Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

Microstrategy (MSTR) has “outperformed all asset classes and major tech stocks” since the company adopted a bitcoin strategy and began accumulating the cryptocurrency in its corporate coffers, says CEO Michael Saylor. The pro-bitcoin CEO will step down as CEO of Microstrategy and take the role of the company’s executive chairman to focus on bitcoin.

Nasdaq-listed software company Microstrategy Inc. (Nasdaq: MSTR) released its Q2 financial results on Tuesday. CEO Michael Saylor tweeted Wednesday:

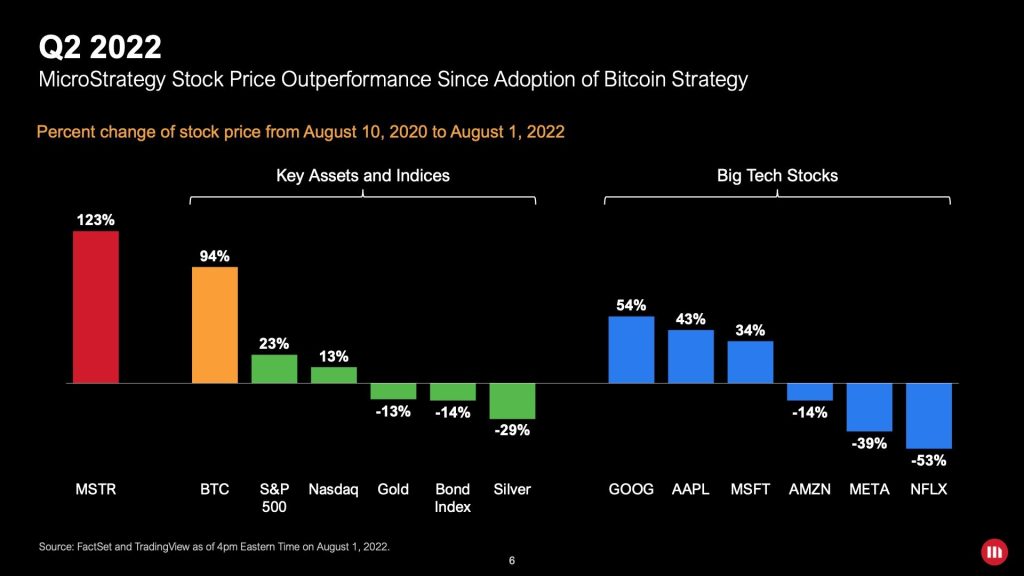

Since adopting a bitcoin strategy, MSTR has outperformed all asset classes and major technology stocks.

He added that the price of bitcoin increased 94% during that time period, while the S&P500 rose 23% and the Nasdaq rose 13%. In contrast, gold, bonds and silver are down 13%, 14% and 29% respectively. Microstrategy adopted a bitcoin strategy in the third quarter of 2020.

He explained in another tweet:

Since Microstrategy adopted a bitcoin strategy, enterprise value is up +730% (+$5 billion) and MSTR is up +123%.

Comparing the performance of Microstrategy’s stock to major technology stocks since adopting a bitcoin strategy, Saylor noted that MSTR outperformed Alphabet/Google ( GOOG ), Apple ( AAPL ), Microsoft ( MSFT ), Amazon ( AMZN ), Facebook owner Meta (META) and Netflix (NFLX).

Microstrategy has two business strategies: business analytics and bitcoin. Bitcoin’s strategy is to “acquire and hold bitcoin long-term; purchase bitcoin through the use of excess cash flows, and debt and equity transactions,” according to the company’s second-quarter earnings presentation.

The software company currently owns about 129,699 BTC, purchased at an average purchase price of $30,664 per bitcoin, net of fees and expenses, for a total cost basis of $4 billion, the company said. Microstrategy reported bitcoin impairment charges of $917.8 million in the second quarter, which are non-cash charges due to BTC price volatility.

Microstrategy also announced Tuesday that Saylor will step down as CEO of the company and take the role of executive chairman, effective Aug. 8. Phong Le, the company’s current CFO, will become the new CEO.

Saylor, who has served as CEO of the company since 1989, will remain chairman and CEO of the company. He detailed:

As Executive Chairman, I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives.

“I believe that splitting the roles of Chairman and CEO will enable us to better pursue our two corporate strategies of acquiring and holding bitcoin and growing our analytics software business,” commented the outgoing CEO.

“In my next job I intend to focus more on bitcoin,” he tweeted on Wednesday.

What do you think of Microstrategy’s performance since adopting a bitcoin strategy? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.