Mooners and Shakers: Binance-Driven Concern over FTX Cool Bitcoin and Crypto Market Rise

Well, it was a great weekend for holders of Bitcoin and many other crypto assets. But it’s Monday, and fresh FUD (fear, uncertainty and doubt) has appeared. This time about FTX and its FTT token.

How serious is it? It’s not entirely clear yet – it’s an unfolding story that we’ll touch on in a second, but fingers crossed that it’s not another Terra LUNA or Celsius-like crypto crash event. (Unlikely, but be aware.)

The total crypto market capitalization increased by more than 7% over the weekend, but has since cooled slightly. At the time of writing, it is still holding on to some gains there, but Bitcoin is hovering back above USD 21k for the first time in almost two months.

Binance vs FTX

But what’s all this FTX noise then? Much of it actually comes from Binance CEO Changpeng Zhao, aka “CZ”. We will try to summarize what we know so far.

• Binance, via CZ on Twitter, has announced that it is selling more than US$584 million in holdings of the FTX exchange/utility token FTT.

• CZ revealed that he will phase out FTT gradually to reduce any market impacts. He emphasized that this is not an attempt to harm FTX.

We will try to do it in a way that minimizes the market impact. Due to market conditions and limited liquidity, we expect this to take a few months to complete. 2/4

— CZ 🔶 Binance (@cz_binance) 6 November 2022

• FTX is owned by another crypto billionaire – Sam Bankman-Fried, who also owns the trading firm Alameda Research. The Binance announcement comes a few days after rumors about Alameda Research’s financial health. The trading firm (assets totaling USD 14.6 billion) is closely linked to FTX and has huge exposure (USD 3.6 billion) to the FTT token, according to crypto media outlet CoinDesk. It has raised doubts from crypto industry commentators about the financial stability of Alameda Research and FTX more generally.

• CZ has also said this, claiming that FTX has secretly lobbied other industry players:

Liquidating our FTT is just risk management after exit, and learning from LUNA. We were supportive before, but we won’t pretend to love after divorce. We are not against anyone. But we will not support people who lobby against other industry players behind their backs. And further.

— CZ 🔶 Binance (@cz_binance) 6 November 2022

• There is more to the story, which the FT covers here. Meanwhile, would an ongoing ugly exchange giant war between Binance and FTX hurt the crypto market? It’s certainly not the most helpful narrative right now, so we hope it just blows over.

Not war or battle. We wash a little and move on.

— CZ 🔶 Binance (@cz_binance) 6 November 2022

Two coins that usually trade in lockstep are now heading in opposite directions.

