Neobanking gets all the love on Dalal Street, but here’s why you should choose wisely

An emerging segment within banking offers consumers and investors spoiled choices. Neobanking or fintech companies – which offer software and technology to streamline digital banking services – have not only disrupted the commercial banking business, but also forced conventional lenders to expand their business to discourage further competition.

Most experts say that this creates synergy in the general banking business by pushing every single big or small player to innovate and entice the consumer with better service and experience.

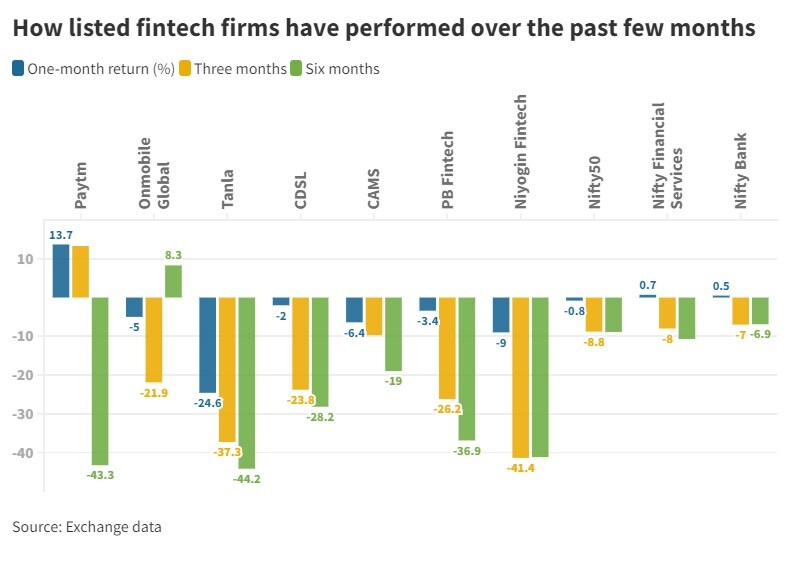

So what is it for the investor? Just like consumers, investors have a sea of options to add some fintech to their folios, but experts have one piece of advice: Choose wisely.

“There will be interesting times ahead when fintech companies transform banking … Profit masses will shrink, non-bank customers will receive new offers and be integrated into the financial system, and banks will be forced to provide better service and better price valuations. to customers, “market expert Ajay Bagga told CNBCTV18.com.

“It’s good for the whole ecosystem,” he said.

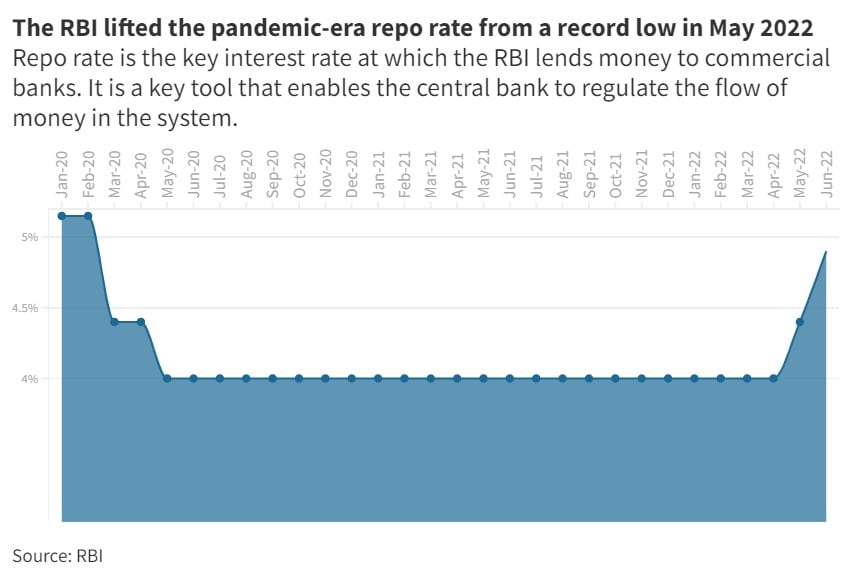

His remarks come at a time when most banks have consistently reported signs of healthy lending growth, although the RBI has begun to increase the cost of money after keeping the repo rate – the key interest rate – at a record low for two back-to-backs. years to deal with the covid pandemic.

So what brings neobanking to the table?

These players promote increased customer reach for lenders and enrich the customer experience for the end user. Investors generally have two categories to choose from: relatively newer players that offer a purely fintech game and existing banks that rely heavily on fintech.

Indian stock quotes continue to struggle in a correction phase since October 2021 amid sustained sales from foreign institutional investors and wild fluctuations across global markets, amid fears that aggressive pandemic rate hikes will lead to an economic downturn.

How to look at neobanking as an investment path

Many experts, even if they are positive about the place, suggest to exercise caution while choosing among the many options for playing the theme.

Investors who want to use the fintech area must be careful and selective, Tanushree Banerjee, Co-Head of Research at Equitymaster, told CNBCTV18.com.

“Among the large number of fintech startups in India today, not many have a profitable and viable business model … Commercial banks are certainly well positioned to take advantage of the space given their lending experience and well-built networks … Investors need to keep a keep a close eye on cash flows and balances, “she said.

