NFT Market Aggregators: How Popular Are They and What Meaning Do They Have for Less Popular Marketplaces?

What are aggregators?

NFT market aggregators are platforms that allow users to browse and discover NFTs from several different marketplaces. These aggregators consolidate listings of NFTs from marketplaces, making it easier for users to find and buy NFTs and saving users time and effort from comparing listings across multiple different marketplaces.

Aggregators also allow traders to buy NFTs across pools and marketplaces in a single transaction, saving users time and gas fees if they buy more than one NFT.

Aggregator share in NFT trading volume

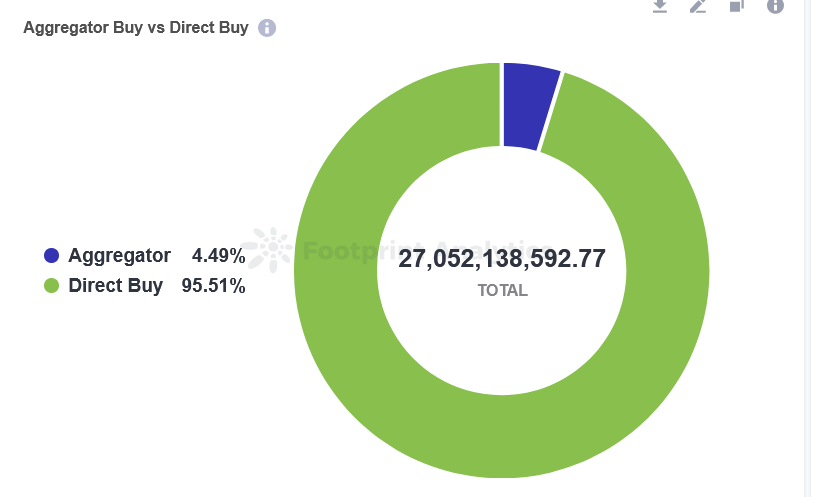

Figure 1 – Market share of aggregator trades in all NFT trade volume on Opensea, Looksrare and X2Y2 since the launch of Genie.xyz (wash trade filtered) Source: Footprint Analytics @Hanson502

The first ever NFT aggregator, Genie.xyz, was launched on November 17, 2021. Figure 1 shows the volume share of aggregator trades in the NFT market after the first aggregator ‘Genie.xyz’ went live in November. The data includes Blur.io, Gem.xyz and Genie.xyz aggregators and Opensea, X2Y2 and LooksRare marketplaces. Laundry transactions are filtered.

As we can see from Figure 1, aggregators make up 4.49% of NFT volume. This indicates that aggregators are not really widely used among NFT buyers, even though it has better features than marketplaces. If we include wash trade transactions as shown in Figure 2, aggregators account for only 2.3% of all volume on the marketplaces since Genie.xyz launched.

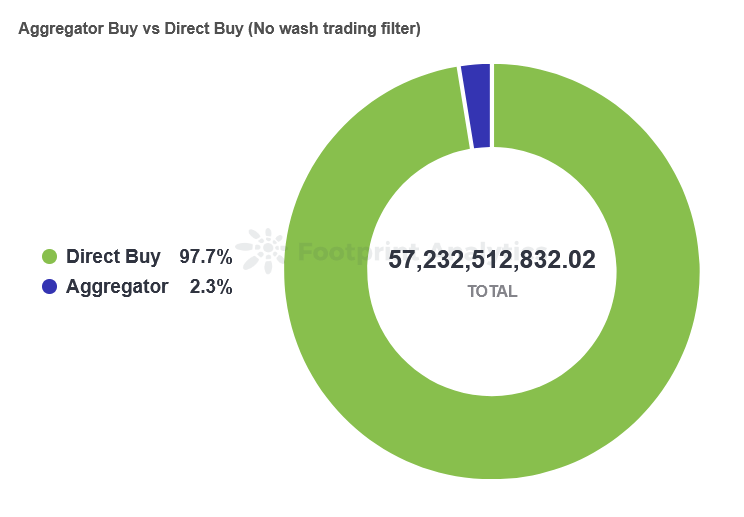

Figure 2 – Market share of aggregator trades in all NFT trade volume on Opensea, Looksrare and X2Y2 since the launch of Genie.xyz (without filtered laundry trade) Source: Footprint Analytics @Hanson502

However, wash trade transactions are also detected in trades through aggregators. 7.43% of the volume of aggregators is detected as laundry trade transactions. Note that when laundry trade transactions are filtered in Figure 1, the laundry trade transactions through aggregators were also removed.

