Nu Holdings: I’m Buying Buffett’s FinTech Play (NYSE:NU)

Kevin Dietsch/Getty Images News

company overview

Nubank (NYSE:NOW) is a recently listed company that operates in Brazil and a few other South American companies. This “neo-bank” jumped onto the scene by offering consumer credit cards. Although this may hardly seem like an innovation, we have it to understand that a large population in Brazil has been underserved in this sector. Wealth differences are large in South American countries, and a large part of the population traditionally did not have access to financing options such as credit cards. The bank earns most of its income from interest charged to the credit cards, but has expanded its offering to other banking segments, such as regular loans and insurance.

There is much to like about NU as it is growing rapidly and increasing profitability. On top of that, however, I’m particularly fond of the bank’s crypto-friendliness and the fact that Warren Buffett owns this stock.

Nubank has its own cryptocurrency in the works, Nucoin. It is currently being beta tested, but in the future will serve as a means to extend discounts and other offers to its customers. Although I don’t think this is anything revolutionary or game-changing, Nubank is making the right moves in a market that could really benefit from a more modern, democratic and accessible form of banking.

Recent results

The company has just released its results for the fourth quarter of the year, delivering a turnover rate and showing very promising trends in customer growth, revenue and profitability.

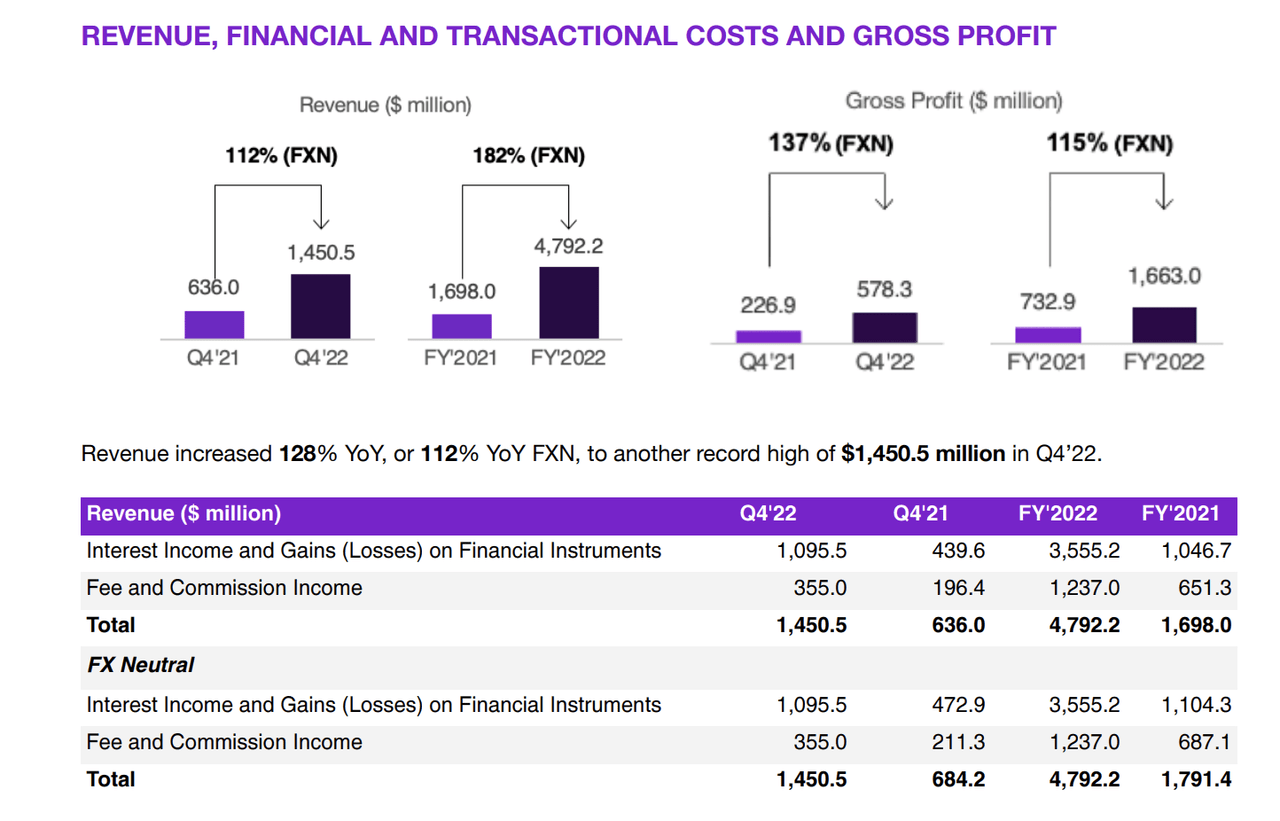

Revenues, costs and profits (investor slides)

