MicroStrategy: Buying the Bitcoin Dip Was a Smart Move (MSTR)

Joe Raedle

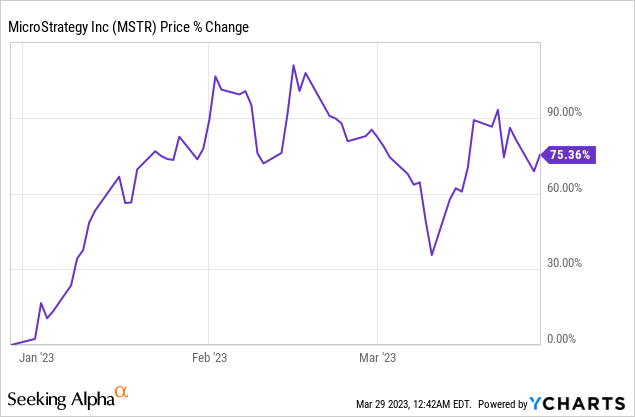

MicroStrategy (NASDAQ:MSTR) shares have been on an absolute tear so far in 2023 ever since I previously wrote about MSTR stock on January 6, 2023, when MSTR was trading at $160.

MSTR stock is up 75% YTD and the whole story around Bitcoin (BTC-USD) has changed drastically since my previous MSTR article.

The banking crises of 2023 explain the case for Bitcoin

The banking crisis of 2023 explains why so many people around the world are turning to Bitcoin as a safe haven when banks collapse and play risky games with customer deposits.

Silvergate, Silicon Valley Bank, Signature Bank and Credit Suisse are the biggest banks to collapse in 2023, but I think there will be more bank failures in the next few months.

US banks have over $600 billion in unrealized losses, and that number should continue climbing as long as the Fed refuses to lower interest rates.

MicroStrategy’s Q4 2022 Results and Recent Bitcoin Purchases

Let’s be honest: most of us hold MicroStrategy stock for our Bitcoin holdings and aren’t too concerned about how the underlying company performs in the short term.

MSTR shares were literally abandoned for nearly two decades until Michael Saylor became a Bitcoin maximalist and held BTC on MicroStrategy’s balance sheet in 2020.

MicroStrategy did quite well in Q4 2022 as Phong Le began to transition well into his new role as CEO of the company.

Total revenues reached $132.6 million in the fourth quarter of 2022, while net income reached $193.7 million for the quarter. Write-downs on the company’s Bitcoin holdings accounted for $197.6 million of the quarterly losses, leaving MicroStrategy’s core business with a small net profit of $3.9 million.

Since my previous MSTR article, MicroStrategy has bought the dip and bought more Bitcoin at very attractive long-term prices.

- In the fourth quarter of 2022, MicroStrategy purchased 3,204 Bitcoins at an average price of $17,616 per coin.

- So far in the first quarter of 2023, MicroStrategy has purchased 6,455 Bitcoin at an average purchase price of $23,238.

Both of these purchases are well below the company’s total Bitcoin acquisition price of $29,817, which helped lower MicroStrategy’s total Bitcoin cost base.

Each MSTR share holds around 0.12 BTC, making MicroStrategy a solid alternative to buying Bitcoin Direct or Grayscale Bitcoin Trust (OTC:GBTC).

Why did MicroStrategy pay back its Silvergate loan

For those of you wondering about the $205 million Silvergate loan, MicroStrategy paid off the entire loan at a 20% discount to move on from the bankrupt crypto bank.

Silvergate is in bankruptcy proceedings and can use any form of cash at the moment to settle with depositors. MicroStrategy saved $44 million by paying off the loan early, due in 2025.

The only downside is that MicroStrategy offered 1.3 million new shares to repay the Silvergate loan and raise more Bitcoin. As far as I know, MicroStrategy stock sales were diluted by 10% to 10.5 million as of Q1 2023.

It’s not an ideal situation, but the company made a smart move by paying off the Silvergate loan and buying into the recent Bitcoin dip.

Bitcoin is a deflationary asset that continues to rise in value as the US dollar loses purchasing power.

Many people are aware of Bitcoin’s potential due to the recent banking crisis and I think Bitcoiners are quite excited as we approach the 2024 halving about 13 months from now.

Risk factors

Bitcoin has performed well so far this year, but nothing is guaranteed in such a tough economic climate. The biggest risk will be Bitcoiners losing confidence in Bitcoin and moving to another cryptocurrency or asset class.

MicroStrategy has no major debt obligations until 2025, so the company looks pretty safe right now financially.

What’s next for MicroStrategy?

I wouldn’t worry about the recent dilution now because MicroStrategy killed two birds with one stone by eliminating the Silvergate loan and acquiring more Bitcoin at a lower cost than the average base price.

The global banking sector is facing major turmoil, and that bodes well for Bitcoin in the long term.

I still believe that the crypto bull market will begin in April 2023 as more bank failures and bailouts put fear throughout the global economy.

For now, I’m holding my MicroStrategy shares and patiently waiting for the next Bitcoin halving to consider taking some profits off the table.