Figure 3 – Wash trade volume % of all aggregator transactions Source: Footprint Analytics @Hanson502

Aggregator use on marketplaces

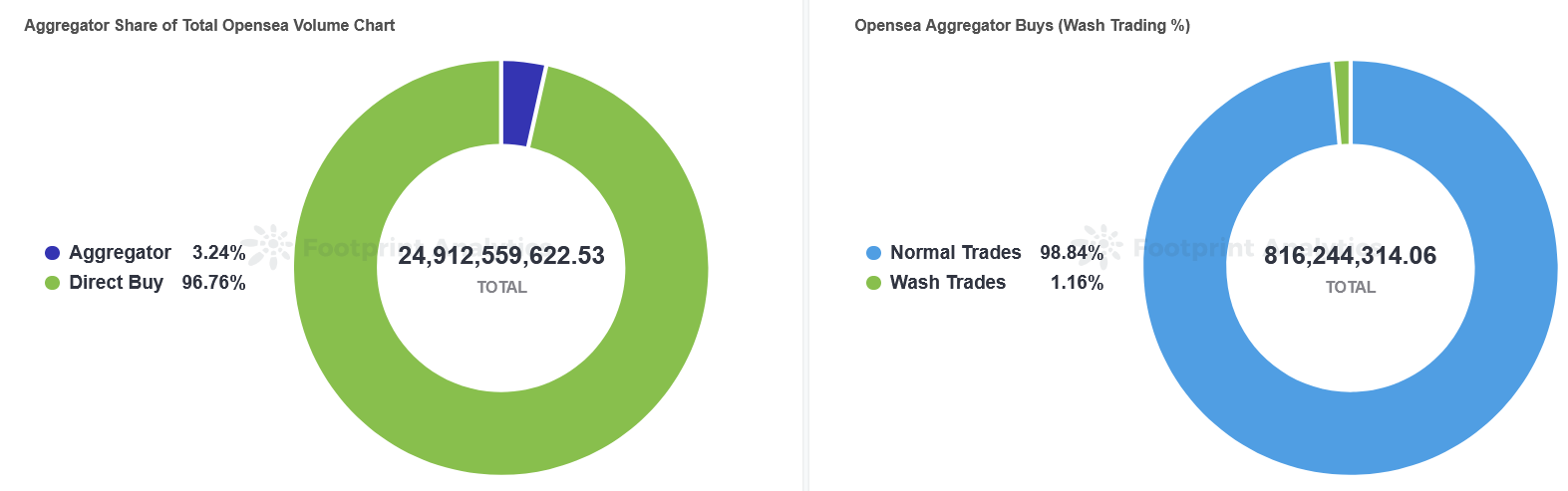

Figure 4 – Aggregator volume % of all Opensea NFT transactions since Genie.xyz launch (Wash trade filtered) & wash trade % of all aggregator transactions to Opensea. (Source: Footprint Analytics @Hanson502)

In terms of volume, only 3.24% of NFT purchases on Opensea are transacted through aggregators. Being the most popular marketplace, Opensea does not need to rely on aggregators to increase their NFT listing exposure to NFT buyers. Almost all aggregator trades on Opensea are normal transactions, people do not use aggregators to launder trades on Opensea.

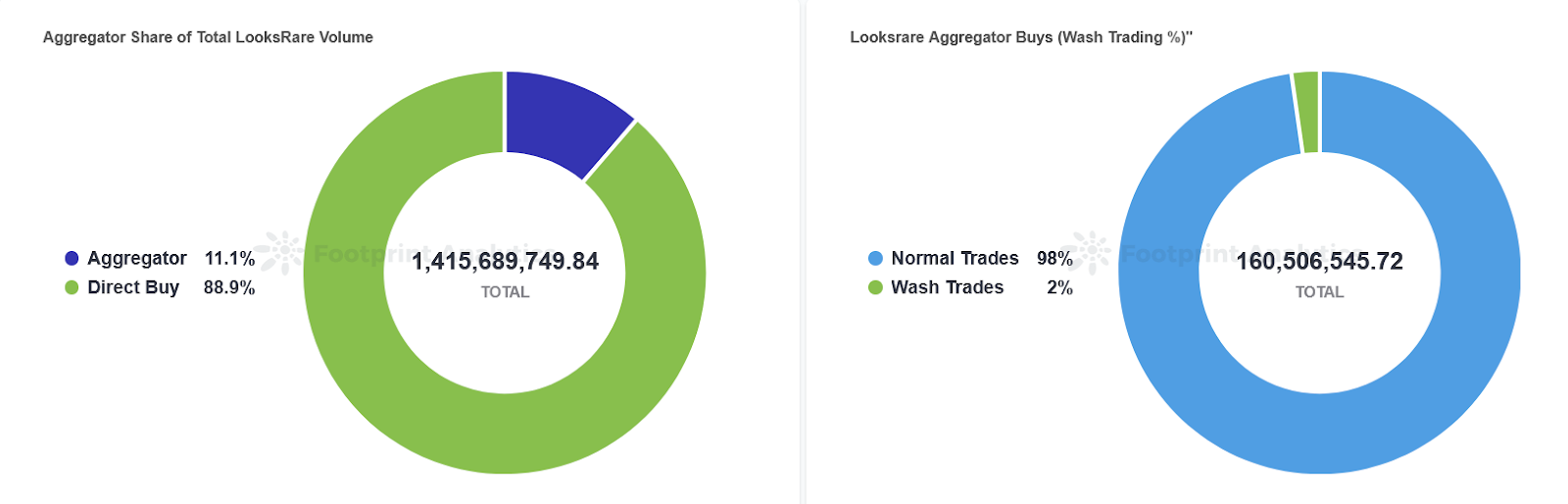

Figure 5 – Aggregator volume % of all LooksRare NFT transactions since Genie.xyz launch (Wash trade filtered) and wash trade % of all aggregator transactions to LooksRare. (Source: Footprint Analytics @Hanson502)

In terms of volume, 11.1% of NFT purchases on LooksRare are transacted through aggregators. Like the other popular marketplace, LooksRare relies more on aggregators than Opensea.

