Nigerian fintech giant Flutterwave loses $6.4 million in hack, and traders are feeling the heat

Nigerian fintech unicorn Flutterwave is at the center of yet another financial scandal, this time bringing down digital asset traders in Africa’s largest Bitcoin market.

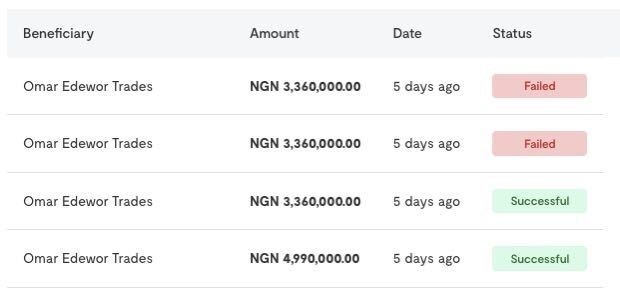

Flutterwave, a digital payments startup valued at $3 billion in its latest fundraising, was reportedly hacked recently for 2.9 billion naira ($6.4 million). The hack was flagged by some of the users who received alerts that their accounts were being emptied.

However, earlier this month the company denied the hack. It claimed that during a routine check of its systems it had identified “an unusual trend of transactions on some users’ profiles”. The review found that only users who had not enabled any of the recommended security settings had been exposed.

“We want to confirm that no user has lost any funds and we are proud of the fact that our security measures were able to resolve the issue before any harm could be done to our users,” the company claimed.

But local media has exposed the company, with dozens of its users proving that they lost millions of naira to the hackers. One of the victims, Alex Onyia, revealed to an outlet that he lost over 8 million naira ($17,400). A third attempted transaction failed as he did not have enough left in his account.

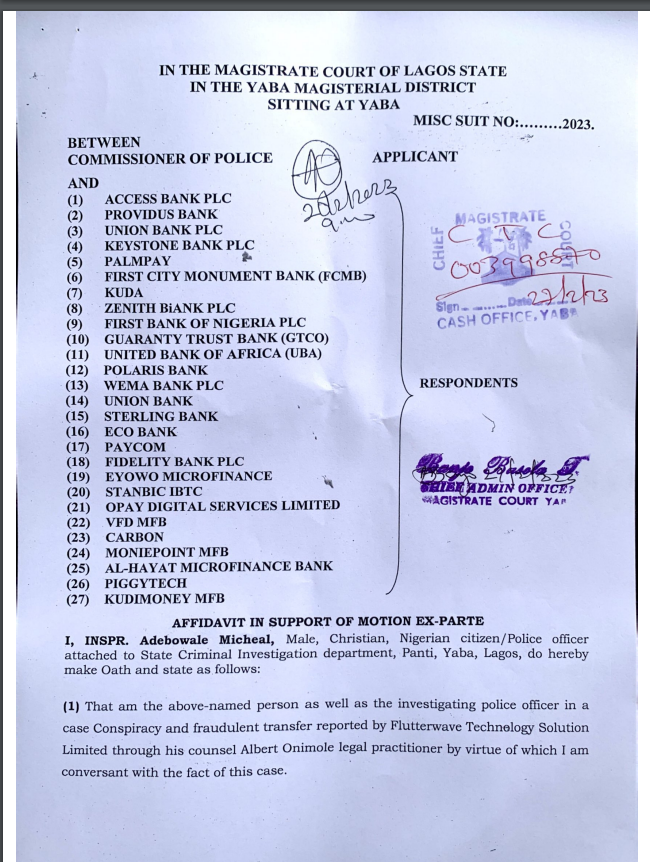

In addition, local outlets have uncovered court documents from Flutterwave’s attorney seeking an order to freeze bank accounts belonging to the hackers and third-party beneficiaries.

Flutterwave hack threatens digital currency traders

The hack, and its effects, are now being felt by the Nigerian digital asset community. Reports reveal that any bank account that transacted with the alleged hackers has been frozen. Many of them are digital asset traders.

Flutterwave’s court order extended to direct recipients, second and third recipients. It has led to the freezing of hundreds of bank accounts in 27 Nigerian banks and caused outrage in the crypto world.

In one case, what started as a routine USDT-naira trade has led to the freezing of multiple bank accounts for traders who claim they don’t even use Flutterwave. Ajeka Iliasu Opaluwa, who runs a digital asset trading firm, told a local outlet that he sold USDT worth 1.6 billion naira ($3.4 million) to a Chinese trading partner he has been trading with for over five years.

Two days after the trade was settled, he received an email from his bank informing him that his account had been frozen.

“Please let us know the source and purpose of the transaction and use evidence where appropriate,” he was told.

Other digital asset traders who have received money from Opaluwa have also had their accounts frozen. Some of them have never used Flutterwave and their plight has been exacerbated by an apparent collective reluctance on the part of most Nigerian banks to address the issue.

The freezes had a disproportionate effect on digital asset traders since a significant amount of the stolen funds went to OTC trading desks. With the country’s central bank being anti-crypto and preventing banks from processing related payments, OTC desks have become more popular in the West African country.

Now dozens of traders are worried that the outage could be a major blow to the booming digital asset industry. Nigeria is home to Africa’s largest market for digital assets, with a report claiming that 20% of the country’s 213 million residents own a digital asset.

Flutterwave is no stranger to controversy. In 2022, regulators in some of the markets it operates in, including Kenya, accused it of offering its services without a license. The Kenyan central bank froze $50 million held by the startup in 62 bank accounts. It has since received the funds back.

See: Cybersecurity A Safer World with Blockchain

width=”562″ height=”315″ frameborder=”0″ allowfullscreen=”allowfullscreen”>

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – as originally envisioned by Satoshi Nakamoto – and blockchain.