Nubank had revenue growth of 112% year-on-year on a currency-neutral basis and a 137% increase in net profit. The company actually posted net income of $58 million, although this includes the adjustment for a “one-time non-cash recognition of the CSA termination in 2021 in the amount of $355.6 million.”

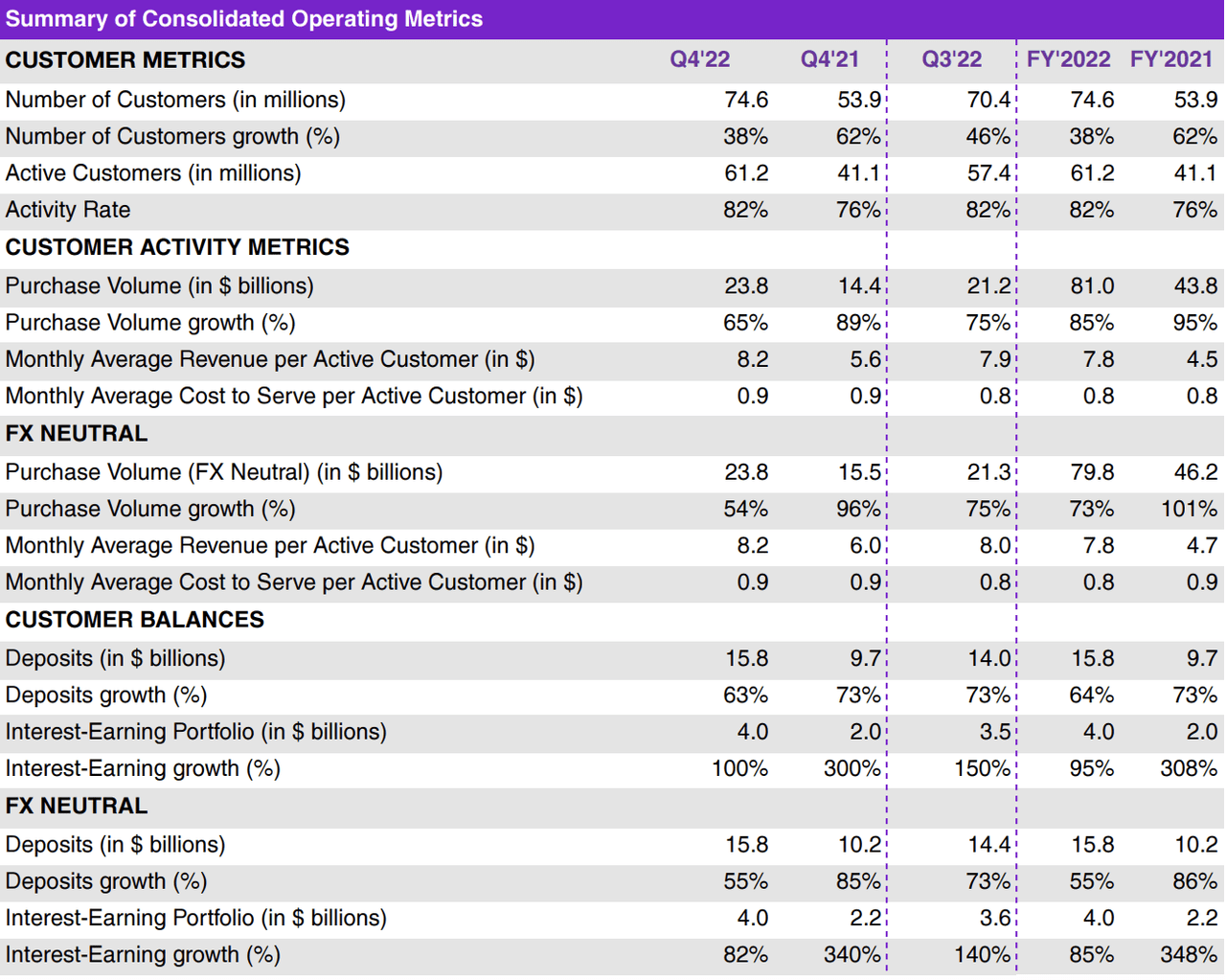

NU Financial Summary (Investor Slides)

Not only did Nubank increase the number of customers, but it also managed to increase the activity rate of customers, and deposit growth even exceeded customer growth. The increased activity is reflected in how Nu has managed to cross-sell its products, increasing the average income per active user in the process.

