Mooners and Shakers: The Bitcoin and crypto markets are trying to recover from a messy weekend

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Okay, where were we? Ah yeah, Bitcoin and Ethereum sat on the ground, with a nasty hangover, while DXY takes off again. After a big weekend dip, all crypto flights remain delayed, but the voice on the tannoy says to be patient.

In case you missed it and just enjoyed your weekend like you probably should have, the entire crypto market shed about US$100 billion over the weekend.

Does this mean that the bears are now in full control again? Many of them about, so maybe. The Crypto Fear & Greed Index, the market’s most popular sentiment tracker, suggests so. This is a pretty big drop for that metric as well, since some mild, building hopium around this time last week.

Still, the two bull-goose crypts, Bitcoin and Ethereum, have managed to break the fall on a tree branch or two on the way down, John Rambo of First blood-style.

Let’s take a little look…

Top 10 overview

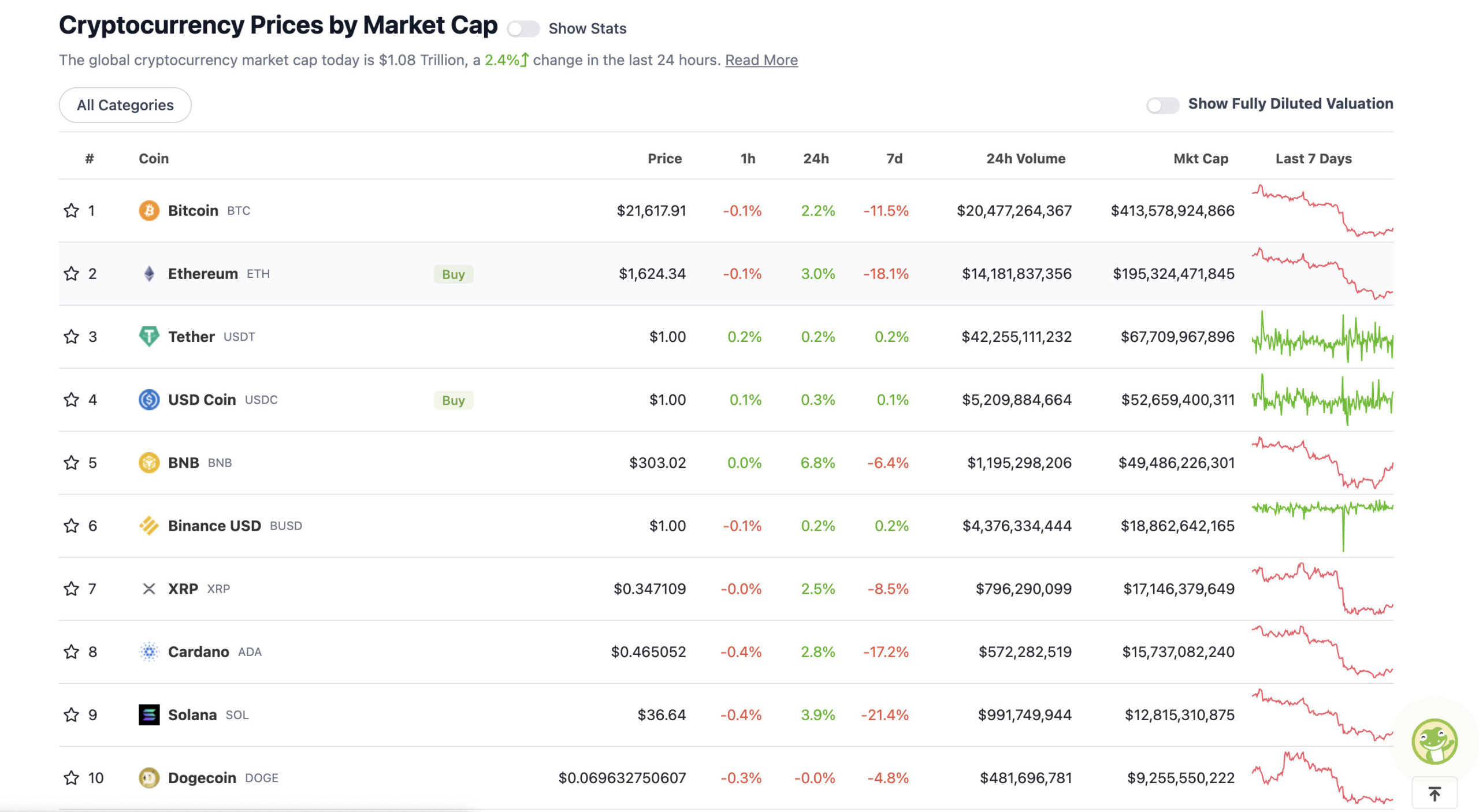

With the total crypto market cap at $1.08 trillion and up approx. 2.4% since yesterday, here is the current situation among the top 10 tokens – according to CoinGecko.

