Mooners and Shakers: Ravencoin soars and Bitcoin pumps, but Ethereum flattens before Merge

Okay, Ravencoin. What is this about then? It’s pumping, so let’s dig into it. Meanwhile, Bitcoin has also been on a roll, while Ethereum is currently lounging on a deck chair hoping for a decent Merge tan.

Ravencoin – Evidence of Merger Related Price Action?

Deep into that crypto-winter darkness and peering, long I stood there, Wondering, fearing, doubting, dreaming dreams no shadowy supercode Ever dared to dream before.” “Put Ravencoin, ‘Never again.’

Edgar Allen Poe didn’t quite write that.

That being said… we can say with 99.93% certainty that the legendary 19th century American fountain pen and opioid user would have been a crypto fan. Probably. Apparently he had a “keen interest in cryptography” and indeed had something of an influence on modern science.

Would love to go into that a bit more, but we have magical internet money to talk about.

Now, what squawk is Ravencoin (RVN) then, and why is it flapping and ca-cawing it’s way up the daily cryptocurrency top 100 chart? Would it surprise you to find out that in a roundabout way it is related to “Merge”? No? Didn’t think so.

However, Ravencoin is not a Proof-of-Stake coin and it is not new. Launched in 2018, the protocol is an Ethereum mining alternative that uses a Proof-of-Work consensus algorithm blockchain that mimics Bitcoin’s 21 million coin supply. It has its own sophisticated tokenized ecosystem that uses RVN for various DeFi and NFT applications.

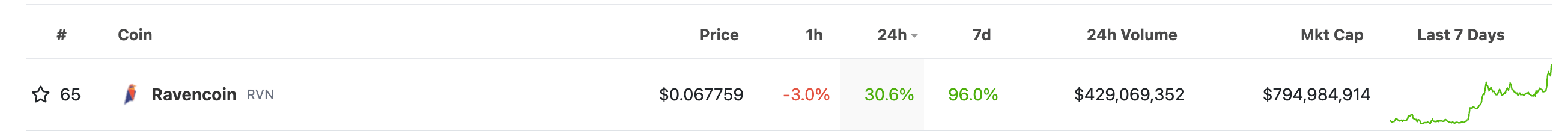

According to CoinGecko data, Ravencoin has increased by around 30% in the last day and more than 95% during the week.

Why? Well, all things Ethereum (well, except ETH itself today) seem to be taking turns to take the spotlight ahead of the leading smart contract blockchain’s Merge to Proof-of-Stake.

Despite the ESG, carbon-reducing positivity that the Merge movement partly builds its momentum on, there are still a good number of mining, PoW fans out there doing their thing and seeking mining alternatives like the main Ethereum blockchains. It is partly so, but perhaps the main reason is this…

To mine Ravencoin $RVN News

The second largest global #Crypto exchange for volume lists Ravencoin!FTX Exchange lists Ravencoin.

With the coming #EthereumMerge this is another major global announcement regarding the Ravencoin Blockchain ecosystem.

Thank you @FTX_Official— Leon Ravencoin 🅁🅅🄽 ₿ (@leon_texas) 11 September 2022

The RVN pump in price has basically coincided with the news major global crypto exchange FTX announced the listing of Ravencoin perpetual futures on September 12th.