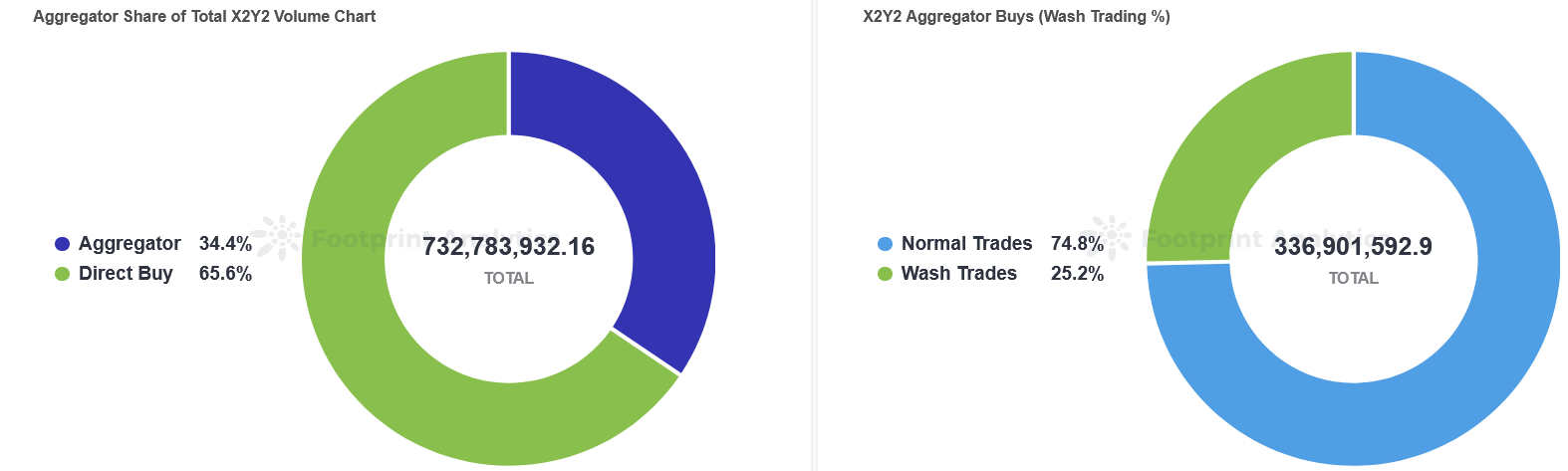

Figure 6 – Aggregator volume % of all X2Y2 NFT transactions since Genie.xyz launch (Wash trade filtered) and wash trade % of all aggregator transactions on X2Y2. (Source: Footprint Analytics @Hanson502)

In terms of volume, 34.4% of NFT purchases on X2Y2 are transacted through aggregators, i.e. ⅓ of the volume on X2Y2 after the wash trade is filtered. Moreover, Figure 6 shows that 25% of the aggregator volumes on X2Y2 are laundry trade transactions. Wash traders use aggregators to wash trade on X2Y2.

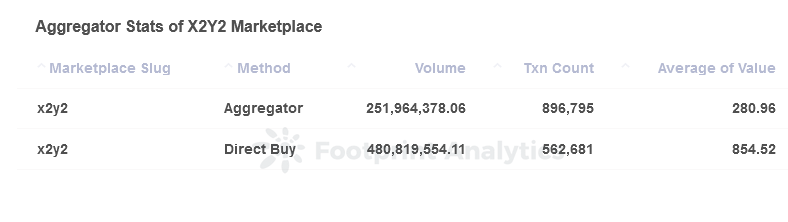

Figure 7 – Trading statistics for all X2Y2 NFT transactions since Genie.xyz launch (Wash trade filtered) (Source: Footprint Analytics @Hanson502)

Looking at Figure 7, X2Y2 has more NFT transactions through aggregators than direct transactions on the marketplace. The average value per aggregator transaction on X2Y2 is much less than direct transactions. This is because NFT wash traders trade low-value NFTs repeatedly to create a false sense of volume and liquidity for NFT pools they launched, resulting in relatively low-priced transactions with high transaction frequencies.

Takeaways

- The aggregated data of aggregators tells us that they are not really widely used among NFT buyers

- Aggregator purchases make up a larger proportion of trading volume on less popular marketplaces than on popular marketplaces such as Opensea.

- X2Y2 relies mostly on aggregators and people also use aggregators to wash transaction volumes for trading NFT collections on X2Y2.

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Footprint website:

Disagreement:

Disclaimer: Views and opinions expressed by the author should not be considered financial advice. We do not provide advice on financial products.