MicroStrategy: Crypto’s Winter Might Be Warming Up (NASDAQ:MSTR)

Araya Doheny

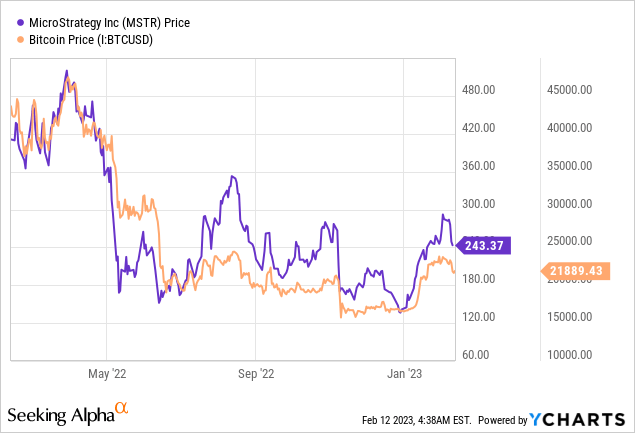

MicroStrategy (NASDAQ:MSTR) is up from near-term lows as Bitcoin shakes broader fears around the crypto space’s retrenchment to warm up from a long winter. Not even the Chapter 11 bankruptcy filing of Genesis, the Digital Currency Group’s crypto lender, could stop the price of Bitcoin from pushing above $20,000.

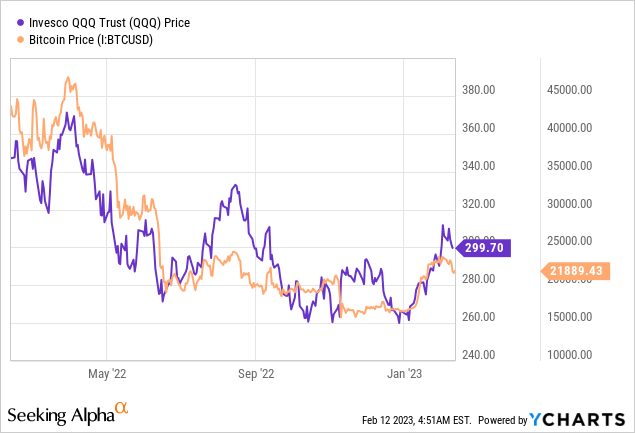

Its investors, speculators and maximalists now look to broader macroeconomic numbers for direction. Indeed, the economic story of the past 12 months has been defined by rising inflation, rising Fed funds rates and the specter of a recession. Why is this relevant to bitcoin? The digital asset has tracked the performance of the technology-heavy Nasdaq 100 index for some time.

MicroStrategy is essentially a proxy for a direct Bitcoin investment rather than a spot bitcoin ETF. Therefore, I think the direction of inflation, the interest rate and The US economy is likely to be the biggest driver of Bitcoin returns this year. Essentially, a return of animal spirits on the back of an apparent dovish pivot by the Fed as inflation cools to their 2% target rate will be the most significant determinant of where MicroStrategy trades at the end of the year.

To be clear here, Bitcoin essentially fell from its pandemic highs just as tech, SPACs, and growth stocks collapsed. The golden era was then defined by very jubilant animal spirits as heavy stimulus programs from the pandemic pumped liquidity into the markets. This, of course, changed with the energy crisis and Russia’s war in Ukraine, which fueled inflation and forced the Fed to embark on its most aggressive tightening program in decades.

