New York Anti-Crypto Regulatory Stance Creates Hostility

Crypto regulations have always been the biggest gray area in the US, especially in New York. Under NY Attorney General Letitia James, the enforcement tone has been particularly harsh.

New York is often considered one of the most anti-crypto states in America. Mainly due to its strict regulatory framework, which makes it difficult for crypto businesses to operate. However, it is important to note that other states also have varying degrees of regulation for the crypto industry.

Strange relationship between crypto and the big apple

One of the main reasons why New York is considered anti-crypto is the implementation of the BitLicense. These regulations require businesses to obtain a license to operate in the state. This framework was introduced in 2015 by the New York State Department of Financial Services (NYDFS) and applied to businesses engaged in virtual currency activities. BitLicense requires firms to adhere to strict rules, including anti-money laundering (AML) and know-your-customer (KYC) requirements.

The BitLicense has been criticized by some in the crypto community for being too burdensome and restrictive, leading some companies to avoid operating in New York altogether. For example, in 2015 the popular cryptocurrency exchange Kraken announced that it would suspend its services in New York due to BitLicense regulations.

Other crypto companies have also expressed frustration with the regulatory framework, leading some to argue that New York is hostile to the industry. So, what makes the said region move towards crypto?

It all starts with the leaders

State attorneys general are responsible for enforcing state laws within their jurisdiction. This includes laws relating to consumer protection, securities regulation and financial fraud. In recent years, state attorneys general have increasingly focused on enforcing cryptocurrency and blockchain technology laws.

As cryptocurrencies continue to gain popularity, there have been concerns about fraudulent activity and consumer protection in the crypto market. State attorneys general can investigate and prosecute cryptocurrency exchanges, businesses, and individuals who violate state laws related to cryptocurrency. In this case, it is the New York Attorney General’s office, led by Letitia James, who is the front runner.

The Democrat has taken a strict approach to the regulation of cryptocurrencies.

In 2018, the office launched the Virtual Markets Integrity Initiative, which aimed to protect cryptocurrency investors by increasing transparency and accountability in the industry. As part of this initiative, the Attorney General’s office sent letters to thirteen cryptocurrency exchanges requesting information about their operations, security and compliance measures.

Crypto exchanges and companies at risk

The exchanges were required to fill out a questionnaire that asked for detailed information about their policies and procedures, including how they prevent market manipulation and secure client funds. The Virtual Markets Integrity Initiative resulted in several enforcement actions against cryptocurrency exchanges, including settling charges against Bitfinex and Tether for allegedly covering up a loss of $850 million in customer funds.

The attorney general’s office also filed a lawsuit against cryptocurrency exchange Coinseed, accusing it of defrauding investors and embezzling funds. Recently, high-profile enforcement actions have targeted KuCoin, CoinEx, and the Celsius Network. James also charged Ethereum for operating unregistered as a security, which directly affected the ETH price.

So there is one question that arises here. What is behind this intense hostility? Does James choose crypto, or are her actions justified? The controversy surrounding New York Attorney General Letitia James’ handling of the crypto industry has sparked a range of opinions and views.

Select pages in the crypto domain

Supporters of the NY AG’s actions argue that her crackdown on crypto companies is necessary to protect investors and prevent fraudulent activities. They believe the crypto industry is still largely unregulated and that bad actors can take advantage of unsuspecting investors.

For example, Parrot Capital, a Twitter handle with over 12,000 followers, claimed:

“Letitia James has arguably done more to stop crypto-fraud than any other law enforcement officer. New York State has a long history of regulatory overreach, but when it comes to cracking down on crypto-crime, they’ve done a lot better than most.”

On the other hand, critics of the AG’s actions argue that her crypto regulatory approach is too heavy-handed and stifles innovation and growth in the industry. They believe the industry needs more clarity and guidance from regulators rather than strict enforcement. Some respondents on Reddit told BeInCrypto that the AG’s actions are driven by a desire to “score points in the political game (by going after crypto).”

The controversy surrounding the regulator’s treatment of the crypto industry is complex and multifaceted, with differing opinions and viewpoints. Is this the case in other US states as well?

Other regions and their regulatory climate

Other states have also implemented regulations for the crypto industry, but it can have a bad aftertaste. In 2019, Wyoming passed several bills to create a favorable regulatory environment for crypto businesses. These bills included exempting certain crypto assets from state securities laws and creating special purpose depository institutions (SPDIs) that could provide banking services to crypto businesses.

Other states have also taken steps to regulate the industry, although their approaches vary. For example, some states have passed laws requiring businesses to obtain a money transmitter license to operate. In contrast, others have created regulatory sandboxes that allow companies to test products and services without complying with existing regulations.

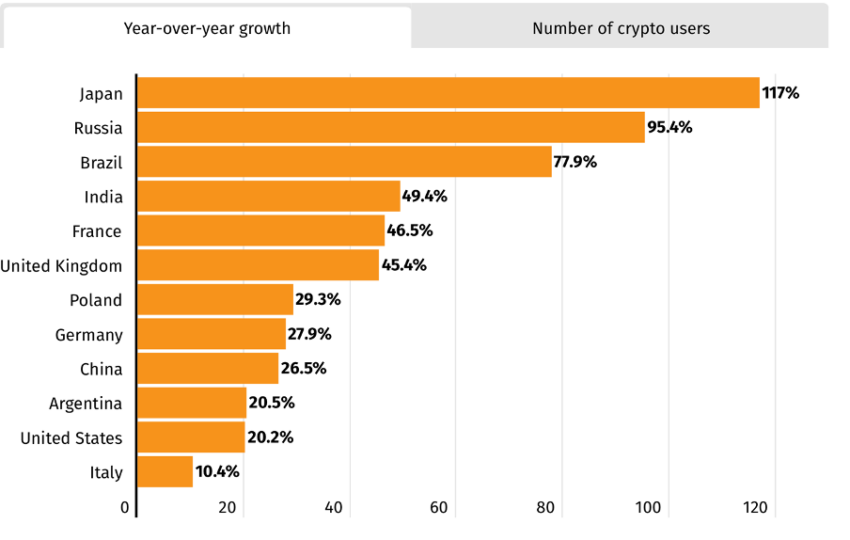

It’s fair to say that regulations remain unclear on US soil for cryptocurrencies to function at their full potential. That’s one of the reasons why the crypto adoption curve in the US has slowed compared to other geographies.

Overall, it remains to be seen whether New York will continue to be seen as hostile to the crypto industry. Or whether it will take steps to create a more favorable regulatory environment.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.