NFT: Even Blue Chips Keep Falling

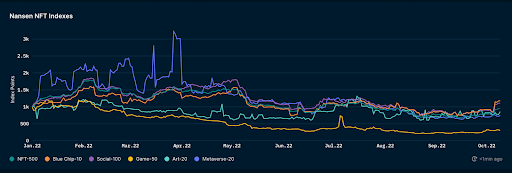

The The NFT market has fallen down more and more, registers double-digit drop in USD so far this year with Blue chip especially collections that experience the least inconvenience in September 2022.

Revealing this data about non-fungible tokens is a report published by Nansenan industry-leading blockchain data analytics platform.

The The NFT marketlike most global financial markets, has suffered from a sharp downturn and rising inflation.

It has resulted in increased volatility across all categories of NFTs, including the top 500 projects which reported a -20.6% loss as of 30 September 2022.

Gaming and Blue Chip NFT Markets

Taking a deeper look at the sectors experiencing less volatility, the report points to a -7.8% reduction inn top 10 Blue Chip NFT projects, as well as in social NFTs which were only down -7.9%.

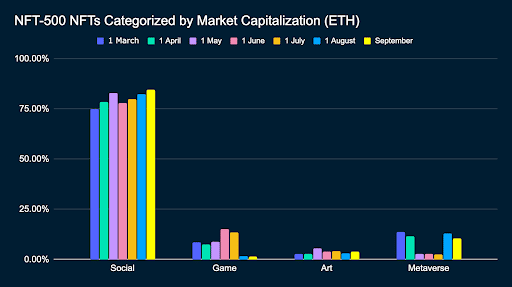

In the composition of the NFT-500 (ETH) index, we see that the weighting of social NFTs continues to increase in Q3.

Similarly, this was the case for Metaverse NFTs, although there was a slight decrease in weighting in the last month of Q3 (September). Art NFT’s weighting remained relatively stable in the NFT-500 (ETH) index, with a small increase in September. Finally, gaming NFTs fell significantly in weighting for Q3, in line with the significant drop in market cap as an NFT sector.

But NFT gaming projects reported the worst performance with a decline of -71.8%. However, the index also indicates that the market in the last 30 days of September experienced a small increase.

The report further shows that Blue Chip NFTs remained the least volatile and can be attributed to notable Blue Chip NFT sales such as BAYC #6388 – sold for 869.7 ETH, with a profit of 809 ETH, held for 377 days or CryptoPunks #3614 – sold for 275 ETH, with a profit of 265 ETH, in Q3 is a likely factor that contributed to the Blue Chip projects experiencing the least downside so far this year.

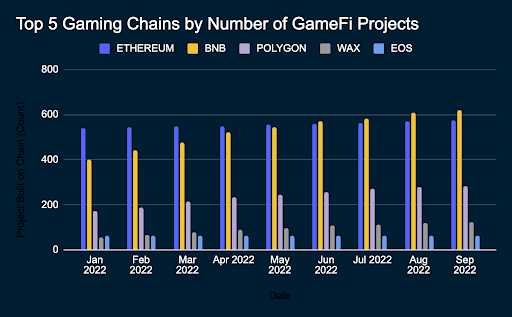

Compared to a previous analysis from Q2, the gaming and art ecosystems have seen a slowdown in overall growth.

The the gaming sector saw the biggest decline in performance so far this year compared to other NFT fields.

In the last week of the 3rd quarter, the weekly transactions and number of users were below all calculations. With Mints NFTs and OpenSea NFTs seeing a majority of the decline.

However, according to the analysis, Nansen’s investigation could not ignore the fact that gaming NFTs are migrating to other chains, so this is the reason why the Ethereum list is going down.

In fact, the report discovered an increase in GameFi-related projects being built on chains such as BNB and Polygon.

Louisa Choeresearch analyst at Nansen, said:

“Given the drop in NFT values and thus market capitalization, it is not surprising that the average spend per transaction on NFTs has fallen significantly since the start of 2022.

We can interpret that the NFT market participants are still cautious about the broad market conditions. However, more on-chain data is required to confirm this observation.”