Miami Debuts NFTs Ahead of Holiday After Crypto Spiral, FTX Bankruptcy Risk

In the coming weeks, Miami plans to debut a series of non-fungible tokens (NFTs) ahead of the holiday season.

The offering follows a marked period of turmoil in the crypto market, of which NFTs are a part, the evaporation in value of the City’s trademark cryptocurrency. It will also come shortly after revelations of grave danger to cryptocurrency exchange FTX, which last year secured a nine-figure, 19-year deal with the city and Miami-Dade County to rename the Miami Heat arena.

Miami Commissioners in July OK plans in late July to roll out the NFTs through a partnership with TIME Magazine, Mastercard and Salesforce. The aim of the programme, Mayor Francis Suarez said at the time, is to use NFT sales to generate revenue for the city, local artists and nonprofits.

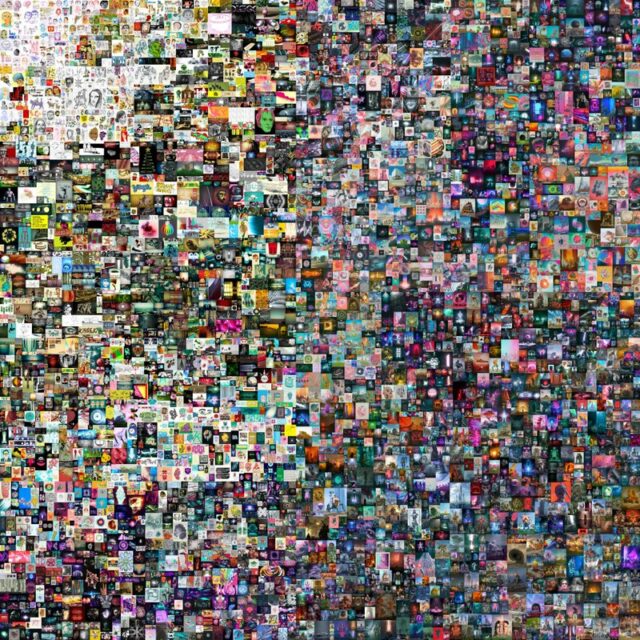

Website for investment information Investopedia defines NFTs as “cryptographic assets … with unique identification codes and metadata that distinguish them from each other.” They are often represented by visual artwork and held on a blockchain, a decentralized, digital ledger that tracks cryptoasset transactions and ownership.

NFTs have been around for almost a decade, but their popularity up 21,000% at $17.6 billion heading towards its trade in 2021, according to a study by French research firm L’Atelier.

Critics have compared the tokens to “digital Beanie Babies“, with reference to collection craze of the small plush toys in the 1990s that some cite as the world’s first internet sensation.

Whether NFTs will go down like another fad is yet to be known, but that uncertainty hasn’t stopped big names from getting in on the action. Actor William Shatner of “Star Trek” fame sold 90,000 virtual trading cards in 2020 for $1 each. Electronic musician Grimes sold 6 million dollars worth of her digital in February 2021, including a video clip of winged cherubs floating in pastel dreamscapes valued at $389,000.

Clip of NBA star LeBron James dunks sold last year for as much as $225,000. Actress Lindsey Lohan sold a photo of her face. People can also buy virtual land in video games and meme characters like New cat.

The 5,000 upcoming Miami NFTs will be “designed by 56 local artists, representing the city’s 56 square miles” and held on the Ethereum blockchaina Miami press note so.

TIME Magazine committed in July to invest more than $514,000 into the program with the expectation that it will recoup the money through NFT sales. Miami will split NFT sales revenue beyond this amount between the city (50%), local artists (25%), TIME Magazine (15%) and local charities (10%).

The NFT rollout follows efforts led in part by Suarez’s Dare Miami Initiative to transfer some city revenue streams and citizen services to Web3, a conceptualized new Internet also known as Web 3.0. Created by Ethereum’s co-founder Gavin Wood in 2014, proponents see Web 3 as a way to upgrade the current internet model which has been in place for nearly two decades and wrested content and information control from a small number of “Big Tech” companies.

“Miami has been at the forefront of the Web3 revolution, and we will continue to use these new technologies to support our existing businesses while attracting new ones, raising capital and providing experiences to our residents and those who visit this great city ,” Suarez said in the announcement. The NFT program. “At the same time, we can also use this new approach to support local artists and charities.”

TIME president Keith Grossman said the NFT offerings “will provide a unique opportunity for the City of Miami to build deeper connections with residents and visitors alike.” It’s “the first move in a new venture for TIME,” he said, calling Miami “a leader in Web3 innovation.”

The NFTs are set to arrive around the same time as the city’s three days MiamiWeb3 Summit, which will take place in late November at the InterContinental Miami Hotel and will be hosted by blockchain company CTH Group. Speakers include Suarez, US Sen. Cynthia Lummis from Wyoming, venture capitalist Tim Draper and Academy of Motion Picture Arts and Sciences executive director Bill Krameramong many others.

But there is likely to be a flurry over the summit and the NFT release, both of which come months after the value of the city’s cryptocurrency, MiamiCoin, dropped almost 99%.

Suarez, who in October 2021 compared the potential profits MiamiCoin could produce with those of “an oil-producing country,” said he was disappointed by the steep devaluation, but remains optimistic about how crypto can help the city and its current residents.

He pointed more than 5 million dollars set aside for rental assistance for city residents that Miami Commissioners accepted last year from CityCoins, the group behind MiamiCoin.

Others offered less sunny shots.

“MiamiCoin can make you a millionaire – if you started as a billionaire,” Billy Corbenone of the Miami government’s most outspoken critics, wrote further Social Media.

Urban technology researcher Mike Bloomberg told the Miami Herald that the city should have been more careful before taking money from the project and promoting MiamiCoin to investors.

“There was an incredible lack of diligence on the part of the city,” he said.

Additional crypto-based financial problems may soon hit the city and county. Last year, Miami-Dade Commissioners approved a deal to convert the home of the Miami Heat into FTX Arena after the Bahamian cryptocurrency exchange FTX.

The deal, which marked the first arrangement where a US sports arena would bear the name of a crypto market, was expected to give the county $90 million of a $135 million scheme through 2040.

That money may no longer be such a sure thing.

On Wednesday, FTX’s 30-year-old founder and CEO, Sam Bankman-FriedFTX — valued at $32 billion earlier this year — told investors could go bankrupt if it cannot secure funds to cover an estimated $10 billion shortfall.

He said FTX needed about $4 billion in the short term to remain solvent, and offered, “I was worried.”

Where did all the money go? The Wall Street Journal reported on Thursday FTX lent billions of dollars value of customer funds to fund risky bets from affiliate trading company Alameda Research.

Federal authorities are now investigating FTX, whose user base is fleeing to other trading platforms such as Robinhood, Coinbase and Binance, as of Wednesday withdrew an offer to take over the struggling stock exchange.

“In the beginning, our hope was to support FTX’s customers by providing liquidity,” Binance said in a statement. “But the problems are beyond our control or ability to help.”

The deal’s collapse led to a plunge in cryptocurrency values. Bitcoin fell 15% on Wednesday, following a 13% decline on Tuesday when word of FTX’s problems emerged. Ether, the signature currency of Ethereum, plunged 30% in value since Tuesday and was on the verge of trading below $1,000. Both cryptocurrencies have since risen by 9.6% and 18% respectively.

___

The Associated Press contributed to this report.

Post Views: 0