Non-fungible token (NFT) sales picked up slightly last week, increasing 1.23% to $232.49 million in recorded sales. The top two NFT collections, Otherdeed and Doodles, saw growth of 44% to 58% compared to last week. Ethereum continues to dominate the NFT industry, accounting for more than 81% of total sales last week with $188.51 million in NFT sales.

7-Day NFT Sales Increase; Otherdeed, Doodles See 44% to 58% growth

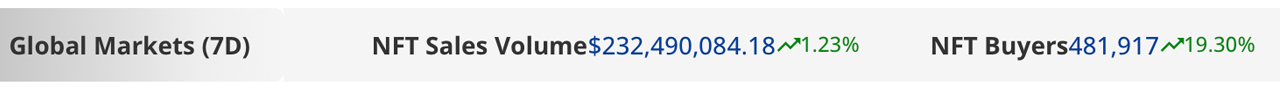

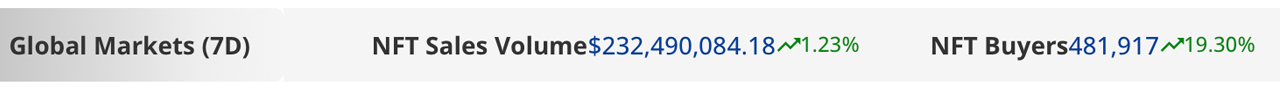

NFT sales remain steady this week and throughout February 2023, with $39.72 million in recorded sales so far this month. Over the last seven days, there were $232.49 million in NFT sales, an increase of 1.23% compared to the previous week.

During that time, 481,917 buyers participated in NFT sales, 19.30% more than last week. In addition, 1,390,784 NFT transactions were processed, an increase of 3.21% from the previous week. Of the $232.49 million in sales, Ethereum had the most out of the 20 blockchain networks listed on cryptoslam.io.

Ethereum accounted for 81% of total NFT sales, or approximately $188.51 million in settlements. The second largest blockchain for NFT sales was Solana, which processed $27.40 million in the last week, down 2.65% from the previous week. Immutable X ranked third in NFT sales, with sales rising 37.85% to $4.5 million.

The remaining top NFT selling blockchains, in order, are Cardano, Polygon, Flow, BNB Chain and Arbitrum. Fantom saw the biggest increase in NFT sales this week, with an increase of 73.81%, although only $17,064 in NFT sales were settled in the last seven days.

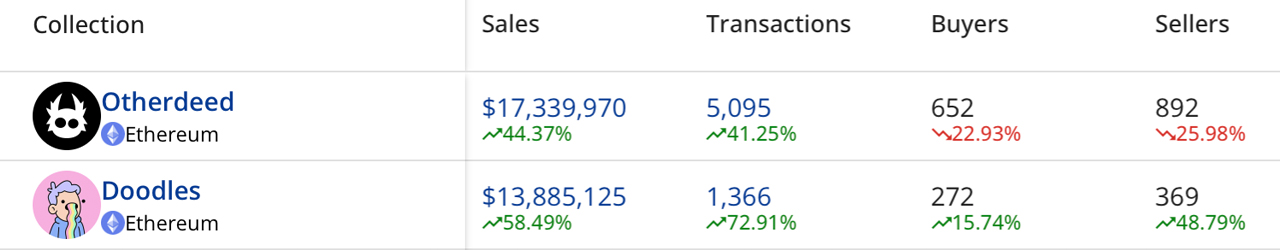

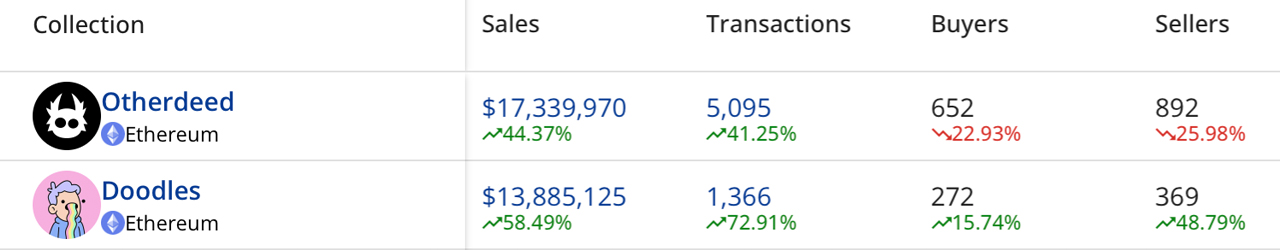

In the past week, the top NFT collection was Otherdeed, with sales rising 44.37% to $17.33 million. Doodles saw a 58.49% increase, reaching $13.88 million in total sales. Otherdeed and Doodles were followed by Mutant Ape Yacht Club (MAYC), Bored Ape Yacht Club (BAYC) and Checks VV Edition.