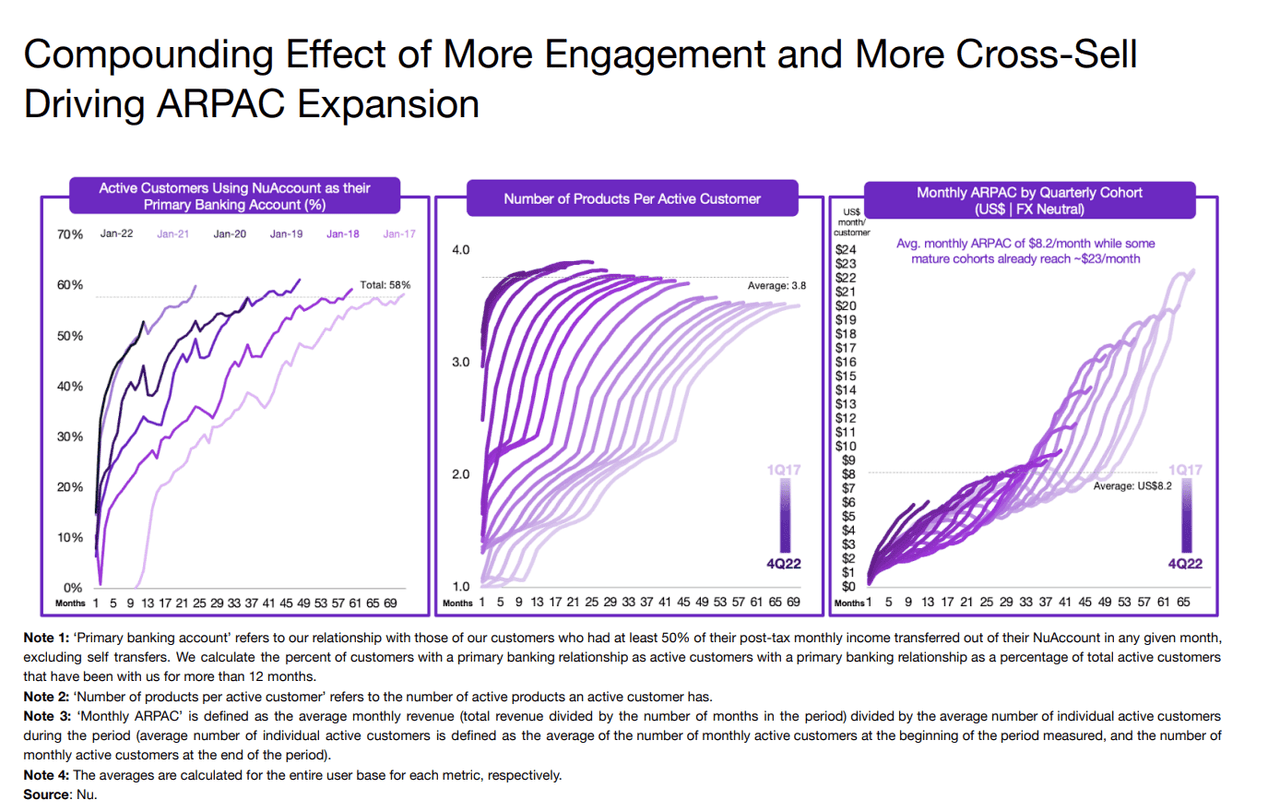

NOW ARPA (Investor Slides)

We can see that Nu customers are using other products over time and that the monthly ARPAC is growing. It’s also worth mentioning that the monthly average cost to serve per active customer remained unchanged at $0.9 year-over-year.

