NFTs subject to retroactive taxation, says Washington State

Washington state’s recent guidance on the tax treatment of non-fungible tokens, or NFTs, will be applied to transactions going back more than a decade, the IRS said Thursday.

The question of whether the government will tax NFTs prospectively or retrospectively has swirled since the tax department issued an interim guidance statement on 1 July. However, agency officials clarified Thursday that transactions that occurred before that date will be considered taxable. Technically, the guidance goes back as far as 2009, when Washington passed sweeping legislation levying its 6.5% sales and use tax, and its Business & Occupation tax on digital products; in reality, the first NFT is believed to have been created only in 2014.

“We tax digital goods, digital codes and digital automated services. NFTs typically fall into one of these categories, Nikki Bizzarri, a tax policy specialist at the department, said in a public listening session on NFTs. “So as long as we’ve taxed digital products, and NFTs have been transacted, and there’s a nexus with Washington State, those NFTs are taxable here.”

Timothy Jennrich, the department’s assistant director for interpretations and technical advice, acknowledged that some types of NFT transactions may prove difficult to classify and tax for prior periods. He said the department is “open to hearing feedback” on issues where tax compliance would be difficult or impossible.

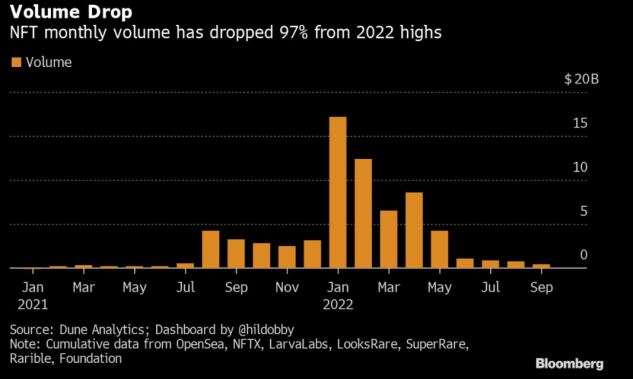

NFTs have lost their luster recently. Because many investors bought and sold them at what now appear to have been bubble prices, they could be on the hook for tax bills that exceed the assets’ current values.

The department plans to issue permanent guidance “early next year,” Jennrich said.

NFTs are unique digital assets registered on a blockchain that act as certificates of authenticity for digital products and services. In addition to Washington, only Pennsylvania, Minnesota, and Puerto Rico have issued guidance statements drawing NFTs into their tax codes.

The NFT craze sent trading volume for the digital assets to a record $17 billion in January 2022, but volume has since fallen, reaching just $466 million in September, according to data from Dune Analytics. The decline in NFT trading is part of the broader selloff in cryptoassets that has followed the tightening of monetary policy by the Federal Reserve and other central banks.