Mooners and Shakers: Bitcoin and Ethereum Grounded as US Dollar Takes Off Again

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Bitcoin and Ethereum currently stand still on a flat, moving walkway in an airport, while others move faster on the adjacent non-automated floor. Maybe they have to stay on the ground for a while.

Ah well, guess we should at least be thankful that they, and the crypto market at large, aren’t completely capitulating again. For now. That said, there are plenty of bearish headwinds.

But what else is new? Kind of fine, but uh, let’s talk about a couple of the potential bearish headwinds.

The fear of Mount Gox is emerging… really, though?

There has been one a little A little fear resurfaces here and there about a possible impending mountain place related to Mt. Gox, but is it actually justified? Mt. Gox, if you didn’t know, was a Japan-based crypto exchange that lost around 850,000 Bitcoins in an alleged hack in 2014.

It has been reported that Mt. Gox victims, its creditors, this month will begin receiving back some of the stolen assets, raising fears that this could induce a further dump on the crypto market.

However, the fact is that of these 850,000 Bitcoins, only 140,000 of them have been recovered, which IF all creditors were to sell would only represent about 8% of Bitcoin’s daily sales volume. A drop in the orange, peer-to-peer digital ocean, really. And the other thing is that these creditors have the ability to receive the money back directly in cash as well.

Sentiment could still help drive crypto prices lower based on this event, of course. And speaking of crypto sentiment, it has actually fallen again after a burst of positivity a few days ago.

The US dollar is rising, well… that’s not so good for crypto

Whether or not it’s ethically justifiable to “mess around” after a slide of the US dollar slide, the fact is that a pumping dollar has mostly been a pretty bleak signal for risky assets like the magical internet money that is crypto.

US Dollar Index (DXY) had just recently it looked like it had run out and was going to have an extended southbound vacation. But as the chart in currently very bearish US cryptoanalyst Justin Bennett’s tweet below shows, it has actually only broken a fairly significant resistance.

If it rises to the level he’s talking about in the next few months, crypto’s miserable 2022 may still have a way to play out. The operative word, of course, is “if”.

As always, everything will largely depend on the Fed. The final minutes of the last FOMC meeting, in July, indicated that interest rate hikes will continue for the foreseeable … but the level of the hike may begin to decline – at least from 75 bps to 50, for example.

However, as we mentioned yesterday, the 2022 bulls are not yet defeated. And it’s still somewhat comforting to note that even the most bearish on crypto generally tend to believe in things, or at least Bitcoin, for the long term.

People like Director of Macro for investment firm Fidelity Jurrien Timmer, for example, who reckons that a USD 23k BTC is cheap as chips.

Eye on Digital Currencies: If you believe in Bitcoin’s adoption curve thesis (ie the network will continue to expand in line with past S-curves), then it’s reasonable to see Bitcoin as cheap at these levels.

