Mooners and Shakers: Crypto Market Falls as ‘Uptober’ Begins Amid Credit Suisse and Deutsche Bank Fears

If you thought the macroeconomic environment couldn’t get any shakier, news that two major banks may be on the brink is fueling stock market fears today. Bitcoin and crypto are anything but immune to this – will it destroy ‘Uptober’?

Rumors have spread far and wide on Twitter and beyond that both Credit Suisse and Deutsche Bank may be on the brink of collapse. These banking giants have around 2.7 trillion in assets under management between them.

Some are calling it another potential “Lehman Brothers moment”. The last time we heard it was late last year, when fears surrounding the collapse of Chinese property developer Evergrande began to hit the mainstream.

It’s not as if this kind of speculation regarding these two banks is particularly new, but the fear, uncertainty and doubt are definitely circulating.

Credit Suisse isn’t the only big bank whose price-to-book is flashing warning signs. The list below is of all G-SIBs with PtBs below 40%. A failure by one of them is likely to call into question the survival of the others. pic.twitter.com/LJA0YVrqco

— Alasdair Macleod (@MacleodFinance) 2 October 2022

Anyhoo, on to some daily crypto price action and other happenings.

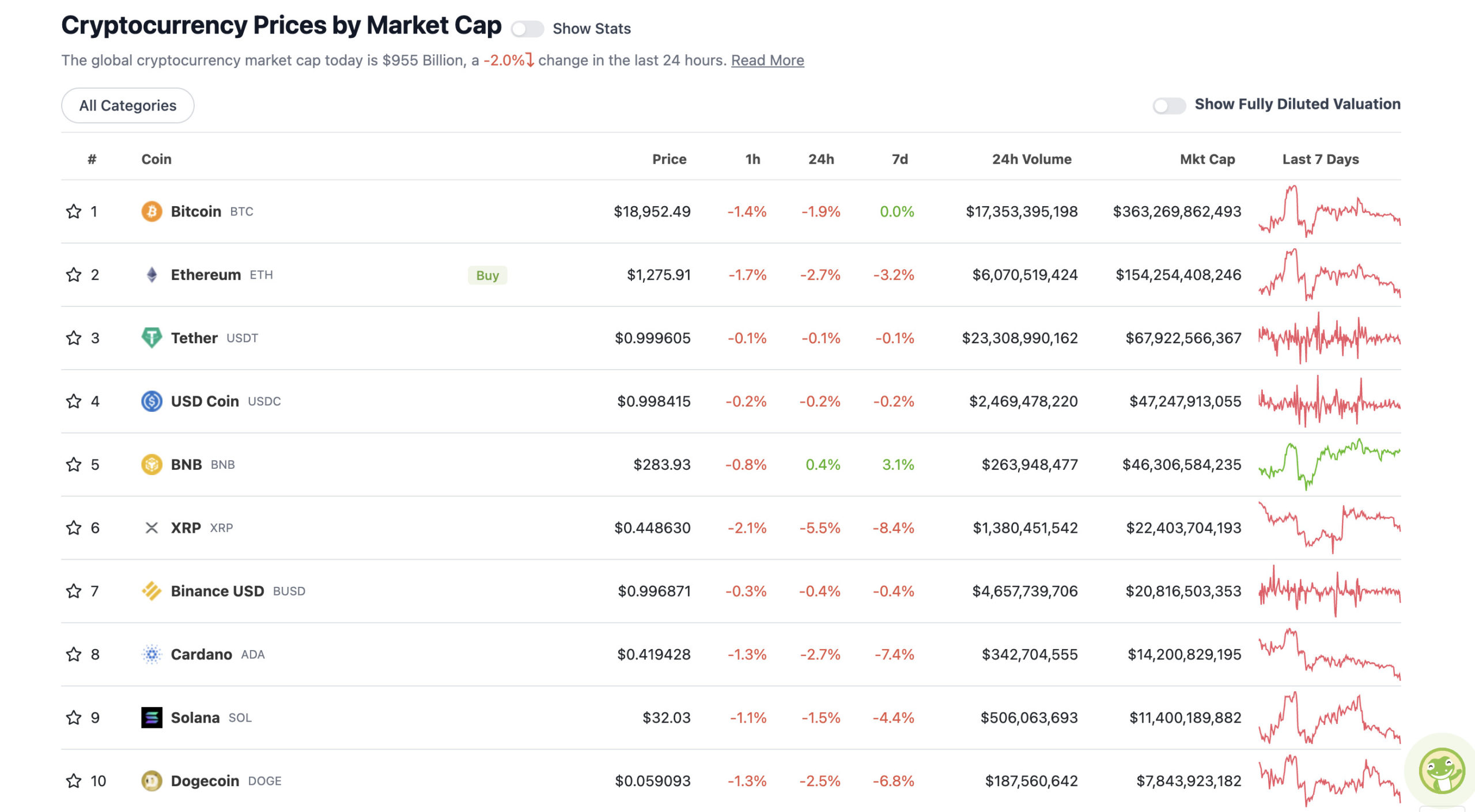

Top 10 overview

With the total crypto market capitalization at USD 955 billion and down around 2% since yesterday, here is the current status of the top 10 tokens – according to CoinGecko.

And then the crypto market’s “Uptober” begins in earnest… with a fall. Not surprising when you take a look at what the S&P 500 and other major indexes are doing.

Based solely on historical data for Bitcoin performance in October’s past, it is the least some a kind of hope that we can see a better month for the crypto market. But the bleak bigger economic picture globally needs to be taken into account, and that is clearly the driving narrative right now.

Recessions do not happen all at once. The economy is generally doing well from the consumer side here in the US

This will probably be drawn out for many months.

The stock market is Macro bearish, yes.

But don’t be tunnel visioned.

Expected volatility#Bitcoin $SPX

— Kevin Svenson (@KevinSvenson_) 2 October 2022

BTC volatility looks set to break out in the coming days…with short-term price action bursting either up or down.

— Dr. Jeff Ross (aka “Dr. Bear”) (@VailshireCap) 2 October 2022

Yep. Can go up. Can go down. Laterally too.