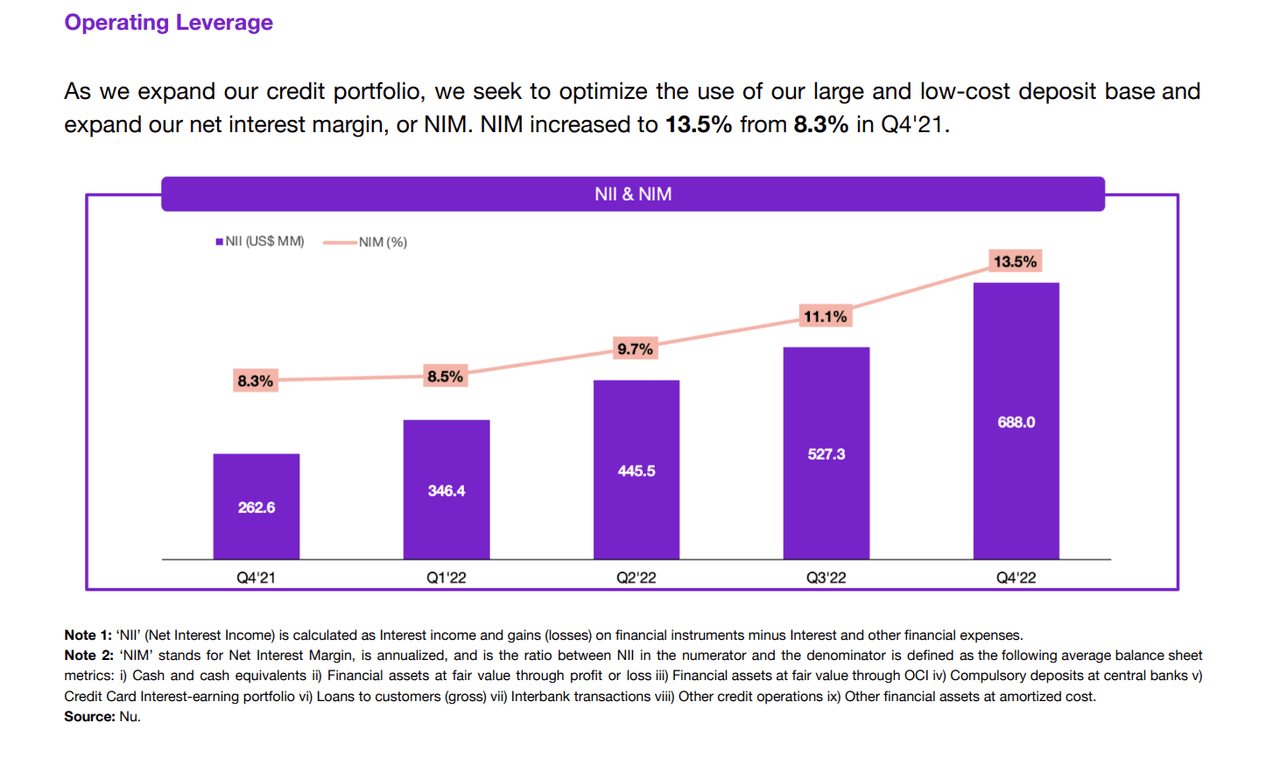

NOW operational leverage (investor slides)

And not only that, but the company has also significantly increased its net interest income margin, which says a lot about how profitable Nubank can become.

Outlook and valuation

Nubank is in a good position right now. It has found a place in the market and is using it to expand its offering to the rest of Latin America. Let’s not forget that Brazil has a population of $214 million, and Nubank is expanding into Mexico and Colombia, finding similar success so far in those markets.

Banking-as-a-service in LatAM is expected to deliver a CAGR of 20.2% from 2023-2027, so Nu has a lot of growth to reach.

