. As you can see from the next chart, I’m plotting the correlation between Bitcoin prices and QCOM and INTC’s diluted EPS on a quarterly basis this time. I know for a fact that these two chip manufacturers have little to no exposure to Bitcoin mining. And indeed, their EPS shows little or negative correlation to Bitcoin prices (0.025 average in case of QCOM and -0.117 in case of INTC).

Source: Seeking Alpha data Source: Seeking Alpha data

Summary of risks and final thoughts

To summarize, the peak of Robertsen’s 2023 Black Swan events is another 70% drop in Bitcoin prices to around $5,000. And I see this as plausible considering factors such as insufficient funds, bankruptcies and investors’ psychological shift to more familiar safe haven assets such as gold.

Such a Black Swan event can have a large and negative impact on NVDA prices from a combination of physical impact and also fundamental factors – which are both important and intertwined in investing. Based on my results, my view is that NVDA management is still underestimating the impact of their crypto exposure, probably as they did back in 2018. In the last year, BTC prices have fallen from ~$65k to ~$17k (translating to an annual decline of ~74%), and NVDA’s annualized (quarterly) operating revenue growth rates reversed from an expansion of ~50% to a decline of 16.5%. According to this recent Reuters report, NVDA’s supply of crypto mining chips continues to contribute significantly to sales. Meanwhile, investing in NVDA also involves significant valuation risk at this time. Its FY1 P/E is roughly 48x, more than double AMD’s 20x and nearly quadrupling that of INTC (14x) and QCOM (11x).

All in all, I don’t recommend getting involved at this point. The downside is simply too great with the combination of negative psychological effects from Bitcoin prices, earnings effects and also the valuation risk.