MicroStrategy’s Bitcoin approach is ‘comically stupid,’ expert says

North Rock Digital founder Hal Press criticized MicroStrategy’s Bitcoin acquisition strategy, saying the company will eventually have to sell all the BTC it bought.

In accordance Press, the business model is unsustainable as “every single one of Saylor’s coins must be sold.” He added that “when the time finally comes, it will be a short career.”

The crypto-focused hedge fund founder noted that this would not happen anytime soon and that it would take at least a few years. Press further noted that there is a good chance that Michael Saylor’s BTC game could be profitable in the future.

He added:

“The idea of taking a software company and making it run a ‘Bitcoin acquisition strategy’ is so comically stupid it’s actually quite funny. Will be so obvious in hindsight.”

Would ETH be a better investment?

Press opinion generated differing views, with some arguing that MicroStrategy’s BTC acquisition may backfire. Others argued that the firm should have invested heavily in Ethereum instead.

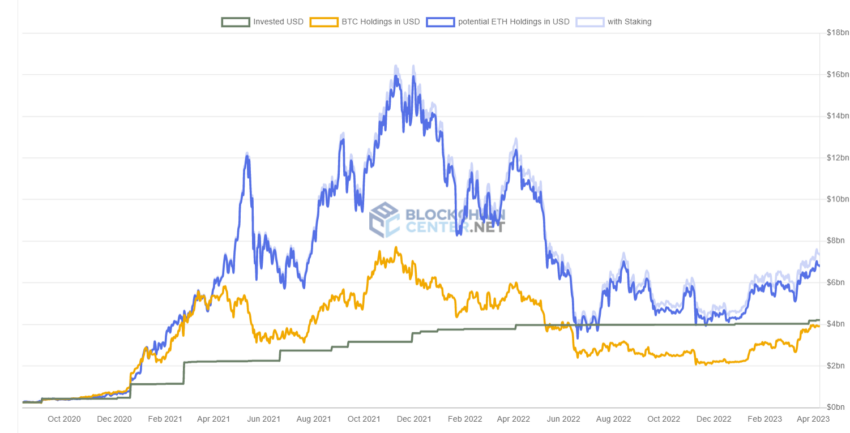

A comparison page tracking MicroStrategy BTC purchases if it had been ETH shows that the company would now have 3.68 million ETH. ETH will be worth $6.883 billion compared to BTC holdings valued at $3.926 billion.

The company could also have earned over 300,000 ETH worth $561.6 million betting the digital asset.

However, Press said buying ETH would be just as stupid. He added:

– My point is that the structure does not make sense. Hijacking a public company and then taking it over to acquire an asset in a way that doesn’t add anything to the core business just doesn’t make sense.”

MicroStrategy remains bullish on Bitcoin

Meanwhile, the criticism surrounding MicroStrategy’s Bitcoin strategy comes as the company’s holdings stand at 140,000 BTC. Recent SEC filings showed that the company bought BTC heavily during the first quarter of the year and plans to buy more as the year progresses.

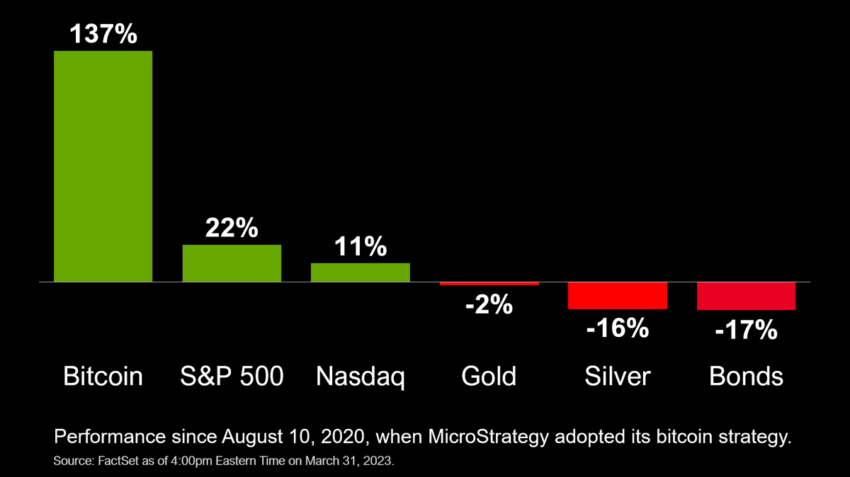

The company’s founder Saylor remains a BTC bull and has advocated for wider use of the digital asset. According to an April 1 tweet, BTC has outperformed other traditional assets such as gold, silver, Nasdaq, S&P 500, etc., since MicroStrategy was adopted in 2020.

Institutional investors are pouring into MicroStrategy shares

Meanwhile, institutional investors are buying MicroStrategy’s stock to gain indirect exposure to Bitcoin. During the first quarter of the year, Fidelity and Bank of America acquired over $75 million of the company’s stock, according to Bitcoin Magazine.

MicroStrategy’s stock MSTR is among the best stocks in the market – growing by over 80% year-to-date. MSTR’s performance mirrors Bitcoin’s, up 72% in 2023.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.