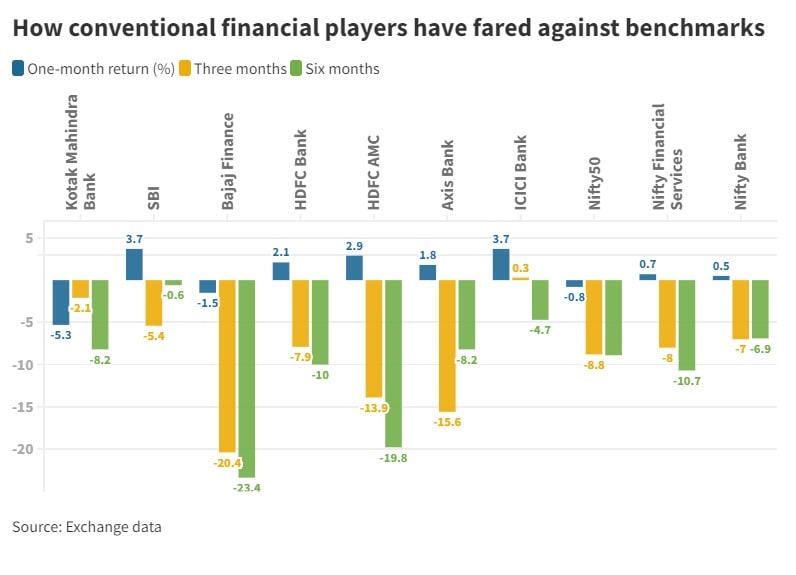

And this applies not only to investors who approach the segment as a pure game, but also to those who find largecap borrowers relatively safer to invest in fintech indirectly.

Many experts believe that counteracting the disruption is not something for conventional lenders, whether banks or shadow banks.

“Banks will have the challenge of updating their old systems and taking on fintech. They will have to find fintech competitors or have to build fintech (operations) within their older operations,” added Bagga, who is of the opinion that compliance and risk management will be the key for fintech players to survive and thrive.

Then there are those who believe that regulation that is in headwinds for fintech companies should work in favor of the banks.

“There is a lot of excitement around the fintech markets, but we do not think they will affect banking … Banks and financial institutions are large, they have scale, are hugely profitable and will be able to offer easy convenience and seamless banking,” said Raj Vyas, portfolio manager and Teji Mandi.

For example, RBI’s decision to prevent fintech companies from loading prepaid instruments with credit lines should have a positive impact on banks, which have a large base of credit card users, he pointed out.

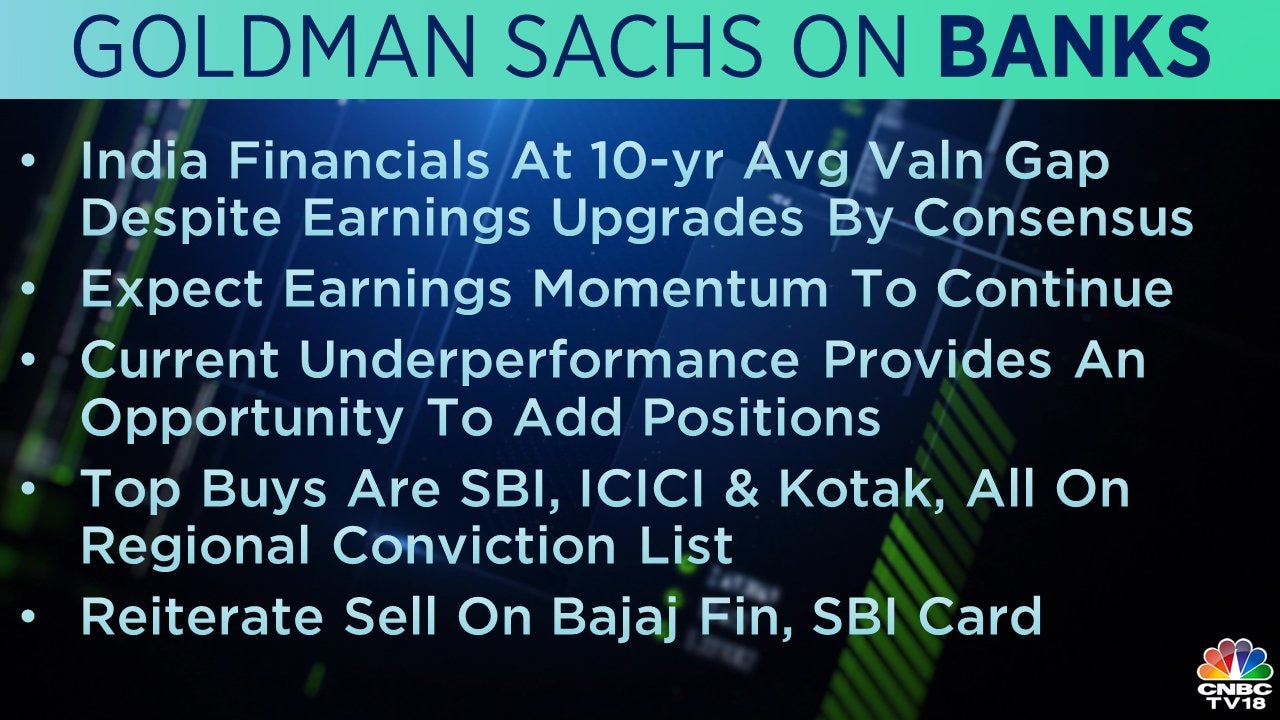

Vyas is among the many analysts who are positive about the bank basket as a whole.

He sees an improvement in the demand for loans as well as the borrowers’ creditworthiness in line with economic growth going forward.

He sees an improvement in the demand for loans as well as the borrowers’ creditworthiness in line with economic growth going forward.