Mooners and Shakers: Bitcoin, Ethereum and Other Cryptos Get Some Relief; BlockFi faces bankruptcy

Inflation in the United States maybe shows signs of turning a corner and the US Dollar Index has sold off. The crypto market? Bitcoin, Ethereum and others have had a small bounce.

Little is the operative word, but we’ll take it. These are macro-related conditions that crypto-watchers have been sweating over for months, and usually the market might have seen a bit more of a lift — perhaps more like the Nasdaq 100 (+8.2% over the past five days) and the S&P 500 (+4.7% ).

But of course the market has FTX, Sam Bankman-Fried and cronies to thank for an anemic push, which otherwise could have been something closer to a classic crypto moon mission.

FTX crypto contagion – BlockFi going bankrupt?

BlockFi, one of the industry’s most prominent lenders (in the same spirit as the collapsed Celsius and Voyager companies), is preparing a potential bankruptcy filing after halting withdrawals of customer deposits, according to reports including The Wall Street Journal.

The firm cited its “significant exposure” to bankrupt crypto exchange FTX, according to the report.

BlockFi halted withdrawals from its platform at the end of last week, expressing that it was “shocked and appalled” by the FTX bed-crazy incidents.

However, the firm’s exposure to FTX may seem obvious in hindsight, given the fact that it received a US$400 million revolving credit facility from Sam Bankman-Fried’s company earlier this year when BlockFi had run into liquidity problems following the Terra Luna collapse.

Implosion begat implosion.

Liquid Global and the SALT lending platform stop withdrawals

And so the crypto contagion continues to spread. Two more crypto firms have now told their clients that they have stopped withdrawals, citing FTX exposure.

Fiat and crypto withdrawals have been suspended on Liquid Global in accordance with the requirements of voluntary Chapter 11 procedures in the United States.

For now, we would suggest not depositing either FIAT or Crypto

We will provide updates when available.

— Liquid Global Official (@Liquid_Global) 15 November 2022

Liquid Group was acquired by FTX Trading Ltd in May last year plus all of the company’s subsidiaries, which include a company called Quoine, which has been no stranger to controversy in the past.

Who’s next without helmet or box, then? There is another crypto lender – SALT.

Deposits and withdrawals on the Salt Lending Platform have been paused. #Crypto #cryptocurrency #CryptoNews #FTXScandal #FTXCRASH #FTXUS #stock market crash pic.twitter.com/9wKErY1NIa

— Torogi (@Khallever1) 15 November 2022

Meanwhile, Sam Bankman-Fried has ended his bizarre Twitter thread that began with “What HAPPENED” over nine separate tweets, ending with the following:

12) As far as I know, after 7/11, with the potential for error:

a) Alameda had more assets than liabilities M2M (but not liquid!)

b) Alameda had a margin position on FTX Intl

c) FTX US had enough to repay all customersNot everyone necessarily agrees with this

— SBF (@SBF_FTX) 15 November 2022

.@elonmusk can we get this account deleted before these tweets are cited in court as evidence of how this fraudulent psychopathic liar tried to do “right by all the customers” until the last minute

