Nilos unifies crypto and fiat accounts for small businesses • TechCrunch

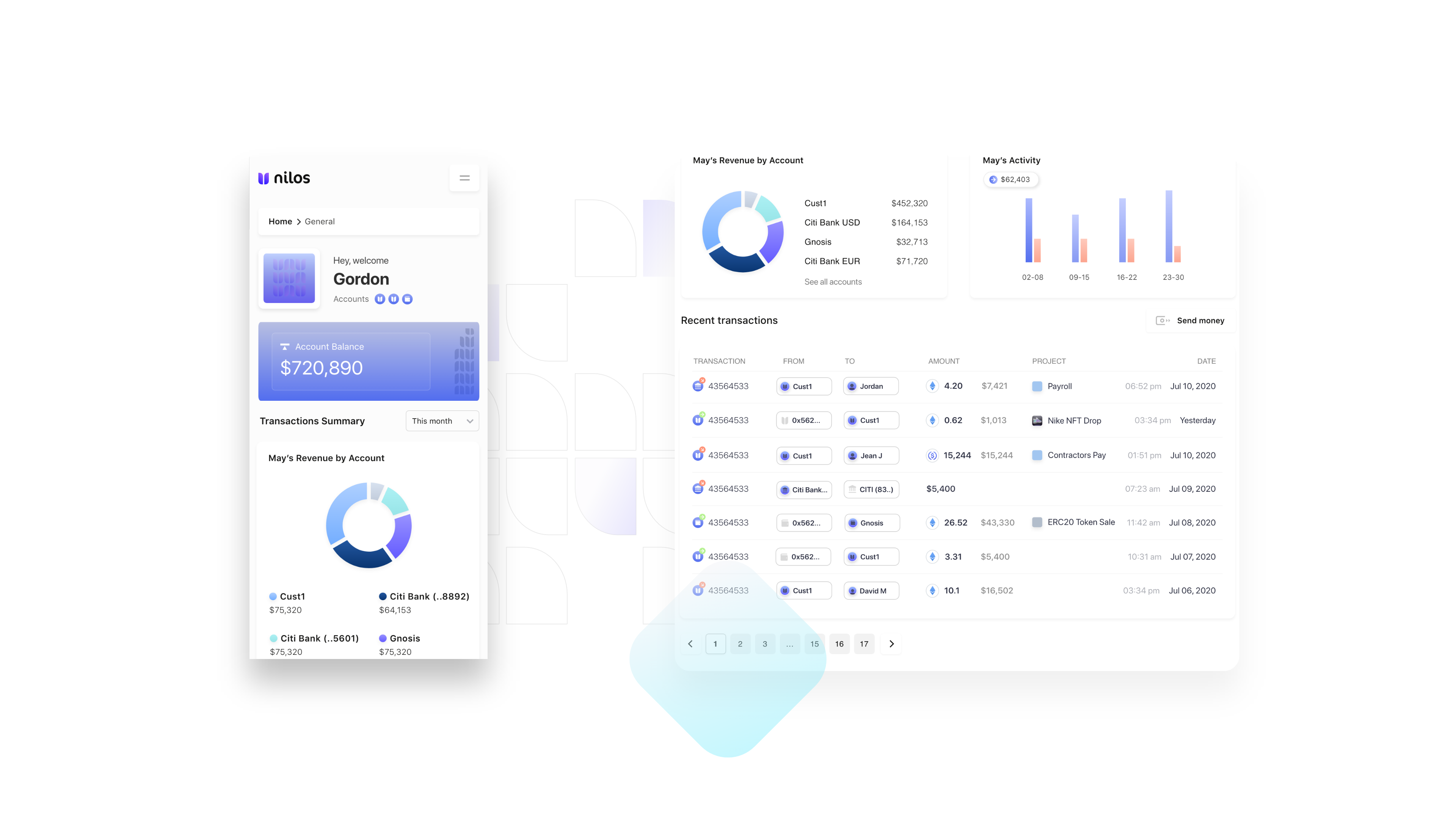

Meet Nilos, a startup that wants to bridge the gap between crypto wallets and traditional business bank accounts. The company offers a dashboard that shows all your transactions – whether they are fiat transactions or crypto payments. From this platform you can initiate payments and reconcile operations across multiple accounts.

The startup raised a $5.2 million funding round back in April. Viola Ventures and Fabric Ventures led the round, with Mensch Capital Partners also participating. Several business angels also contributed in this round, such as Yuval Tal, Sebastien Borget, Emmanuel Schalit, Benjamin Seror, Didier Valet, Guillaume Houzé, Phillipe Suchet and Valentine Baudoin.

“We started with a simple discovery. There are thousands of companies that manage cryptoassets, but there are even more companies that want to hold cryptoassets – but they think it’s too complex,” co-founder and CMO Eytan Messika told me.

And it’s true that there are many implications when you start fiddling with cryptocurrencies. There are some tax issues and some compliance requirements. Dealing with fraud is also becoming much more complex. Large companies can easily add crypto assets to their cash balance because they have enough resources – but it remains a problem for small companies.

In essence, Nilos wants to lower the entry barrier. If you’re up and running, you can create a crypto wallet with Nilos directly. In this way, clients do not need to store and manage digital assets directly.

In the future, customers will also be able to connect their own wallets directly. For example, you’ll be able to use Gnosis Safe, a popular non-custodial option for companies that hold crypto assets. Similarly, you will soon be able to connect your traditional business bank accounts in the interface.

After that, you get a nice dashboard that helps you sort through all your transactions. You can automatically filter, categorize and tag both incoming and outgoing transactions. You can also reconcile payments from Nilos directly.

Image credit: Nile

Nilos also helps you manage your crypto transactions as you can orchestrate crypto-to-crypto payments as well as crypto-to-fiat payments. You can use this feature to pay employees and suppliers, balance your treasury between crypto and fiat assets.

The startup currently charges fees on crypto-to-fiat transactions, but the company plans to move to a more traditional software-as-a-service subscription model as it is more transparent to end users. Some of the first clients are AnotherBlock, Rocket3, Metafight and Rarecubes.

Right now, Nilos is registered under the supervision of the Financial Crime Investigation Service (FCIS) in Lithuania, but the company is already planning to apply to become a virtual asset service provider in France under the PSAN scheme.

In other words, it is still early days for Nilos. But it is clear that crypto companies mostly focus on large corporate clients and retail investors. Small companies remain and underserved the market, and Nilos plans to take advantage of that.

Image credit: Nile