To other crypto related pumps and dumpsters…

Top 10 overview

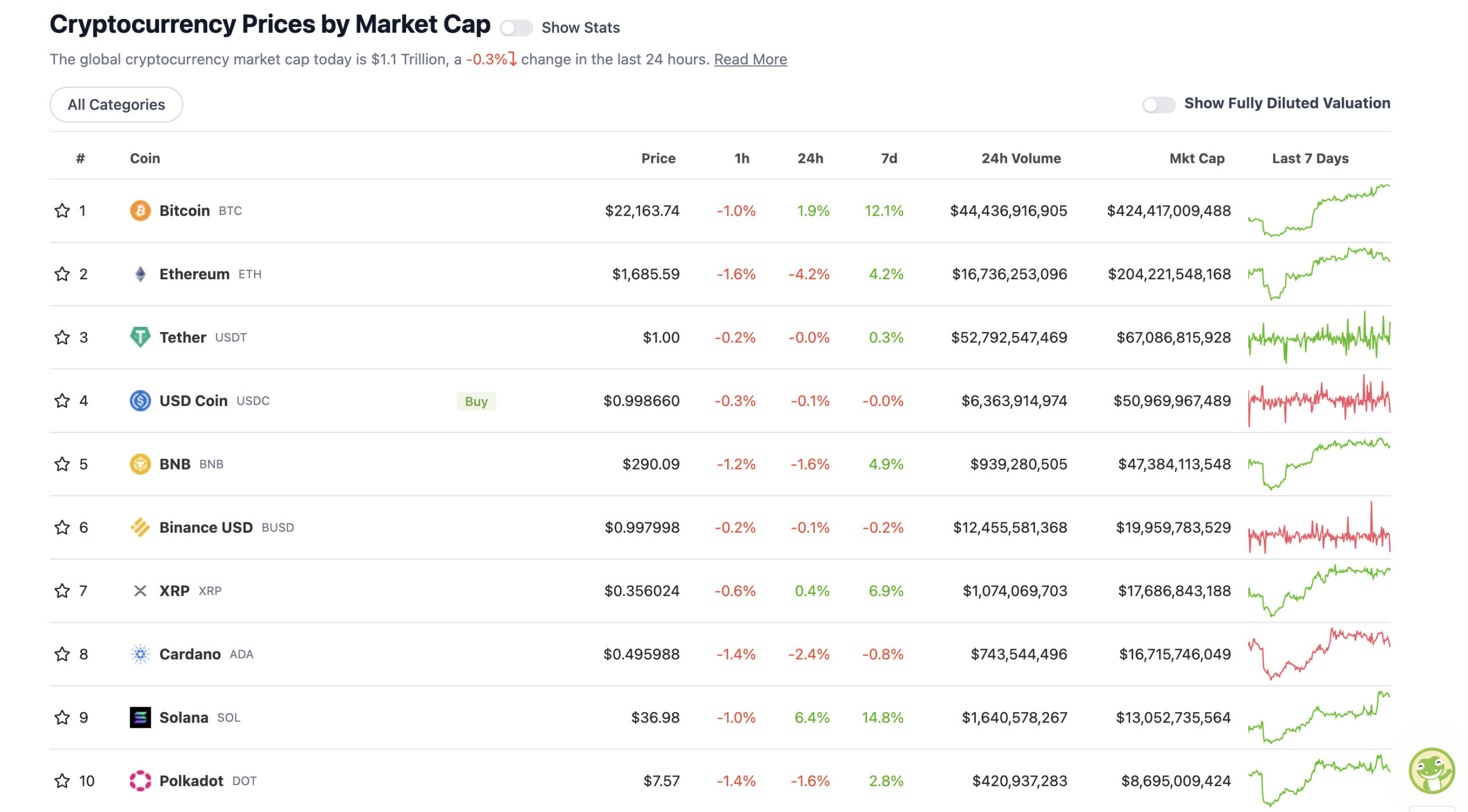

With the total crypto market cap at $1.1 trillion and down approx. 0.3% since yesterday, here is the current situation among the top 10 tokens – according to CoinGecko.

As you’d expect, the chart tells the story here. Basically, Bitcoin, Ethereum rival Solana and XRP are the only things that have been green in the last 24 hours.

Let’s check in on Solana (SOL) for a moment… It seems determined to avoid the braid shadow. Is there a reason for exuberance? Apart from some ongoing positivity based on the Helium project’s potential migration, there is nothing major we see…

we spent months evaluating potential L1s and scaling solutions, and that’s my opinion @solana is by far the best choice for @helium. I am so impressed with what @aeyakovenko @rajgokal @garious14 and teams have built

The HIP70 poll opens in an hour!

— amir.hnt (

,

) (@amirhaleem) 12 September 2022

Although there’s also this… Solana is Ethereum’s biggest rival for NFT-based activity, and it seems to be increasing on Solana’s marketplace Magic Eden again, according to crypto data gurus Nansen…

Solana NFT transactions per week presented without comment pic.twitter.com/LCJBtjQMaI

— Nansen Intern

(@nansen_intern) 12 September 2022

As for Bitcoin, it has kicked with some confidence into what most believe will be a whirlwind of volatility this week. BTC is now trading back above US$22ki at the time of writing, after closing its last weekly candle at US$21,800. It is the OG crypt’s highest weekly closing time in about a month.

In the very short term, the US dollar slowing and seemingly hitting some chart-based resistance seems to be helping Bitcoin, other cryptos and stonks so far this week.