The highest NFT floor value on February 5, 2023 was for Cryptopunks, at 63.99 Ether at 8:00 AM Eastern Time. The second highest floor value belonged to the BAYC collection, with a slightly lower value of around 63.5 ether.

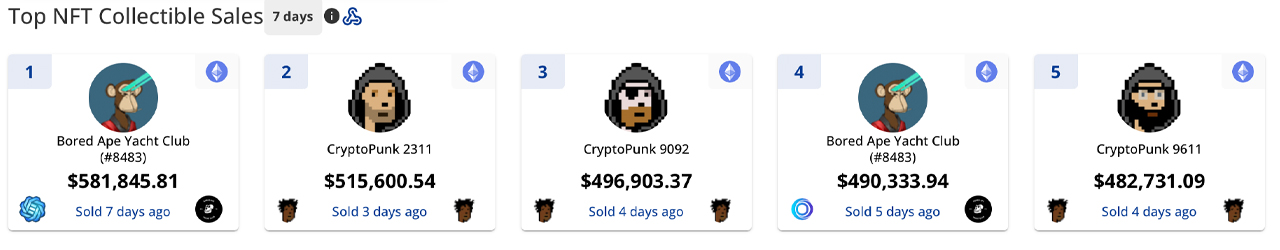

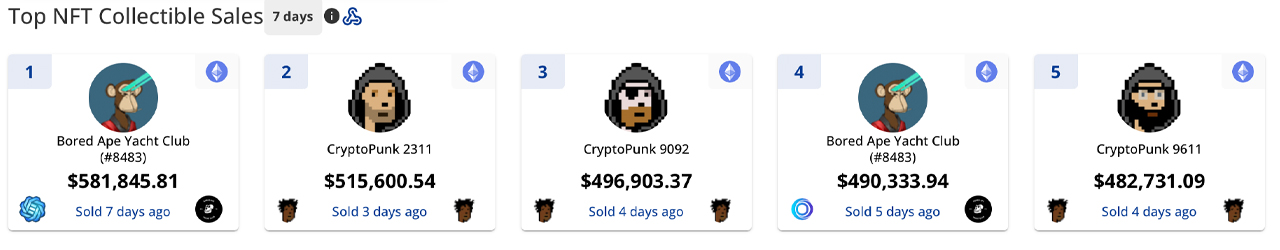

The most expensive NFT sales from the past week include: Bored Ape Yacht Club #8,483, which sold for $581,000 seven days ago but then sold again for $490,000 two days later; Cryptopunk #2,311, sold for $511,000 three days ago; Cryptopunk #9092, sold for $496,000 four days ago; BAYC #8,483, which makes the fourth biggest sale after being sold twice; and Cryptopunk #9,611, sold for $482,000 four days ago.

The fifth most expensive sale was Cryptopunk #9,611, followed by Hausphases #379, which sold for $461,000 on Sunday, February 5, 2023.

Tags in this story

311, 483, 611, 63.99 Ether, 73.81% Increase, 81% Total Sale, Arbitrum, Blockchain, BNB Chain, Bored Ape Yacht Club, Bored Ape Yacht Club #8, Cardano, Checks VV Edition, Cryptopunk #2 , Cryptopunk #9 , Cryptopunk #9092, cryptopunks, Digital Collectible Sales, Digital Collectibles, Doodles, Ethereum, Ethereum dominance, Fantom, Flow, growth, Hausphases #379, Immutable X, Mutant Ape Yacht Club, nft, NFT collections, NFT -sales, NFTs, Non -fungible Token, Otherdeed, Polygon, sales, sales increase, Sales NFT, Solana

What do you think will be the next big NFT collection to make waves in the market? Share your thoughts in the comments below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons, cryptoslam.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.