Mooners and Shakers: Blockchain co crabs that scared cats to stay alive until the end of the year

Coin heads tomorrow…

Rob “If this Hammock’s Rockin’…” Badman is enjoying a well-deserved Christmas break, so you’re stuck with me again for the next few days. Bear with me as I emerge from my Christmas turkey coma to try to make heads and tails of what has been going on in the crypto world.

A quick look at the majors this morning and things look relatively stable, if a little spongy. BTC and ETH are selling down close to 1.0% this morning, as trading volume across exchanges picks up after a mid-Christmas slump.

It was almost as if a large portion of the crypto community actually took a break to spend time with family… either that, or the combined bandwidth consumption of billions of new gaming consoles being unboxed and plugged in on Christmas morning slowed the entire internet to a crawl.

Let’s jump into a few headlines to whet your appetite for the morning, and then I’ll have some details and maybe even a pretty chart to show you. So exciting!

Yo Japan. You’re acting weird again…

The past couple of weeks have been pretty weird in Japan’s financial circles. The Bank of Japan recently emphasized its policy to allow the yield on 10-year Japanese government bonds to move up to 0.50 percent instead of the long-preferred ceiling of 0.25 percent.

That sent people into a frenzy and sent the yen soaring against the USD, up 4.0% in a day – which probably doesn’t sound like much, but for an actual hold-it-in-your-hand currency, it’s outrageous.

However, Japanese regulators have not ignored the crypto space, announcing moves that will see Japanese exchanges list stablecoins for the first time, provided they:

- Is directly linked to a legal tender (ie Yen or USD or whatever you might spend at a supermarket);

- Is issued by licensed banks, registered money transfer agents and trust companies, and;

- Guarantee their holders the right to redeem them at face value (because it is culturally very important in Japan not to lose face).

Japan is still (we think… it’s hard to say) out with a pretty serious suspicion as to whether stablecoins are going to be used properly (as stores of value, etc.) or improperly (for money laundering, because of course they can be) – but the move is a step in the right direction to bring Japanese exchanges in line with most other major markets.

Octopus now closer to Pentapus after losing many employees

NEAR Protocol blockchain Octopus Network has gone Full Grinch this Christmas, using the happiest time of the year to unveil a cost-cutting restructuring that will send 12 of its 30 core employees to the breadline.

The 40% cut is taking place alongside a 20% gutting of the surviving employee’s pay – a robust sign that times at Octopus are about as tough as an under-tendered BBQ tentacle.

(See, the catch is that it takes a huge amount of effort to get squid meat tender enough to cook nicely, and usually involves a long and thorough pounding of the squid’s corpse once it’s dead. #TheMoreYouKnow #CookingWithCrypto).

However, Octopus CEO Louis Liu remains positive and optimistic, saying: “The crypto winter will last at least another year, maybe much longer. Most Web3 startups will not survive. I would not recommend that ordinary people launch a Web3 startup in during the coming year unless they receive support from large institutional investors.”

Wait… that’s not even uplifting. And I’m not sure what he means by “regular people” – so maybe only Batman, Superman and a few people with Asperger’s will flourish in Liu’s version of the future of Web3.

Still, it’s obviously a super classy act to lay off your workers at Christmas time … but it nicely sums up what a real drag the year 2022 has been for many small businesses.

… Is Argo about to go argo-nought?

And if Louis Liu’s Pentapus of Positivity hasn’t got you all jacked to the milkers with a good sense of how the market handles things, there’s an announcement coming from NASDAQ-listed Argo Blockchain that hangs like the sword of Damacles.

Argo, to put it nicely, has been in deep, deep s–t for a while now, with liquidity problems mounting to the point that it’s been harder to restructure than a bunch of Gold Coast buccaneers on The block.

Whether Argo is about to shut up, or whether a Christmas miracle has occurred and it has managed to secure a significant backer to keep it afloat remains unclear, but the announcement is expected before the market, so we’ll find out which way The Argonauts are. sailing this arvo for a while.

Top 10 overview

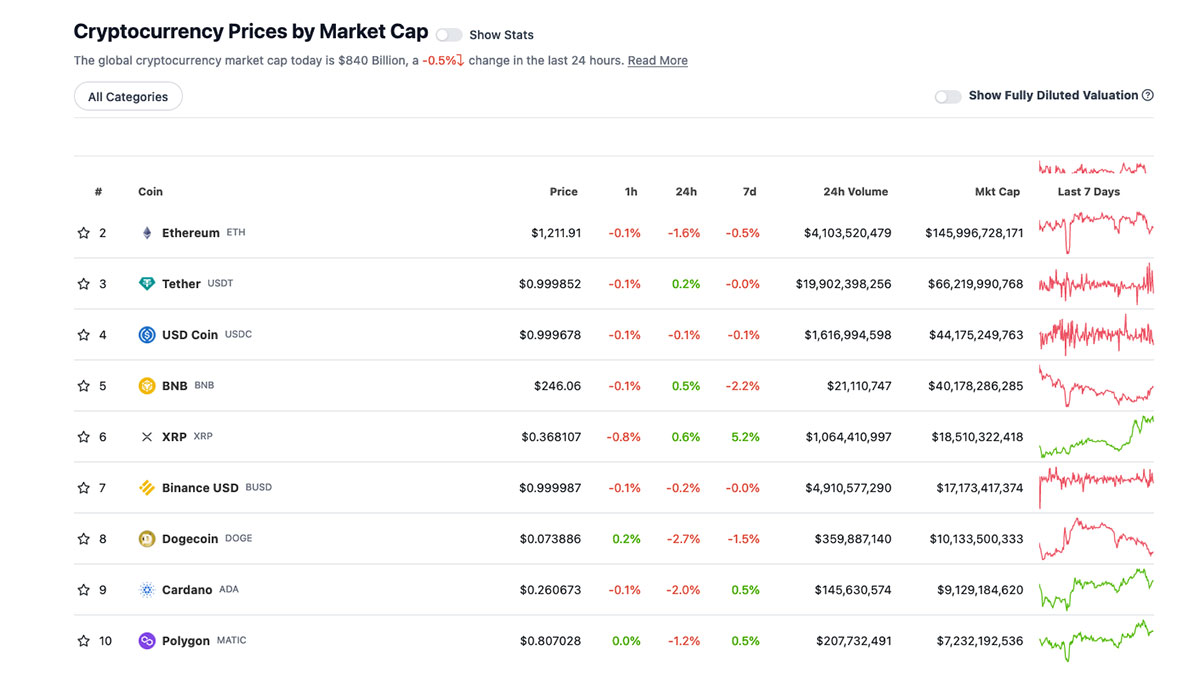

With the total crypto market capitalization at $840 billion, down 0.5% since this time yesterday, here is the current status among the top 10 tokens – according to CoinGecko.

DAILY PUMPS

- Terra Luna Classic (LUNC), (market cap: USD 1.02 billion) +7.2%

- Quant (QNT), (mc: USD 1.66 billion) +4.1%

- OCD (OKB), (mc: USD 6.03 billion) +3.6%

- EthereumPoW (ETHW), (mc: USD 334 million) +3.6%

- Aave (AAVE), (mc: USD 816 million) +2.8%

DAILY SLUMPERS

- Toncoin (TON), (market cap: USD 3.18 billion) -6.8%

- Frax Del (FXS), (market cap: USD 329 million) -4.5%

- eCash (XEC), (mc: $449 million) -4.4%

- Hedera (HBAR), (mc: USD 1.06 billion) -4.0%

- Zcash (ZEC), (mc: USD 509 million) -3.7%

(Statistics accurate at time of publication, based on CoinGecko.com data.)