NFT investors dump cratered tokens on marketplaces for tax write-offs

Thousands of investors with near-worthless non-fungible tokens, or NFTs, rushed to tax-loss-harvesting marketplaces in the final days of last year, dumping their once-expensive digital collectibles to offset gains other places in their portfolios.

That created an opportunity for at least two online platforms that were launched to do something counterintuitive – create liquidity for assets that are by design illiquid and non-fungible. While most markets benefit from growth opportunities for tradable assets, these platforms were quickly launched to help investors realize losses during a year where NFTs saw both a boom and a bust.

Business was brisk on both platforms as investors raced the year-end tax deadline to sell their unique digital assets for a fraction of a penny after buying them for hundreds or thousands of dollars earlier in the year.

After launching in November, the website Unsellable captured nearly 18,000 NFTs, acting on its mission to support beleaguered NFT investors and build “the world’s largest collection of worthless NFTs.” Another platform, NFT Loss Harvestooor, developed by cryptocurrency tax software company CoinLedger Inc., launched a few weeks later and bought 5,000 NFTs, worth a total of $1.3 million at the height of a bull market. After sending these tokens to the “NFT graveyard,” CoinLedger customers could save up to $380,000 in tax savings, according to the company.

“Unfortunately, there is a lot of junk in the market that dilutes the possibilities of what NFTs can do,” said Skyler Hallgren, one of Unsellable’s founders. “So we saw an opportunity to clean up that space and create some real value for investors and allow them to realize their losses in legitimate ways.”

Kirk Phillips, CEO of consulting firm Global Crypto Advisors, called the platforms the digital economy’s equivalent of a “flea market,” offering a much-needed tool to shore up a failing asset class.

“You’re meeting a need, and it’s a very simple solution,” said Phillips, a member of the American Institute of CPAs’ Virtual Currency Task Force.

NFTs succumb to gravity

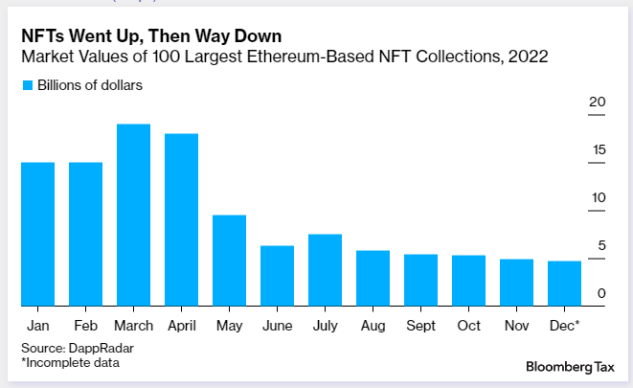

NFTs, digital assets that act as certificates of authenticity for artwork, music, tickets and collectibles, had a rough year after ending 2021 as a superstar. The market for NFTs fell throughout the year, reacting to investor uncertainty and a series of scandals that eroded the value of cryptocurrencies, which are essential for most NFT transactions. The crash was a moment of gravity after the celebrity-driven hysteria that bubbled in 2021 and the first quarter of 2022.

According to research firm DappRadar, 2022 began on a promising note with NFT trade volumes rising to a record high of $12.4 billion during the first quarter. A steady decline followed, with $8.4 billion in trading volume for the second quarter, $2.7 billion in the third quarter and $1.2 billion in the final quarter.

As 2022 drew to a close, executives at Unsellable and CoinLedger said they were frustrated by the lack of a rational system for investors to offload their NFTs and recognize their losses.

“NFT volume on OpenSea had fallen by 85%; prices had also fallen off a cliff,” said Lucas Wyland, CoinLedger’s co-founder and chief technology officer. “So we wanted to build a smart contract and an open tool to help NFT traders realize some of those losses for illiquid NFTs that has no value on paper anymore.”

Tax loss harvesting

While tax loss harvesting is new in the NFT context, Hallgren and Wyland said it is common practice with other assets as investors seek to minimize capital gains tax liabilities. An investor may have gains from selling stocks, real estate or cryptocurrency and can strategically offset these gains by selling a declining or worthless asset elsewhere in their portfolio. The losses can offset an unlimited number of gains from the same year.

For example, one investor buys two NFTs for $1000 each. An NFT doubles in value and is later sold, creating a $1000 capital gain for the investor. The other NFT loses its value, and no party is willing to buy it. The investor sells the token to Unsellable or CoinLedger, creating a loss of $999.99. Assuming there are no other asset transactions for the tax year, the investor reports a short-term capital gain of $0.01 and pays the ordinary tax rate. Assuming a federal and state tax rate of 33%, the taxpayer achieved $330 in tax savings by harvesting.

Tax loss harvesting can also be worth a year when the NFT investor has no capital gains, or losses that far exceed any gains. Under current Internal Revenue Service rules, taxpayers are allowed to carry forward net losses up to $3,000 per year indefinitely until the entire loss is used up.

Although NFTs are relatively new, tokens held for more than a year and sold at a loss will be subject to long-term capital loss rules. Typically, taxpayers can deduct up to $3,000 of the loss against other forms of income.

Tax loss sales of NFTs over Unsellable are transacted in the cryptocurrency ether (ETH). The platform pays 0.0000064 ETH for a worthless token, less than a penny. It also requires a platform fee and a gas fee, which is required for any contract executed over the Ethereum blockchain.

The new tax loss providers may help investors resolve some of their federal and state income tax issues from investments in NFTs, but they may have some lingering state sales tax issues to resolve. A handful of states including Minnesota, Pennsylvania and Washington have said that NFTs must be characterized exclusively as taxable digital products and potentially subject to retroactive taxation.

Bullish on NFTs

Despite the NFT collapse last year, both Hallgren and Wyland remain positive. Tax-loss-harvesting platforms, they said, represent a chapter in the evolution of NFTs that may be unnecessary in a few years.

“I think the core technology has a ton of utility,” Wyland said. “What we saw in 2021 was a big overhyped cycle where greed took over the investment decisions people made. If we look at the long-term horizon, three to ten years, we will see real application results.”

Hallgren agreed, noting that the most important use cases have not been created and will not involve digital cartoon characters or virtual tickets to rap concerts.

“It’s a moment to clear out the low-quality projects that have crowded this space,” he said. “There are a lot of people doing really innovative work on use cases for NFTs and in ways that can really change the world.”