MoneyLion: My Last Fintech Position (NYSE:ML)

Klaus Vedfelt/DigitalVision via Getty Images

MoneyLion (NYSE:ML) is now my only fintech position after the closure of my investment in SoFi (SOFI) with little profit. This new positioning reflects MoneyLion’s deeply discounted value against what remains robust growth profile. The company recently reported a turnover pace for fiscal 2022 fourth-quarter earnings against the broader shroud of fear that has engulfed the financial sector. MoneyLion offers digital banking services, but is not a bank. The company has partnered with banking infrastructure provider Pathward to offer RoarMoney. Therefore, the core near-term impact of the Silicon Valley Bank collapse may coalesce around the continued weakness of MoneyLion’s common stock and a potential slowdown in new client additions as deposit capital moves to the big four US banks.

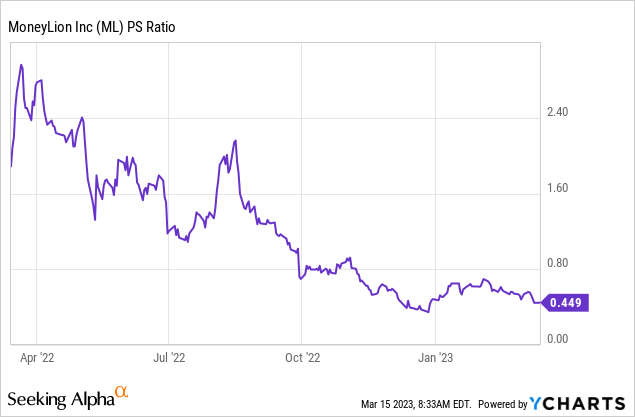

What is the opportunity here? The company’s terrible trailing 12-month price-to-sales multiple of 0.45x versus what was year-over-year revenue growth of 70.9% for the last reported quarter. Bears, which make up short interest at 3.24%, will of course highlight continued unprofitability in a rising rate risk environment as core reasons to avoid the public. In fact, deSPACs have largely been a disaster with at least half a dozen deSPACs filing Chapter 11s in the past year. While this is not a possibility for MoneyLion, the anxiety is there and the SPAC go-public legacy will likely be tied to its common stock until profitability and cash flows can be generated on a sustained basis.

Earning rate and the future of RoarMoney

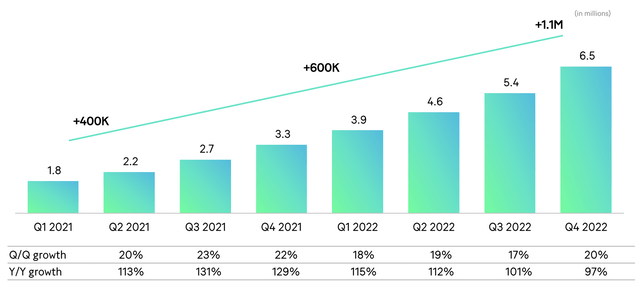

MoneyLion’s fiscal 2022 fourth-quarter earnings saw revenue come in at $94.94 million, up 70.9% from the year-ago quarter and topping consensus estimates by $3.87 million. This growth came on the back of 1.1 million new customers added during the period to increase total customers to 6.5 million. This was up 97% compared to the year-ago figure, and was 20% sequential growth from 5.4 million customers in the third quarter. Loan originations of $496 million also increased 11% sequentially with allowance for loan losses as a percentage of loan originations at 4%. This was at the low end of the company’s target range of 4% to 6%.

MoneyLion

Critically, MoneyLion’s financial services continue to resonate with the American public, and continued momentum underpins MoneyLion’s value addition. The company recently announced a partnership with Column Tax to offer its members free tax filing services and also launched MoneyLion University late last year. This is an initiative to improve financial literacy and get new users to the platform.

MoneyLion

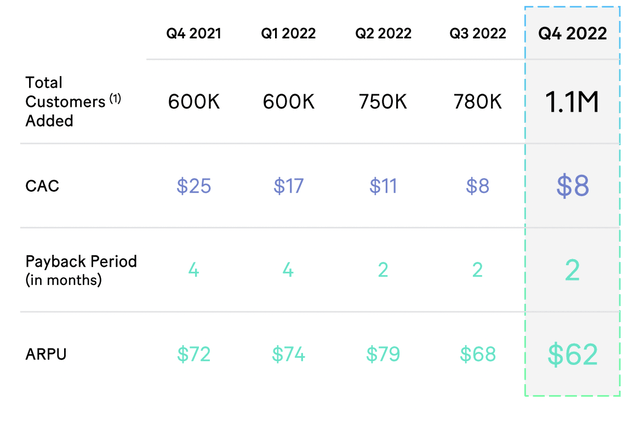

MoneyLion’s unit financials are strong and improving with customer acquisition cost falling to $8 during the fourth quarter, against ARPU of $62. While this is down from $72 in the quarter last year, the company’s payback period has been cut in half over the same time frame. Therefore, underlying profitability has improved significantly with MoneyLion generating a gross profit of $58 million during the fourth quarter. This represented a gross profit margin of 62% and was an improvement of 400 basis points from a gross profit margin of 58% in the third quarter.

What the rest of 2023 might look like

MoneyLion’s revenue reached $328 million for the full year, up about 100% from fiscal 2021. Revenue has now grown at a 100% compound annual growth rate for the three years from 2019 to 2022. Therefore, assuming a compound annual growth rate. at around 40% in the two years from 2022 to 2024, the company’s forward price-to-sales multiple stands at 0.22x. This will bring full-year revenue for fiscal year 2024 to $650 million.

Furthermore, MoneyLion’s underlying profitability has improved with negative adjusted EBITDA of $6 million during the fourth quarter, a significant improvement from negative adjusted EBITDA of $32 million in the same period last year. This was the fourth quarter in a row with a marked improvement in adjusted EBITDA. While the company realized a net loss of $136.2 million during the fourth quarter, this consisted primarily of a $140 million non-cash goodwill impairment charge. The company ended the quarter with cash and equivalents of $154 million.

Critically, MoneyLion is guiding for adjusted EBITDA profitability in 2023. This will represent a step change for the company and will help improve investor sentiment and pull up the valuation. I do not expect common stock to reverse its current downtrend until this break-even point is reached and sustained. I think the forward price to sales multiple reduces the risk of a long position in the commons and sets a fiery backdrop for what appears to be continued strong operational performance. I remain long on the back of this with MoneyLion’s strong positioning set to see members likely to reach 10 million in FY2024 as revenue maintains a 40% CAGR over the same time period.

Editor’s Note: This article covers one or more microcap stocks. Be aware of the risks associated with these stocks.