The revenue for fiscal year 2022 for the fourth quarter

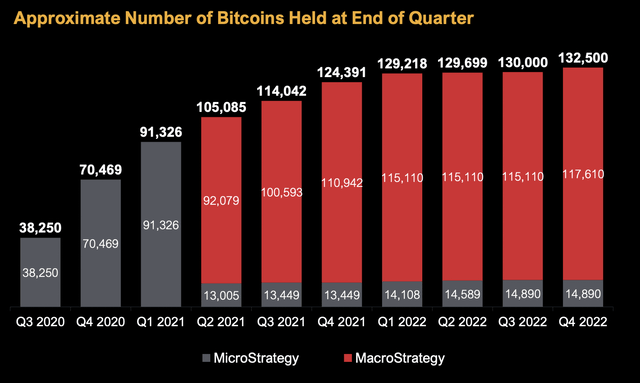

MicroStrategy operates around two business strategies. The first is an operational strategy built on the back of the Business Intelligence software business. The second is a balance sheet strategy built around their use of Bitcoin as a primary reserve asset. MicroStrategy aims to buy Bitcoin and hold for the long term using excess cash generated from the operating strategy as well as the proceeds from capital raising transactions.

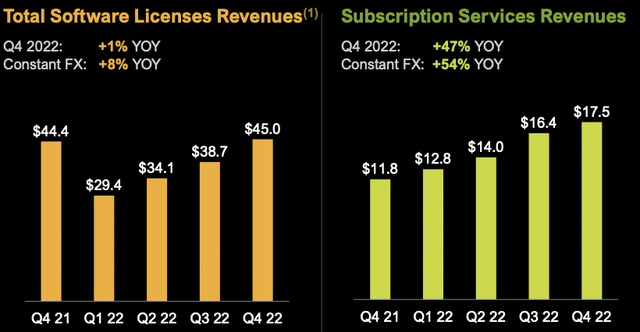

The company’s recently reported fiscal 2022 fourth quarter earnings saw revenue come in at $132.6 million, down 1.4% from the same period a year ago, but still $1.6 million short of consensus estimates. MicroStrategy held 132,500 Bitcoins at the end of the quarter, up 2,500 sequentially from the previous third quarter.

Micro strategy

This had a book value of $1.840 billion and a cumulative loss of $2.15 billion. The current market cap of MicroStrategy’s Bitcoin holdings is now $2.9 billion, up 32.4% from $2.19 billion at the end of the fourth quarter. The company’s purchase of 2,500 Bitcoins during the quarter was completed for a net aggregate purchase amount of $45 million, approximately $17,850 per Bitcoin. With MicroStrategy now up on this particular tranche of Bitcoin purchases, bulls will be hoping the value of the digital asset pushes above MicroStrategy’s average cost per Bitcoin of $30,137.

The Dual Strategy and the Future of Bitcoin

The core software business generated gross profit of $105.8 million, down from $110.5 million in the year-ago quarter, as gross profit margin fell 240 basis points to 79.8%. This decline still came on the back of subscription services revenue that grew 47% year-over-year to $17.5 million.

Micro strategy

This also came with a high renewal rate of 95% during the quarter, up from five consecutive quarters where the company had a renewal rate of 90%. MicroStrategy would realize a net loss of $193.7 million during the fourth quarter, up from $137.5 million a year earlier and driven by a $197.6 million Bitcoin impairment loss. Cash from operations was negative at $18.2 million, down from positive cash flow of $3.2 million in the quarter last year. This helped reduce cash and equivalents to $43.8 million compared to $60.4 million in the same period last year.

Of course, MicroStrategy can dispose of Bitcoin at any time to strengthen its balance sheet, so the runway is not uncertain in any terms. The risk here will come from its inability to buy Bitcoin with positive cash flows in future quarters as per the strategy. The company initiated a share offering of USD 500 million (ATM) during the quarter and raised approx. $46.6 million in gross proceeds, with $453 million outstanding under the ATM. Diluting to buy assets that you lose money on if Bitcoin returns to its near-term lows would not be a shareholder-friendly strategy.

MicroStrategy’s bulls are also looking towards the next Bitcoin halving for a further extraction of positive sentiment. This is a pivotal event that halves the reward for mining Bitcoin to reduce the supply and thus the inflation of Bitcoin. This is more than a year away, around March 18, 2024. In the near term, bulls will hope that the current dynamic of falling inflation and peak Fed funds rates continues to trigger a return of jubilant animal spirits. I am neutral about the company.