As for the biggest movers in the top 10 today, XRP stands out, with a daily loss of 5.5%. It was one of September’s best performersbut, so let’s see what new revelations emerge this month from the ongoing legal drama with the SEC.

Ups and downers: 11-100: Chainlink’s SWIFT news and more

With a market cap of about $7.14 billion to about $372 million in the rest of the top 100, let’s find some of the biggest 24-hour winners and losers at press time. (Statistics accurate at time of publication, based on CoinGecko.com data.)

DAILY PUMPS

• Evmos (EVMOS), (market value: USD 451 million) +4%

• Maker (MKR), (mc: USD 679 million) +3%

• Reserve rights (RSR), (mc: USD 413 billion) +3%

• Pancake Swap (CAKE), (mc: USD 652 million) +1%

• THRONE (TRX), (mc: USD 5.6 billion) +1%

DAILY SLUMPERS

• Chillies (CHZ), (market cap: USD 1.17 billion) -9%

• Quant (QNT), (mc: USD 1.73 billion) -6%

• Huobi (HT), (mc: USD 539 million) -6%

• IOTA (MIOTA), (mc: USD 767 million) -5%

• NEXO (NEXO), (mc: USD 486 million) -5%

Around the blocks

An assortment of coincidences and relevance that stuck with us on our morning through the Crypto Twitterverse…

My first bitcoin investment was in 2015 of ~$400 (yellow circle). Most people said bitcoin was dead.

My second investment was in 2018 of ~$4000 when I published the S2F model. Most people said bitcoin was dead.

My third investment is now at ~$20,000. Most people say bitcoin is dead. pic.twitter.com/oUWppoJgxo

— PlanB (@100trillionUSD) 2 October 2022

Demand for NFTs in a bear market pic.twitter.com/yP4LVESgBr

— Alan Carroll (@alancarroII) 2 October 2022

The only thing that can save Credit Suisse is if it was redirected to Credit Suisse Inu

— yzy.eth (@LilMoonLambo) 2 October 2022

Is the European banking sector on the brink of a systemic crisis?

I have worked for a major European bank for 8 years – pockets of weakness and structural problems are undeniable.

But let’s look at some data to make a non-emotional assessment.

A thread.

1/

— Alf (@MacroAlf) 2 October 2022

…in today’s macro environment.

Again, I don’t like European banks at all here.

But a non-emotional, data-driven assessment of the situation hardly calls for a ”widespread collapse” moment, in my opinion.

However, pockets of serious weaknesses will be there.

15/

— Alf (@MacroAlf) 2 October 2022

NEW!

Ex-Celsius CEO Alex Mashinsky withdrew $10 million weeks before company froze customer accounts – Financial Times

— Bitcoin Archive

(@BTC_Archive) 2 October 2022

Imagine a universe of 9 AAA games all interoperable that use the same in game resources

— Kieran.eth

(@KieranWarwick) 2 October 2022