Dollar is currently showing a monthly rejection candle after it failed to break above the trend.

The month is not over, but notable as resistance has remained.$DXY pic.twitter.com/MpaEI1ofXs— Sven Henrich (@NorthmanTrader) 12 September 2022

Don’t forget (well, you can if you want to), that the fresh US CPI inflation-related data for the month of August is set to be released. And for those slightly overexposed to risky assets, these numbers have lately been a recipe for nervous toilet sessions and/or “Hey EVERYONE, this round is on me!”

CPI tomorrow – what do you think it will be?

— Benjamin Cowen (@intocryptoverse) 12 September 2022

It seems 7/10 people on Twitter are positive going into Tuesday’s CPI, and 9/10 think inflation has peaked.

Maybe it will play out that way, but don’t forget to have a plan in case it doesn’t.

— Justin Bennett (@JustinBennettFX) 12 September 2022

Overdraft and downdraft: 11–100

With a market cap of about $8.4 billion to about $446 million in the rest of the top 100, let’s find some of the biggest 24-hour winners and losers at press time. (Statistics accurate at time of publication, based on CoinGecko.com data.)

DAILY PUMPS

• Ravencoin (RVN), (market value: USD 783 million) +32%

• Hedera (HBAR), (mc: USD 1.6 billion) +10%

• The graph (GRT), (mc: USD 932 million) +9%

• Helium (HNT), (mc: USD 682 million) +6%

• NEAR protocol (NEAR), (mc: USD 3.9 billion) +5%

DAILY SLUMPERS

• Terra (LUNA), (market cap: USD 661 million) -28%

• Terra Luna Classic (LUNC), (mc: USD 2.13 billion) -21%

• Celsius network (CEL), (mc: USD 608 million) -9%

• Rocket pool (RPL), (mc: USD 588 million) -7%

• amp (AMP), (mc: USD 472 million) -6%

Well, probably should have known this would happen. As soon as we open our traps about a Terra LUNA revival, the coins go and dump harder than Brent Naden’s spear tackle a couple of months ago. If you follow such things, that is.

However, this does not change the fact that both LUNA (or LUNA2 as it is also now known) and LUNC have made huge gains recently.

That said, as per yesterday’s column, we’ve been very cautious about “buyer beware” when it comes to CeFi tokens struggling for revival, especially considering Terra LUNA’s catastrophic and crypto contagion-inducing collapse in May.

Tackle them with a retractable barge bar? Not financial advice on that, either anything for that matter, since, unsurprisingly, there are no qualifications for what hangs in my pool room.

Around the blocks

An assortment of coincidences and relevance that stuck with us on our morning through the Crypto Twitterverse…

It is very simple; #Bitcoin takes the spotlight, and therefore #altcoins fall down when they lose speed.

Even $ETH falling down.

The moment that $BTC calms down (which may take some time), #altcoins will have its run significantly.

— Michaël van de Poppe (@CryptoMichNL) 12 September 2022

BREAKING: Russia’s largest technology and industrial company, Rostec, is preparing to use cryptocurrencies for international trade.

— Bitcoin Archive

(@BTC_Archive) 12 September 2022

3 days for the Ethereum Merger

ETH will be split, that’s a fact. Everyone wants ETH and $ETHW in the wallet

Can $ETHW be sold?

Short answer: yes

Long answer: it’s simply an unnecessary risk, and probably not worth itHere’s how to do it – and why you shouldn’t

— olimpio.lens

(@OlimpioCrypto) 12 September 2022

#ethereum pic.twitter.com/sFaUbEKMyz

— Lark Davis (@TheCryptoLark) 13 September 2022

Starbucks and $matic teaming up for the Starbuck’s Odyssey program which will be their web3 experience and integration #nfts!

— Lark Davis (@TheCryptoLark) 12 September 2022

[DB] Novogratz: “A Little Birdie” told me Fidelity is going to move retail clients to crypto soon

— db (@tier10k) 12 September 2022

One of the best traders I worked with while at GS, always looked out for me #Silver for a heads up on what’s coming next for #Gold. #Silver +5% overnight

— Tony Sycamore (@Tony_Sycamore) 12 September 2022

Get ready for what will be an EPIC event and line-up from our family @NFTFestAus

— Oshi Gallery (@Oshi_Gallery) 13 September 2022