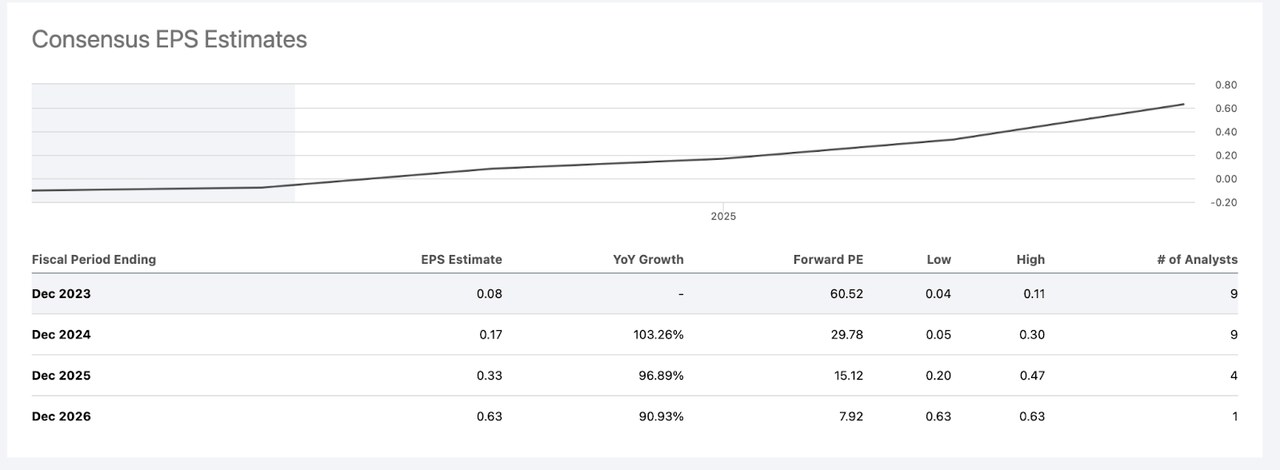

Current EPS estimates show that the company should start turning a profit in 2023.

NOW EPS (SA)

Estimates also show that income growth over the next three years should be almost 30% on average.

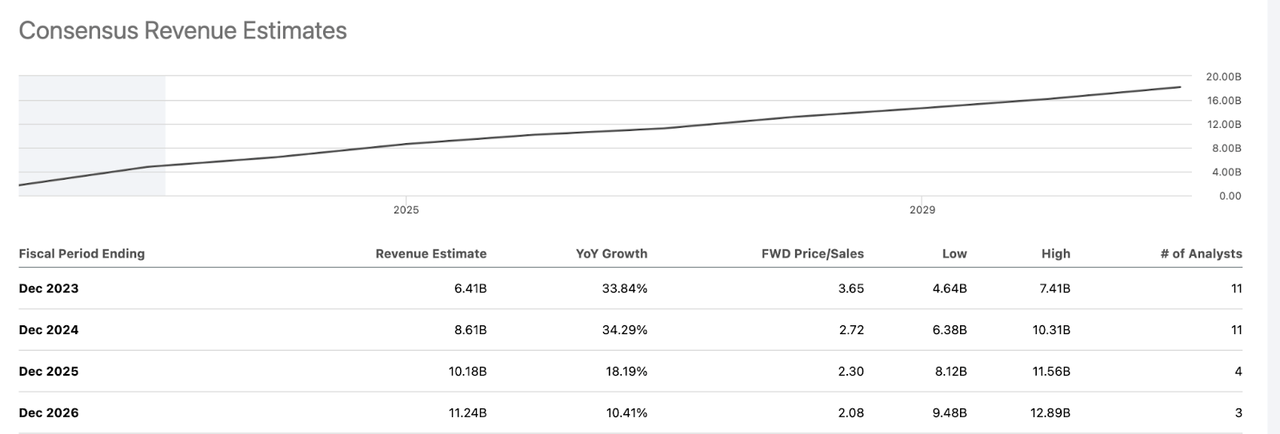

NU income (SA)

Nu is currently trading at a P/S ratio of 12, but the forward price ratio seems much more reasonable. Using these earnings estimates, assuming Nu can achieve a P/S of 6 by 2024, the price target would be $10.14 by December 2024.

I think this would be a fair multiple as it is reasonable to believe that the multiple should contract but still reflect the rapid growth in earnings.