Market pacesetters Bitcoin (BTC) and Ethereum (ETH) have tiptoed again on their latest mortuary record. They have made some inroads into Monday (AEST) as another weekly close approaches in the eastern states of the US, where it seems to matter most on Crypto Twitter for this sort of thing.

Ah yes, the boring sideways plot into the weekly magazine #BTC Close

— Benjamin Cowen (@intocryptoverse) 21 August 2022

The world’s favorite orange-colored cryptocurrency fell sharply to just under US$21k on Saturday, but found some support there and has been licking its wounds around the US$21.5k mark for the better part of a day now… at the time of writing.

Likewise, Merge-tastic (well, not yet) ETH did something similar with a local low of $1,550 and a rally to around the $1,620 zone, where it currently sits.

Unreliable weekend price action? Crypto is known for that. Then again, analyst Michaël van de Poppe described it as a “very organic dump” for Bitcoin, and even allowing for the possibility of things going lower, he still sees a bottom in the market overall. Here’s what he tweeted yesterday…

No serious strength after this cascade #Bitcoin.

The rebound is weak, no buyers step in, and $ETH / $BTC also continues to fall.

We should see another sweep and/or test of $19K before reversing.

All in all, we are very close to the bottom.

— Michaël van de Poppe (@CryptoMichNL) 20 August 2022

Meanwhile, another well-known long-time BTC bull analyst, Kiwi on-chain data guru Willy Woo, is also calling for an accumulation zone, meaning he believes Bitcoin is near the bottom. But not everyone has that…

Is this accumulation in the room with us now?

— strikerv12 (@vainlithium) 21 August 2022

With the US dollar suddenly regaining strength, Woo doesn’t suggest any major upside or a bull market anytime soon. Perhaps more of a protracted, choppy consolidation, a la 2018, where the dollar-cost-averaging patient may ultimately be rewarded. Probably a big request for the fair weather moonlambo crowd.

Overdraft and downdraft: 11–100

With a market cap of about $8.46 billion to about $4,441 million in the rest of the top 100, let’s find some of the biggest 24-hour winners and losers at press time. (Statistics accurate at time of publication, based on CoinGecko.com data.)

DAILY PUMPS

• Lido DAO (LDO), (market cap: USD 1.24 billion) +14%

• Synthetix network (SNX), (mc: USD 704 million) +8%

• Frax Del (FXS), (mc: US$454 million) +6%

• EOS (EOS), (mc: USD 1.56 billion) +6%

• NEXO (NEXO), (mc: USD 516 million) +5%

DAILY SLUMPERS

• Celsius (CEL), (market value: USD 948 million) -12%

• Huobi BTC (HBTC), (mc: USD 823 million) -1%

• Stacks (STX), (mc: USD 529 million) -1%

• Chain (XCN), (mc: USD 1.95 billion) -1%

• STEP (GMT), (mc: USD 481 million) -0.5%

Around the blocks

An assortment of coincidences and relevance that stuck with us on our morning through the Crypto Twitterverse…

Some Ethereum “Merge” Considerations…

Although The Merge has a mainnet date that is less than a month away, there are still many who doubt that it will even happen.

I’ll say it again – The Merge is not priced in.

— sassal.eth 🦇🔊🐼 (@sassal0x) 21 August 2022

Reminder: The #ethereum fusion will not reduce gas taxes 🙁

— Lark Davis (@TheCryptoLark) 20 August 2022

This will certainly matter in a bull market.

The merger and EIP1559 will send $ETH to $10,000. pic.twitter.com/G5QBoppdvP

— McKenna (@Crypto_McKenna) 20 August 2022

Some NFT Natterings…

Well, still a great investment for the minters

— 0xGoGreen (@0xGoGreen) 21 August 2022

1/ Pudgy Penguins floor shoots up 400% in one of the worst NFT bear markets.

The greatest comeback story. This is how it happens 🧵

— doubleQ (@xDoubleQ) 21 August 2022

Some Relentless Bitcoin Sales Pitches From Saylor…

Imagine, everything that exists and everything that will ever be, divided by 21 million.pic.twitter.com/P8WsjyugoB

— Michael Saylor⚡️ (@saylor) 21 August 2022

#Bitcoin is money controlled by no one and available to all. pic.twitter.com/kmEZr97OCV

— Michael Saylor⚡️ (@saylor) 20 August 2022

And speaking of nothing… but this somehow seems like a decent metaphor for crypto investing. (Just out of shot, FBI agent Johnny Utah follows).

An amazing view: Sebastian Steudtner, a German surfer, rode a 115-foot wave at Nazare, Portugal 2018 pic.twitter.com/WatZfyE6mS

— Vala Afshar (@ValaAfshar) 21 August 2022

This is probably a better zoomed in metaphorical reference, but…

Crypto investors try to time the market

— Dr. Parik Patel, BA, CFA, ACCA Esq. (drpatel.eth) (@ParikPatelCFA) 19 August 2022