NFT sold the land and brought in a bucket of profit

by James · May 15, 2023

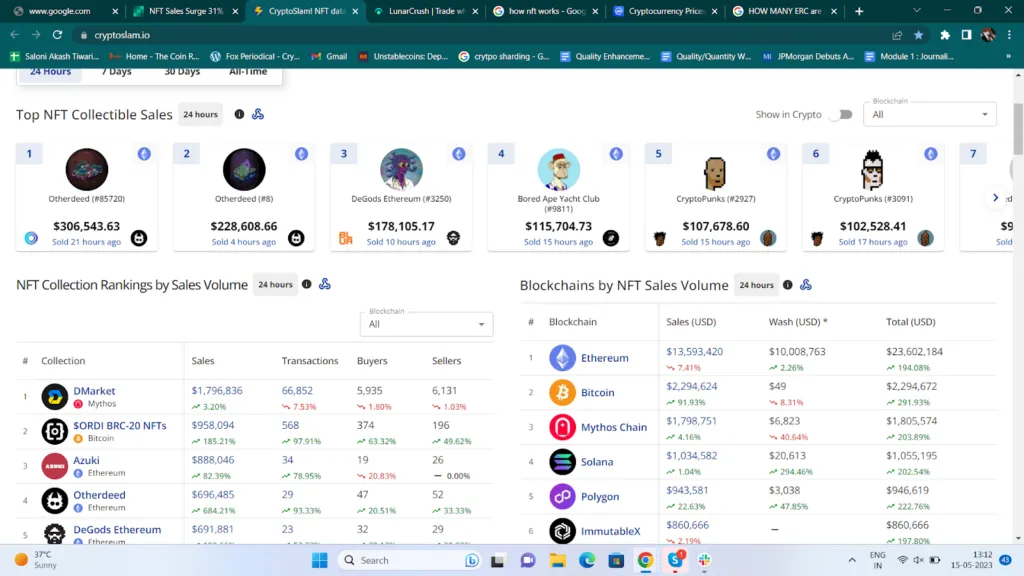

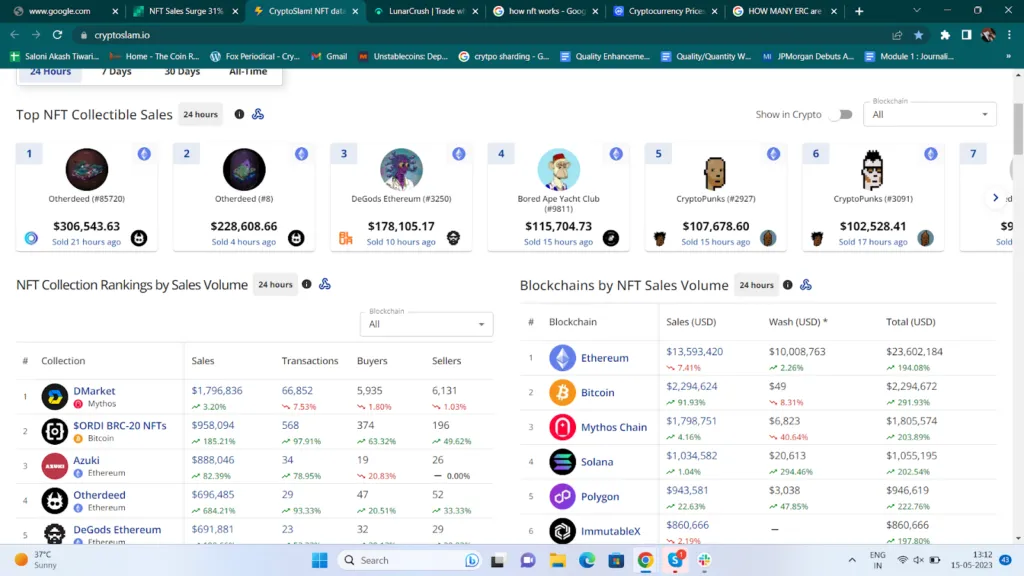

Weekly observations of the Non-fungible Token market show the increase in the volume percentage of NFT. There has been an increase of 31% in the market. The ranking shows that Ethereum is, as I said, the king of NFT. The sales values rank in the millions of dollars, where the artist earns through his creativity on this online market. User-known NFTs can be

- Digital artwork.

- In-game items.

- Essays and articles.

- Virtual fashion items

- Tickets and coupons.

- Digital collectibles.

- Domain name.

The above are the common NFTs through which the sellers get or earn their profits. Ethereum as a holistic ecosystem has been an improvised and well-accepted format for blockchain, where trading takes place crucially by buyers and sellers.

NFTs sold – rate

The 24-hour updates of the NFT collector’s sale show the rankings. Otherdeed NFTs (O’NFTs) secured the first two positions. The latest news on the sale of Otherdeed saw a sale of $306,543.63 and the second highest went for $228,608.66. DeGod’s Ethereum was third with 4,178,105.17 and Bored Ape Yacht Club ranked 4th with $11,704.73. The last in the top five rankings was CryptoPunks sold 15 hours ago before writing this article which amounted to $107,678.60.

Otherdeed became the star performer in the 24-hour time frame. Otherdeed’s equations and summations from the last 24 hours show that the sale of these NFTs has had an increase of 668.12% which totaled $697,825.00. With a decrease in number. of owners, the NFT tops are left to be a total of 19,303. But the share of other buyers has increased by 45.16% and that of sellers by 7.69%. Otherdeed’s collection of outstanding NFTs has all the game features. Individually, Otherdeed has a set of riches, but some are scarce which include Koda in what is an acronym for Kid of Deaf Adult.

NFT Market – Workology

The NFT owners obtain profits either through royalties or stakes. Every time NFT is sold, the owner gets his share as ‘Royaly’. On the other hand, staking is the part where an investor’s investment is opened in the market. The exchanges have the digital currency format and these owners of NFTs or coins open their funds for trading. In return, they receive interest on their investments. The amount of this investment is what makes the market formulate.

Smart contracts make NFT stand out. They also allocate and reallocate inventory. Smart contracts transfer titles for NFTs on the condition that an NFT is sold, transferring it from the old to a new buyer. These NFTs have been a great sell from previous date. The sales volume here for Mythos has been on a maximum rise. Bitcoin’s $ORDI BRC-20 ranked second. When we take the scenes of the top five here, it clearly shows the increased percentages of sales in the NFT market. The majority of coverage is undoubtedly on Ethereum. The maximum sale has gone to $1,796,836, although the number of transactions, buyers and sellers had seen certain percentages of decline. Bitcoin on the other hand has only given an increased percentage and it increased no.

Bitcoin-based NFT sales gain decisive momentum. Bitcoin NFT sales have emerged as an imperial supporter in the digital collectibles sales landscape. The total amounts to a total of 21 different blockchains.