More token unlocks set for this week, crypto market pulls back

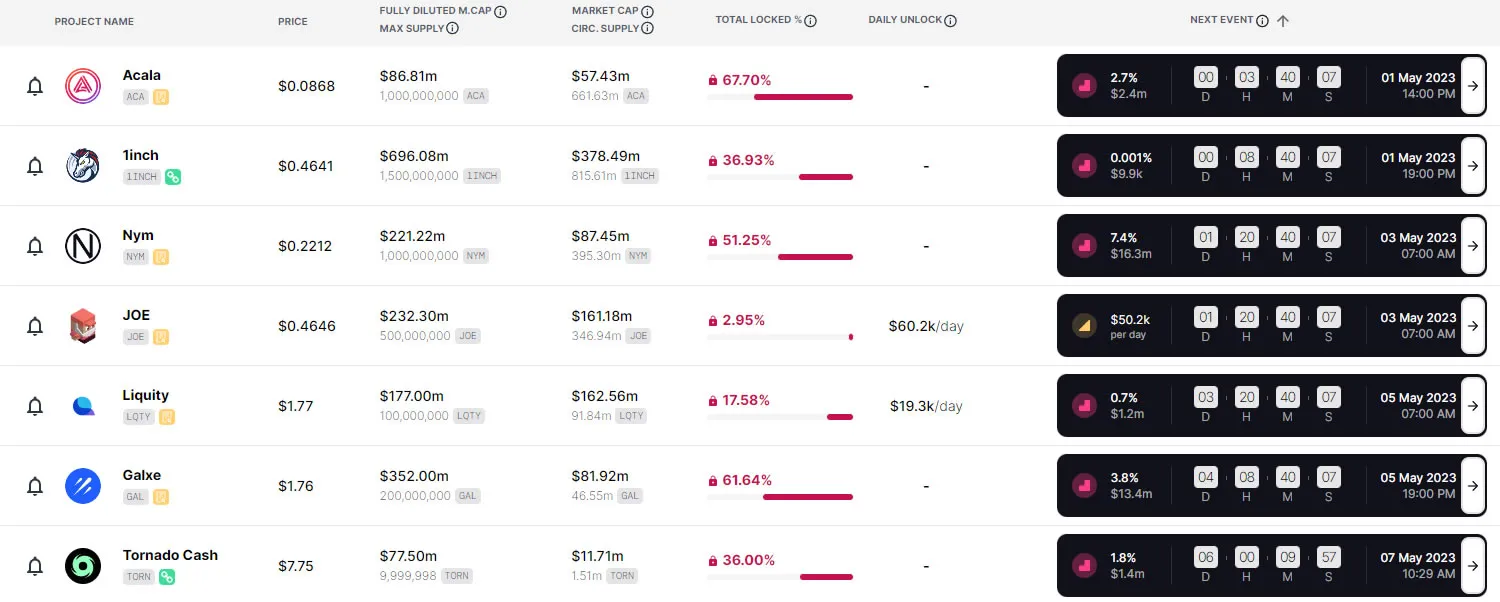

Seven crypto and decentralized finance (DeFi) platforms will perform token unlocks this week. Token prices typically do not respond well to supply dilution.

On May 1st, the 1inch exchange will be the first major protocol to unlock tokens this week. However, with only 21,429 tokens being released, it is unlikely to have any major impact on token prices.

The token will be unlocked this week

The 1INCH token unlock is worth less than $10,000 at current prices of around $0.463. According to Token Unlocks, 37% of the total supply of around 1.4 billion tokens remains locked.

Furthermore, the tokenomics are massively weighted towards the team and the investors. There are 1.29 billion tokens allocated to them in a release schedule that lasts until December 2024.

Also on May 1, the Polkadot-based web3 financial platform Acala will release assets. Around 27.4 million ACA tokens valued at approximately $2.3 million will be unlocked. These represent 2.74% of the total supply, so there may be some downward pressure on token prices.

Acala tokenomics is slightly more event spread, with 34% allocation to public loan participants, 29% to strategic partners and 12% to the reserve. The earning and unlocking schedule runs until March 2028. ACA is trading down 97% from its peak of $0.087.

On May 3, Nym will unlock almost 7.4% of the total supply. NYM tokens worth $16.3 million will be released to anticipate downward pressure on prices this week.

Trader Joe DEX releases tokens every other day and the next one is May 3rd with 108,000 JOE tokens.

On May 5, the token will be unlocked for Liquity (LQTY) and Galxe (GAL). Meanwhile, on May 7, Tornado Cash will unlock 175,000 TORN tokens worth around $1.3 million.

The theory is that the process aligns incentives for all DeFi project investors and stakeholders. However, the reality is that it often causes short-term volatility and selling pressure.

Crypto Market Outlook

Crypto markets have turned red during Asian trading on Monday morning. Its total market capitalization has shrunk by 1.7% on the day, falling to $1.23 trillion.

BTC is down 2% at $28,595, while Ethereum (ETH) has lost 2.7% in a slide to $1,848. The only cryptoasset in the top 20 bucking this trend is Binance’s BNB, which has posted a 4.4% gain to reach $335 at the time of writing.

The correction seems to be resuming, so those projects with token supply releases this week could suffer bigger losses.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.