pic.twitter.com/hEpuQTBmpG

— Jurrien Timmer (@TimmerFidelity) 17 August 2022

Time for some price action…

Top 10 overview

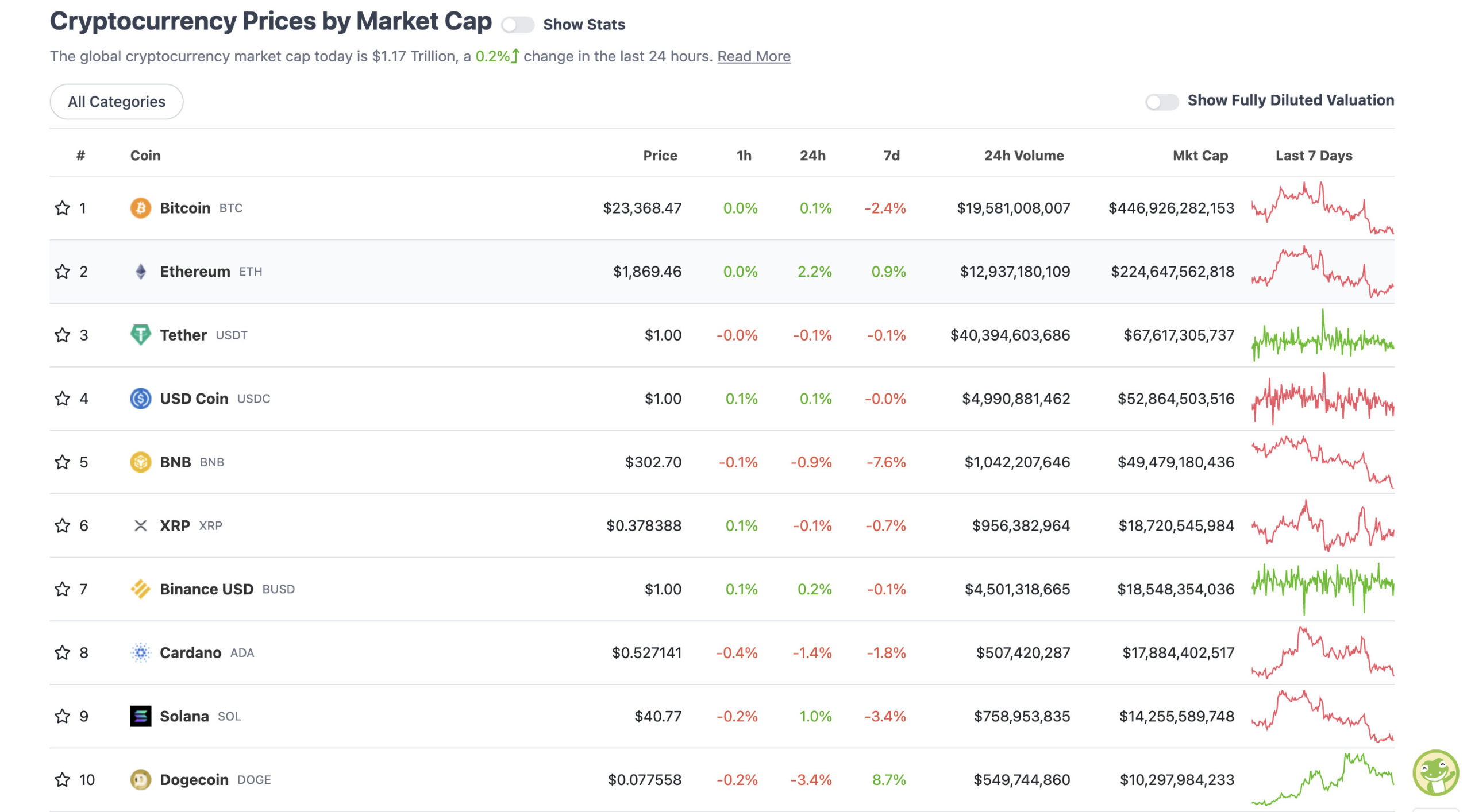

With the total crypto market cap at $1.17 trillion and up approx. 0.2% since yesterday, here is the current situation among the top 10 tokens – according to CoinGecko.

Flat City in the majors over the last 24 hours, pretty much. At least Ethereum (ETH) has been able to preserve some of last week’s gains. Well, a fraction – 0.9%, which is better than most, especially BNB and SOL.

Of course, Dogecoin (DOGE) still has a hefty remnant of its recent heady days, which can largely be attributed to excitement based on the transition to the world of smart contract applications, with Dogechain. And it’s kind of a layer 2, Ethereum compatible network for DeFi, NFTs, blockchain games, you name it, all enabling DOGE as a crypto, or at least an ETH wrapped version of it.

Overdraft and downdraft: 11–100

With a market cap of about $9.26 billion to about $455 million in the rest of the top 100, let’s find some of the biggest 24-hour winners and losers at press time. (Statistics accurate at time of publication, based on CoinGecko.com data.)

DAILY PUMPS

• Gnosis (GNO), (market value: USD 513 million) +14%

• Evmos (EVMOS), (mc: USD 517 million) +2%

• Celsius (CEL), (mc: USD 1.2 billion) +2%

• Lido staked ether (STETH), (mc: USD 7.7 billion) +1%

• The LEO token (LEO), (mc: USD 4.95 billion) +1%

DAILY SLUMPERS

• Lido DAO (LDO), (market cap: USD 1.26 billion) -9%

• Shiba Inu (SHIB), (mc: USD 8 billion) -8%

• Filecoin (FIL), (mc: USD 1.96 billion) -8%

• Helium (HNT), (mc: USD 888 million) -6%

• Synthetix network (SNX), (mc: USD 766 million) -6%

Around the blocks: Apto’s opportunity

An assortment of coincidences and relevance that stuck with us on our morning through the Crypto Twitterverse…

Some more airdrop/free crypto “alpha” from the excellent Olimpio account. Here he describes how you can potentially receive some $APTOS, which is apparently the token for a new layer 1 blockchain called … Aptos.

Aptos is currently on the testnet. Unlike the mainnet, that means it hasn’t fully launched yet.

You can install a wallet and interact with testnet blockchain, but money/tokens are not real.

If you are not familiar with Aptos, here is a thread I made

— olimpio

(@OlimpioCrypto) 18 August 2022

Meanwhile, back on Bitcoin and headwinds etc, again, here’s “Roman Trading” analyzing the bearish rising wedge pattern BTC is in. He’s targeting an 18k-19k USD dip… and a potential bounce from there.

$BTC H4

Successful breakdown and retest of our rising wedge. The volume was decent on the breakdown which provides confirmation.

If our bearish divergences play out, we should see a move to the 18-19k area. I would look there for a long time.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/QdiuuWbKTT

— Roman (@Roman_Trading) 18 August 2022

Hmm, yet more bearish signals…

#bitcoin lost RSI uptrend, bearish MACD cross, lost 50 day EMA right now…. pic.twitter.com/fdsfB2ykPQ

— Lark Davis (@TheCryptoLark) 18 August 2022

Nevertheless, it was this positive story yesterday that is now making global crypto headlines, and you can read a bit more about it at Stockhead here…

BREAKING: Australian convenience store chain with +170 locations now accepting #Bitcoin

Full implementation took only 8 weeks!

pic.twitter.com/Kg0oQDqpHR

— Bitcoin Archive

(@BTC_Archive) 18 August 2022