Binance 📈

FTX 📉 pic.twitter.com/tBmXV2IzVc— Luke Martin (@VentureCoinist) 6 November 2022

Top 10 overview

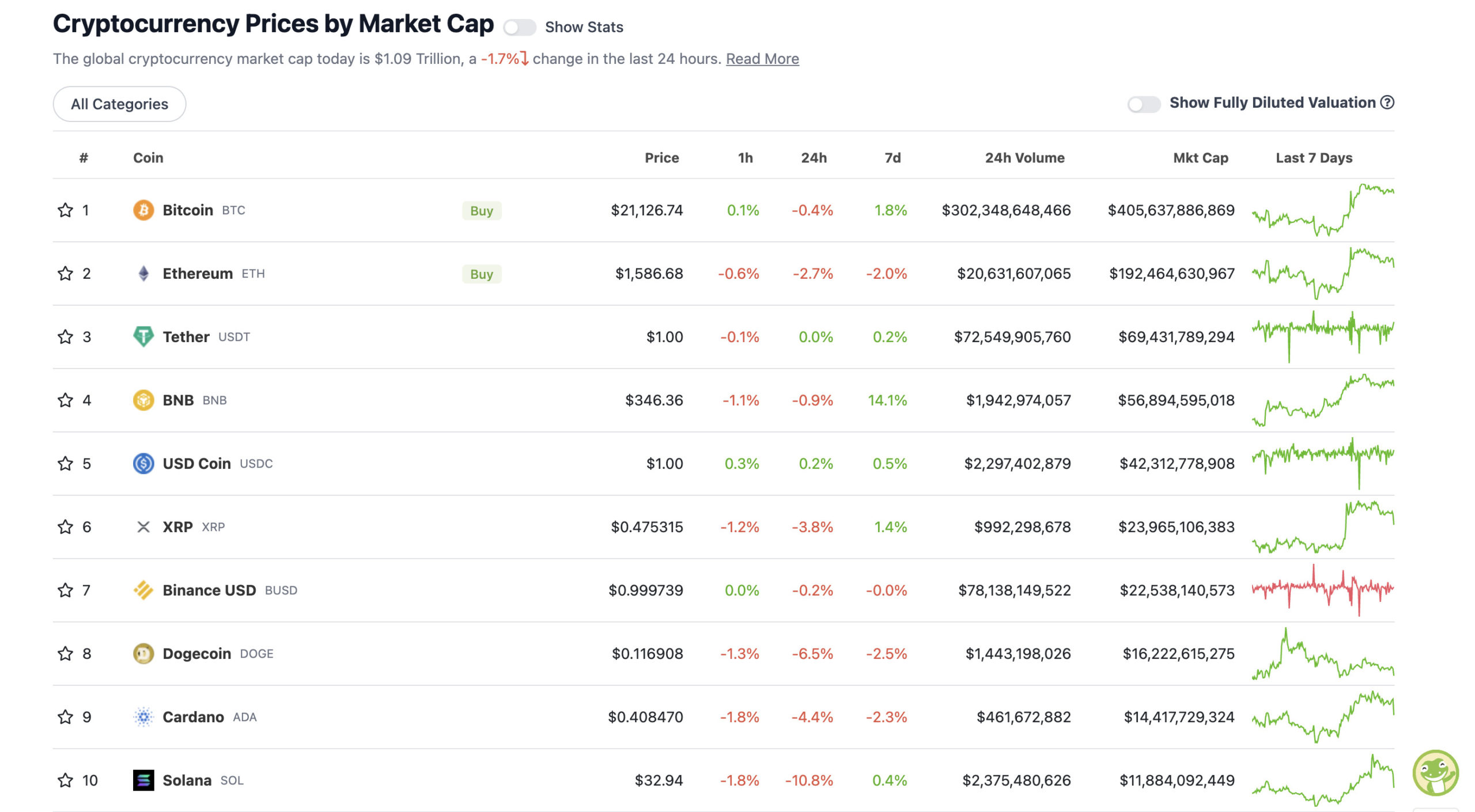

With the total crypto market capitalization at $1.09 trillion, down about 1.7% since this time yesterday, here is the current status of the top 10 tokens – according to CoinGecko.

Over the weekend, Bitcoin (BTC) peaked just above $21,400, while Ethereum (ETH) also rallied, trading above $1,600 for most of the past couple of days.

Tell me why, I don’t like Mondays? Partly because it so often turns out that exuberant crypto trading on the weekends is completely unreliable for the week ahead. As mentioned, however, at the moment some gains have been retained, so we’ll see.

What is coming this week that could affect the narrative? Inflation data for the US consumer price index for the month of October. Landed on November 10.

Big week comes week with Midterms approaching. Probably won’t move the markets that much, but the CPI at the end of the week will.

Volatility a lot.

Staying in the mountains, so it will be fun to see markets in between haha.

— Michaël van de Poppe (@CryptoMichNL) 6 November 2022

Thank you, Michael. Maybe the crypto market can join you in the mountains.

Other things to note in the top 10 by market cap … yep, Binance token BNB is up 14% in the past week, Dogegoin (DOGE) continues to slide after its Twitter/Musk fueled recent run, and Solana’s SOL token is big daily loser (-10.8%).

What happens to SOL? Apparently not much in the way of price action, which is perhaps odd since it had a pretty positive announcement (a Google-related partnership) over the weekend at its big, well-attended Breakpoint event in Lisbon, Portugal.