— Hsaka (@HsakaTrades) 15 November 2022

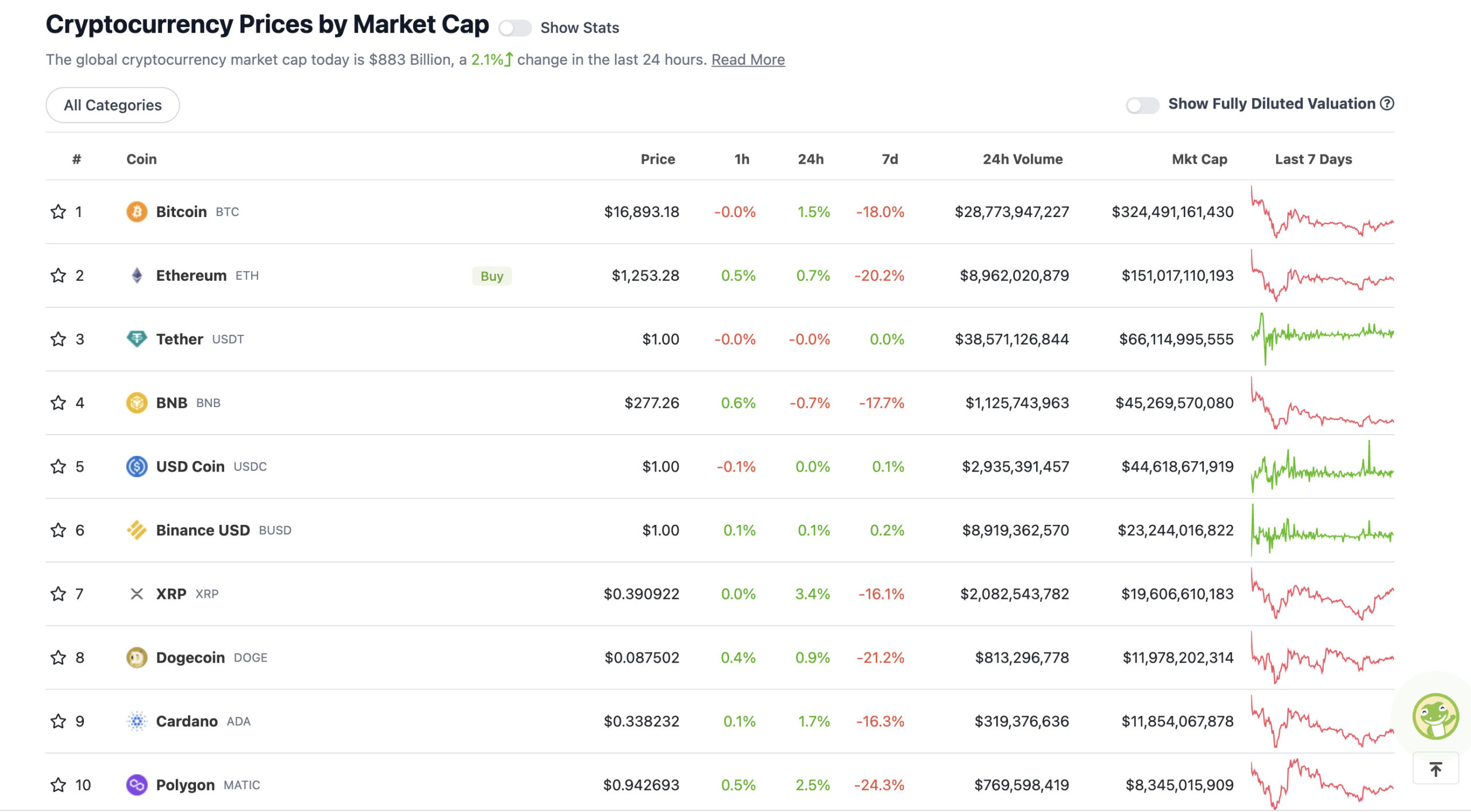

Top 10 overview

With the total crypto market capitalization at USD 883 billion, up 2% since this time yesterday, here is the current status of the top 10 tokens – according to CoinGecko.

Bitcoin traded back above USD 17ka a little earlier, as at least some semblance appeared to return to the global macro outlook on the back of lower than expected producer price index (PPI) numbers in the US and the cooling of the US dollar.

Ethereum had also rallied on the good vibes from inflation-related data – slightly closer to USD 1,300.

XRP is still up a decent amount in the last 24 hours, which probably has something to do with a potential front-run announcement (by Fox Business yesterday) of a settlement in the SEC vs Ripple lawsuit.

We say potentially. Of course, it could just have been a simple mistake.

Overdraft and downdraft: 11–100

With a market cap of about $6.93 billion to about $322 million in the rest of the top 100, let’s find some of the biggest 24-hour winners and losers at press time. (Statistics accurate at time of publication, based on CoinGecko.com data.)

DAILY PUMPS

• Stacks (STX), (market cap: USD 338 million) +12%

• Chillies (CHZ), (mc: USD 1.19 billion) +11%

• Quant (QNT), (mc: USD 1.17 billion) +9%

• Algorand (ALGO), (mc: USD 2 billion) +8%

• Lido DAO (LDO), (mc: USD 910 million) +7%

DAILY SLUMPERS

• Trust Wallet (TWT), (market cap: USD 814 million) -10%

• Tokenize Xchange (TKX), (mc: USD 698 million) -6%

• Chain (XCN), (mc: USD 1.01 million) -5%

• Klaytn (KLAY), (mc: USD 518 million) -4%

• Synthetix network (SNX), (mc: USD 431 million) -4%

Around the blocks

An assortment of rumours, gossip, coincidences and pertinence that stuck with us on our morning movements through the Crypto Twitterverse…

FTX: ‘Big Short’ Author Spent 6 Months Interviewing Sam Bankman-Fried – Book Coming Out.

Looking forward to the movie… 👀

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) 15 November 2022

“I Told You So”

What the FTX failure means for Bitcoin and why it could be the best thing to happen in 2022, as well as the catalyst for the next bull market.

— Svetski.info (@SvetskiWrites) 14 November 2022

Unbelievable @kevinolearytv says he would support SBF again and he was a “great trader”.

Kevin, do you realize he was a front runner and counter trading his own clients and dumping accumulated tokens on his own clients?

You can’t be serious. pic.twitter.com/I6LOWIEvQm

— Will Clemente (@WClementeIII) 15 November 2022

Another large company enters #web3 room!@Nike announced the launch of their new platform SWOOSH — the home of #Niketheir virtual creations.

The #Swoosh the platform works exclusively on @0xPolygon. Will they go to #Cardano and #Ethereum in the future? 🏃♂️

— Satoshi Club (@esatoshiclub) 15 November 2022

BREAKING: Sony has just filed a patent for in-game nft infrastructure for their PlayStation console 😳

Nfts is coming to gaming whether you like it or not 😍

— NFT POWER RANKINGS 💎 (@nftpowerranking) 15 November 2022

JUST IN: $3.7 billion #Bitcoin was taken off exchanges last week – Bloomberg 🙌

— Bitcoin Magazine (@BitcoinMagazine) 14 November 2022