Method raises $16 million for loan repayments, balance transfers and more across fintech apps • TechCrunch

Method, a startup that aims to make it easier for fintech developers to build refunds, balance transfers and bill payment automation into their apps, announced today that it closed a $16 million Series A funding round led by Andreessen Horowitz with participation from Y Combinator (Method’s a Y Combinator graduate), Abstract Ventures, SV Angel and others. Co-founder Mit Shah says the new money will be used for product development and increasing the company’s staff from eight people to 28 by the end of the year.

The method was launched in 2021 after two of the company’s co-founders, Jose Bethancourt and Marco del Carmen, experienced the difficulties of integrating debt repayment in their previous company, GradJoy. (TechCrunch previously covered GradJoy, which sought to help students better manage their loan repayment plans through an app-based system.) Integrating student loans into the GradJoy app turned out to be a patchwork of wonky, insecure screen-scraping APIs, physical check mail and compliance barriers, according to Shah.

“Jose and Marco realized there was an opportunity to provide developers with an integrated API to add debt repayment to their apps and services,” Shah told TechCrunch in an email interview. “In May 2021, we started Method to provide developers with a turnkey infrastructure.”

Shah points out that there is no standard, technically simple way to access all of a person’s financial obligations — their student loans, credit cards, mortgages, and so on — and push money toward those obligations. Because of the lack of standardization, newer fintechs have used screen scrapers and credential-based methods to collect and access the data, he says. But there is a downside to these approaches. Onboarding new financial institutions can take a long time, and the lack of a direct connection makes it impossible to perform actions, such as paying off loans, on behalf of users.

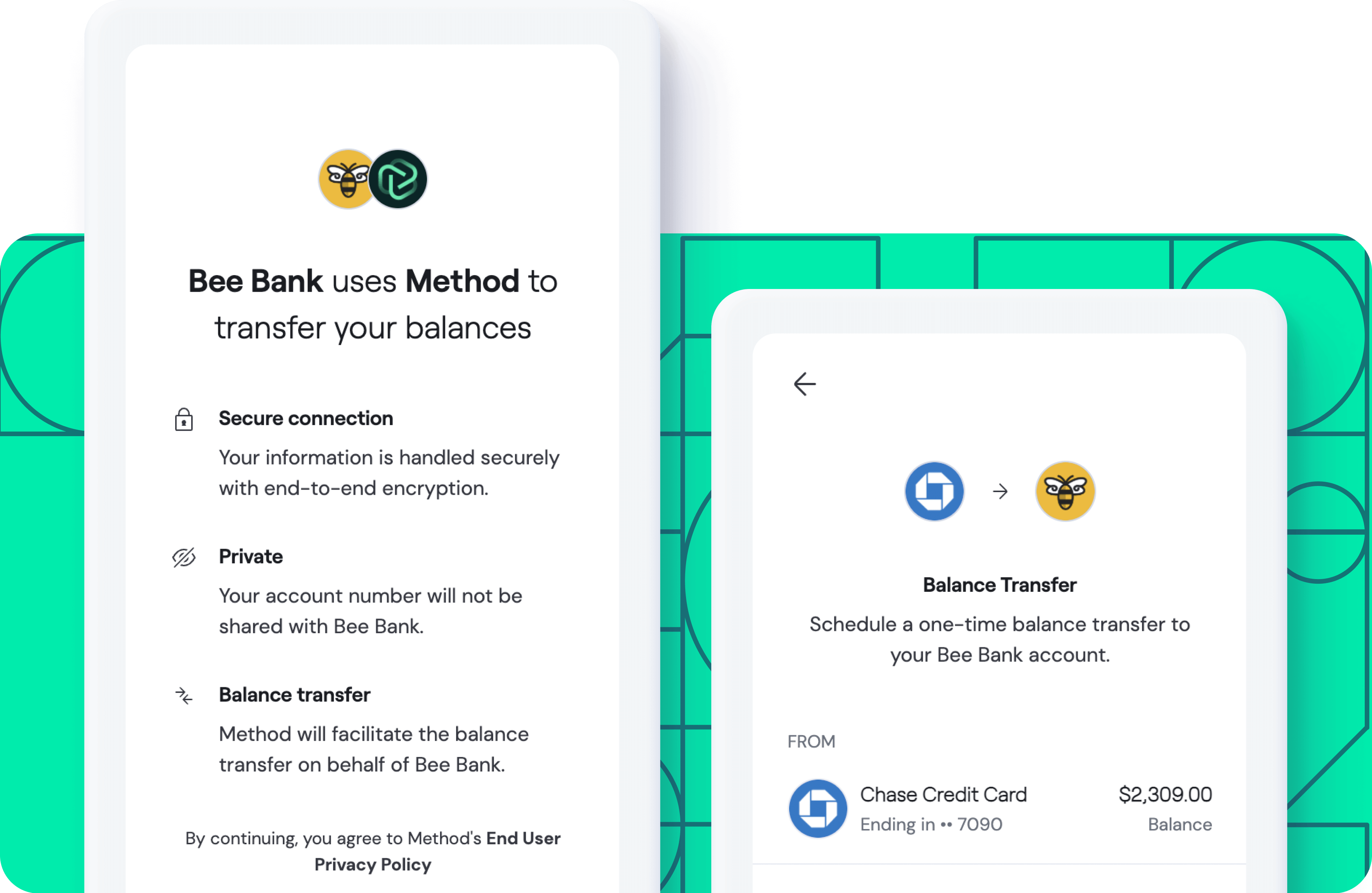

Image credit: Method

“The industry has been chasing ‘open finance’ by developing solutions around user credentials and working indirectly with financial institutions,” Shah said. “We’re going straight to the source to enable read and write access for all consumer obligations.”

The method works by leveraging consumer credit protections enacted into law as part of the Dodd-Frank Act of 2010. Using identity verification data from credit bureaus (e.g. Equifax) and wireless carriers (e.g. T-Mobile) and combining them with real-time data from financial institutions’ core banking systems, Method can aggregate a person’s obligations across more than 60,000 institutions in the US and kick off tasks such as balance transfers, withdrawals, bill payments and more.

“Method’s data API allows our customers—consumer-facing businesses—to retrieve all of a user’s existing liabilities using just their phone number. The liability accounts, once connected, can be immediately written and paid,” explained Shah.The method’s payment API allows users to push money to all types of consumer debt and bills. Method handles the entire money movement process end-to-end, freeing you from cash flow.”

Method handles a lot of sensitive data, which may give some end customers pause. But Shah said the company’s privacy policy is written to assuage consumer advocates’ fears, specifying that Method collects only “minimum user information” and does not sell user data to third parties. In another step to establish trust, the startup plans to launch a portal where users will be able to log in with Method to manage the data they share with other apps and services.

Method claims it has 35 customers and over 75,000 users currently, with annual recurring revenue of around $2.25 million. While the startup competes with big names like Plaid, MX, Spinwheel and Dwolla, Shah sees Method holding its own, especially as the platform rolls out new features over the next few months, including real-time credit card transactions, instant balance transfers and improved live data points for commitments.

“For now, new-age fintechs don’t have access to [sophisticated] infrastructure and traditional financial institutions have manual processes set up to retrieve real-time data on consumer lines of credit or make payments against them via checks,” Shah said. “We’re giving fintechs the ability to innovate faster and compete with larger banks with our turnkey real-time data and payment operations. Traditional institutions can onboard users faster and see big savings on manual backend processes… We’ve seen demand for our product from all areas in traditional finance and new-age fintech in lending, debt consolidation and personal financial management.”

To date, Method has raised $18.5 million in venture capital.