Yesterday, Solana’s price rose when Google confirmed a partnership with the L1 blockchain.

Here’s the scoop. 👇 pic.twitter.com/w7AOPx1dbR

— Lite // @Breakpoint Lisboa (@LitecoinYagami) 6 November 2022

Google Cloud has announced a plan to become a validator on the Solana network, similar to the recent Ethereum node announcement. Validator nodes efficiently verify, vote on, and maintain a record of transactions on a blockchain network.

And Google is a big deal, we hear.

Overdraft and downdraft: 11–100

With a market cap of around $10.1 billion to around $427 million in the rest of the top 100, let’s find some of the biggest 24-hour winners and losers at press time. (Statistics accurate at time of publication, based on CoinGecko.com data.)

DAILY PUMPS

• The BTSE token (BTSE), (market value: USD 637 million) +2%

• Chillies (CHZ), (mc: USD 1.46 billion) +2%

• WhiteBit Token (WBT), (mc: USD 977 million) +1%

• Chain (XCN), (mc: USD 1.1 billion) +1%

DAILY SLUMPERS

• Tokenize XChange (TKX), (market cap: USD 1.22 billion) -11%

• Aave (AAVE), (mc: USD 1.23 billion) -10%

• The graph (GRT), (mc: USD 670 million) -9%

• Evmos (EVMOS), (mc: USD 610 million) -8%

• Phantom (FTM), (mc: USD 678 million) -7%

Lower capsule

There is a lot of chaff the further you dive down the stock market value list. An occasional grain of wheat too. Remember to DYOR.

• Goldfinch (GFI), (market cap: USD 29 million) +54%

• Phala network (PHA), (mc: USD 113 million) 53%

• Rare (RARI), (mc: US$44 million) +14%

• Ocean Protocol (OCEAN), (mc: USD 98 million) +32%

• Mesh network (MASK), (mc: USD 244 million) +23%

DAILY SLUMPERS

• OriginTrail (TRAC), (market cap: USD 88 million) -14%

• Ethereum naming service (ENS), (mc: USD 423 million) -9%

• ImmutableX (IMX), (mc: USD 343 million) -9%

• Looks Weird (LOOKS), (mc: USD 118 million) -9%

Around the blocks

An assortment of coincidences and relevance that stuck with us on our morning through the Crypto Twitterverse…

Lots of FTX R&D going around today.

Reminder, exchanges are not banks, your crypto should be stored on a hardware wallet. #bitcoin #crypto

— Lark Davis (@TheCryptoLark) 6 November 2022

Quick bounce to 21500 and 1700 is still likely.

— il Capo Of Crypto (@CryptoCapo_) 6 November 2022

BREAKING – CZ to Sell $500M FTX Token FTT:

We will not support people who lobby against other industry players behind their backs.

What has Sam been up to? 🤔

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) 6 November 2022

You’re way smarter than me, bro. I don’t think much. 😂

— CZ 🔶 Binance (@cz_binance) 6 November 2022

The WC is in 2 weeks. World cup fan tokens are one of the few narratives that are playable right now, and CHZ is the most liquid fan token for degens to tap into. IF this week breaks out, I’m in. pic.twitter.com/lJ1RjRUbHp

— Will Clemente (@WClementeIII) 5 November 2022

If @saylor had bought $ETH instead of #Bitcointhe micro strategy will be up $1.8 billion versus down $1.2 billion. pic.twitter.com/NWDdDkalGi

— Miles Deutscher (@milesdeutscher) 5 November 2022

Boomer’s smash purchase #Bitcoin when they realize that property and stocks are still overvalued. pic.twitter.com/tDb5BNKyXN

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) 6 November 2022

FUN FACT: 9 years ago today, someone paid to store all the lyrics to “Never Gonna Give You Up” on #Bitcoin blockchain for all times ✨ pic.twitter.com/8aP0PfTZNr

— RIZZO (@pete_rizzo_) 5 November 2022

If you need a laugh.. 😅 pic.twitter.com/05dO0n9aPm

— Buitengebiden (@buitengebiden) 6 November 2022