Millennial Female Crypto Investor Research from BlockFi

One in 10 women chose crypto as their first investment

A generation gap is emerging for female investors

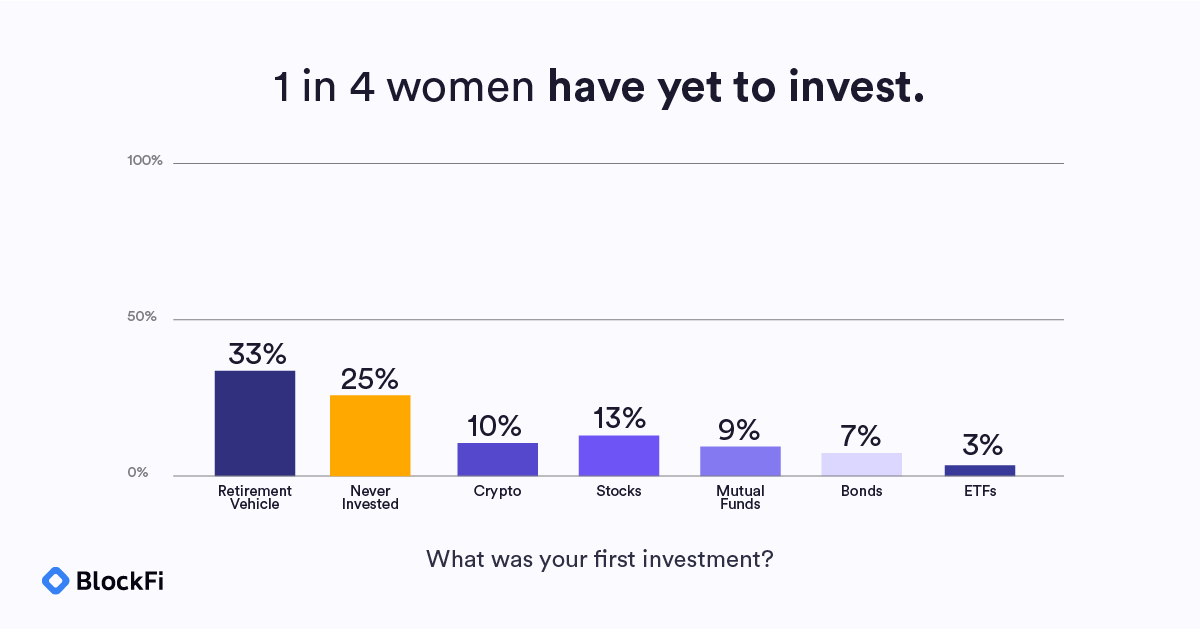

BlockFi’s latest survey found that one in 10 women chose crypto as their first investment, with 17% of Millennial women and 11% of Gen Z women saying crypto was their first investment. Crypto has even inspired new Gen-Xers to invest, with 7% making it their first investment, despite having more time to move into other asset classes than their Gen-Z and millennial counterparts. Overall, one in three (33%) women surveyed cite investing in a retirement vehicle as their first entry point into the markets, while one in four (25%) respondents said they have yet to invest.

Financial confidence is essential for women in crypto

BlockFi’s research also found that one in four women said they are not confident about their wealth-building investment strategy, while nearly half (45%) feel financially secure. In addition, one in three women reported that they often talk about finances in social circles, and Gen Z and Millennials signal greater comfort than their Gen X and Baby Boomer counterparts. And while the vast majority of women report having heard of crypto before, nearly 81% of women still report that crypto is confusing and 77% see crypto as a risky investment.

“Having a sense of financial confidence and security is essential. Our research shows that there is a significant difference between women who feel safe and secure about their investments and those who do not. We need to come together to close this gap – especially in the crypto ecosystem,” Marquez added. “Knowledge gives confidence and self-esteem. I would encourage those women who feel financially secure and confident in their investment strategies, especially in the crypto community, to reach out to those in your social circles who may not feel the same and see how you can help them build their financial confidence .”

