MicroStrategy, Inc ( NASDAQ:MSTR ) shares fell more than 5% Monday as the company heads into first-quarter earnings pressure after the close.

When a software and cloud-based services company posted massive fourth-quarter earnings on Feb. 2, the stock fell slightly the next day and continued to fall over the five trading days that followed, losing about 18%

For that quarter, MicroStrategy reported a loss of $20.51, missing the consensus estimate of negative 13 cents.

ENTER TO WIN $500 IN STOCKS OR CRYPTO

Enter your email and you’ll also receive Benzinga’s ultimate morning update AND a free gift card of $30 and more!

For the first quarter, analysts on average forecast that MicroStrategy will report an earnings loss of $1.28 per share on revenue of $119.04 million.

Ahead of the event, Berenberg analyst Mark Palmer initiated coverage with a Buy rating and announced a $430 price target. The price target suggests over 30% upside for the share. Read more here…

Options 101: The Beginner’s Guide

Want to become an options master? In his free reportoptions expert Nic Chahine will give you access to four bulletproof tips for beginnersthe secret to achieved 511% gain with options, and his time-tested “plan” for success. Grab your free copy of Options 101: The Beginner’s Guide ASAP.

Traders and investors will be watching to see if MicroStrategy’s Bitcoin position has started to benefit the company’s top and bottom lines. Between January 1 and March 31, Bitcoin rose 70%.

How MicroStrategy reacts to the earnings print will likely depend on whether it hits or misses and on the guidance. The company has not reported an earnings after it published its results for the fourth quarter of 2019 on January 28, 2020.

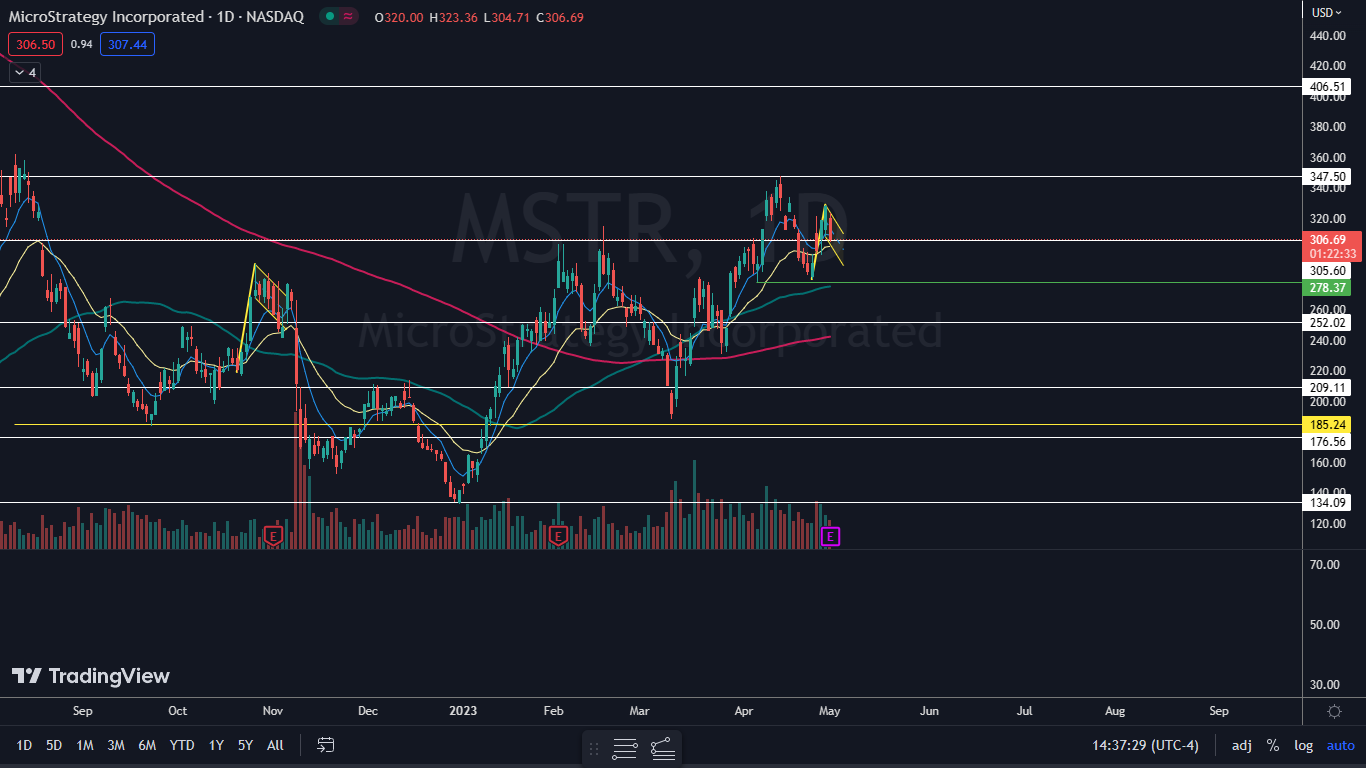

From a technical analysis perspective, MicroStrategy’s stock looks bullish heading into the event, having settled into an uptrend pattern on the daily chart. It should be noted that holding stocks or options over an earnings statement is akin to gambling because stocks can react positively to an earnings miss and bearishly to an earnings.

Do you want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

The micro strategy diagram: MicroStrategy reversed its last uptrend on April 25 near the $280 level. On Monday, the stock traded lower, possibly pushing the next higher low within the pattern. If MicroStrategy receives a positive reaction to its earnings, Monday’s intraday low will serve as a higher low, and traders will then want to see the stock rise above Friday’s intraday high of $328.98.

- MicroStrategy can form a bull flag pattern within the uptrend, with the upward sloping bar formed between April 25 and Friday and the flag formed during Friday and Monday. If the pattern is recognized, the measured move is about 17%, which suggests that the stock could rise towards $358.

- If MicroStrategy gets a bearish reaction to earnings and falls below $304.71, the uptrend will be negated and a downtrend could be on the horizon. If that happens, the stock could find support at $278.37, where it printed a double bottom pattern on April 6 and April 25.

- MicroStrategy has resistance above at $347.50 and $406.51 and support below at $305.60 and $252.02.

Photo via Shutterstock.