Technical analysis

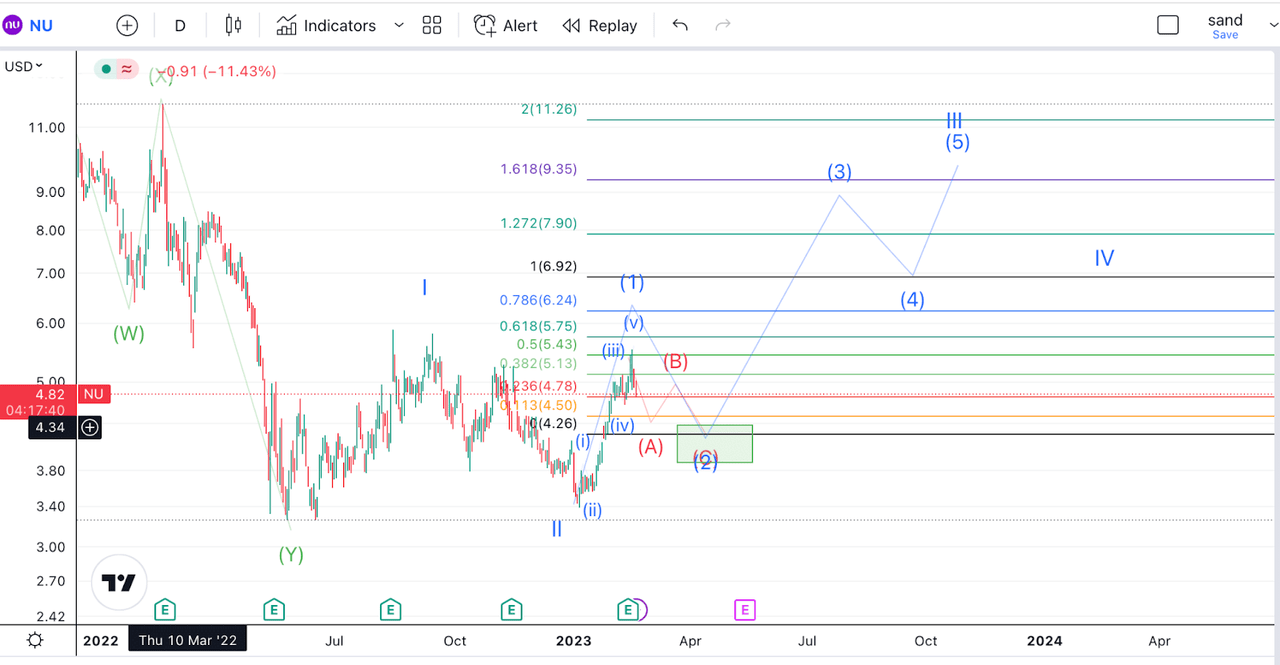

If we look at a possible Elliott Wave path for Nu, a $10 price tag also seems quite achievable in the coming years.

NU TA (author’s work)

This type of analysis is more difficult to do on companies with a short price history. However, if NU manages to hold the lows of $3.40, we can argue that the stock has put in an I-II structure, which could be the beginning of an impulse that could take us north of $11 in a largely wave III fashion.

For now, I think we could see a significant retracement in wave 2, so I would place some buy orders around the $4.5 area, just above the 50% retracement from the last rally.

Risks and other considerations

Now, we can’t finish this article without addressing the elephant in the room. Nu operates mostly in Brazil, a country that has been plagued by political instability and inflation. If Nu were an American company, it wouldn’t be a good idea to buy it, but it isn’t.

That being said, there is reason to believe that Brazil’s economy can perform well in the coming years.

Politically, the country has just undergone a tumultuous transition of power, but the worst is behind us. Lula is now president, and while some investors may see this as bad news for the market, Brazil’s central bank has come out strongly to defend its fight against inflation, despite this being at odds with Lula’s intentions.

In what can be described as a bold move, the president of the central bank gave a long interview on television to address the public’s concerns.

In a rare two-hour television appearance, Campos Neto, 53, took a battery of tough questions from six reporters and walked a diplomatic tightrope. He expressed a desire for good relations with Lula’s economic team, while refusing to heed two of its key demands: to cut interest rates and raise the inflation target. Based on the positive market reaction the following morning, his gamble paid off.

Source: bnnbloomberg.ca

The Brazilian real has been strong against the dollar, and with Brazil’s interest rate at 13.75%, inflation should continue to cool.

Overall, I think the dollar will weaken in the coming months, after a strong rally in 2022. This should help emerging markets, which already appear to be a consensus trade in 2023, with investors pouring $1 billion into them.

Remove

In conclusion, Nu shows promising results and takes the right approach in a key market in Latin America. Nubank brings banking to the people, and it is not afraid to use new technologies, such as blockchain and crypto in the process. Brazil is a risky gamble, but one that can pay off handsomely.