Female crypto owners remain robust

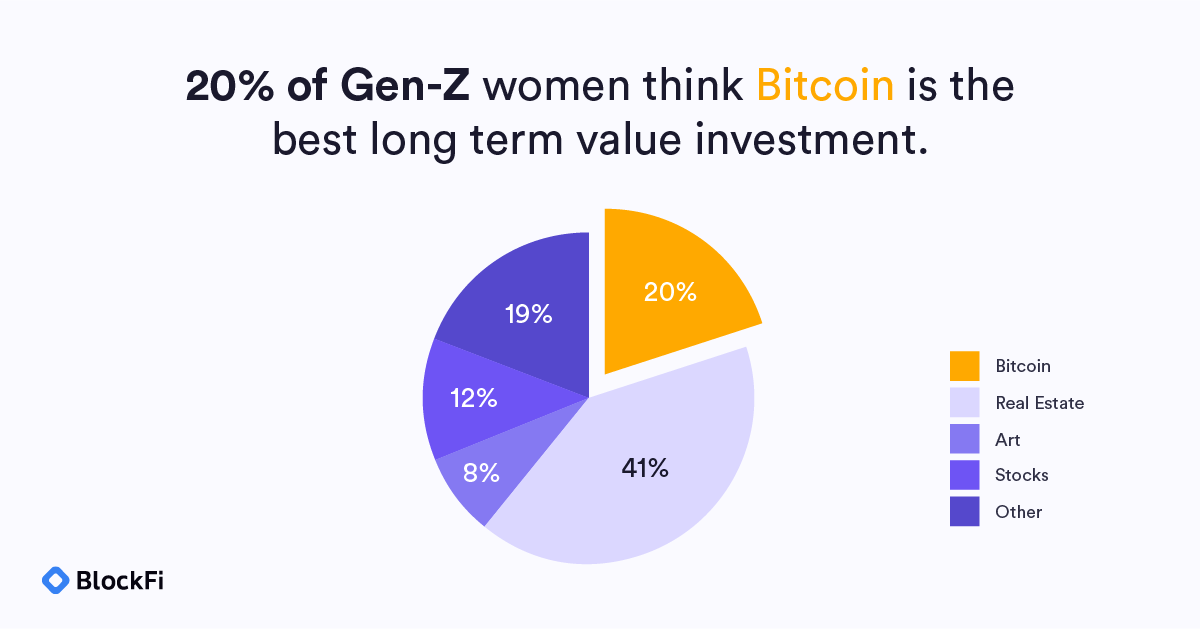

Despite a broad market decline, the survey’s longitudinal results suggest that female investors’ interest in crypto has not abated significantly. More than one in five women (22%) still intend to buy crypto in the next 12 months, somewhat down from 28% the previous year. When asked, one in five women believe crypto is a good hedge against inflation. Even more, 20% of Gen Z women noted Bitcoin as the best long-term investment when presented with a list of options, including individual stocks and real estate. This was twice as many women as Gen X.

BlockFi’s research also indicates that the majority of female crypto investors have adopted a buy-and-hold investment strategy, suggesting strong long-term prospects for the asset class. When asked what best describes their crypto investing style, the majority of female crypto owners (69%) said they hold crypto and remain hold-only. Additionally, 21% of women report feeling welcome in the crypto community. However, the majority are unsure (52%), which indicates a lack of knowledge about society rather than being seen as unwelcoming.

Marquez concluded: “The crypto landscape and the number of players looks completely different than it did six months ago when we last published this survey, and yet faith in the crypto markets and its potential as a long-term investment strategy remains. This resilience is extremely promising. As many have noted, the best building happens during bear markets. It’s important that we use this time to build products and communities that are inclusive of all investors. At the end of the day, BlockFi’s vision is to accelerate global prosperity and is committed to ensuring that everyone feels welcome regardless of where they are in their crypto journey.

Methodology

The survey, the third in a series evaluating women’s investment patterns, was conducted through a third-party survey panel on September 20, 2022. 1,075 female-identifying Americans between the ages of 18 and 65 were surveyed.

About BlockFi’s Real Talk

About BlockFi

BlockFi is a new type of financial company. Founded in 2017 by Zac Prince and Flori Marquez, BlockFi is building a bridge between cryptocurrencies and traditional financial and wealth management products to advance the integrated digital asset ecosystem for individual and institutional investors.

This blog post is for informational purposes only and is not investment advice. The information herein has been compiled by BlockFi from sources believed to be reliable, but no representation or warranty, expressed or implied, is made as to its accuracy, completeness or correctness.

Nothing in this document shall be construed as a solicitation of an offer to buy or offer, or recommendation, to acquire or dispose of any security, commodity, investment or to engage in any other transaction. The information provided herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This information is not directed to any person in any jurisdiction where the publication or availability of the communication is prohibited, by reason of that person’s citizenship, residence or otherwise. Nothing in this document shall be construed as providing legal, tax, investment, financial or accounting advice to BlockFi or any of its affiliates or representatives. You should consult your own legal and/or tax advisors before making any financial decisions. The information herein, unless otherwise stated, is the property of (and all copyright shall belong to) BlockFi. You are prohibited from duplicating, abbreviating, distributing, copying or circulating this information or any part of it without the prior written consent of BlockFi.

Cryptocurrencies and digital assets are speculative and highly volatile, can become illiquid at any time, and are for investors with a high risk tolerance. You should seek additional information about the benefits and risks of investing in cryptocurrencies or digital assets before deciding to buy or sell such instruments.