MercadoLibre: E-Commerce Booms and Fintech Booms (NASDAQ:MELI)

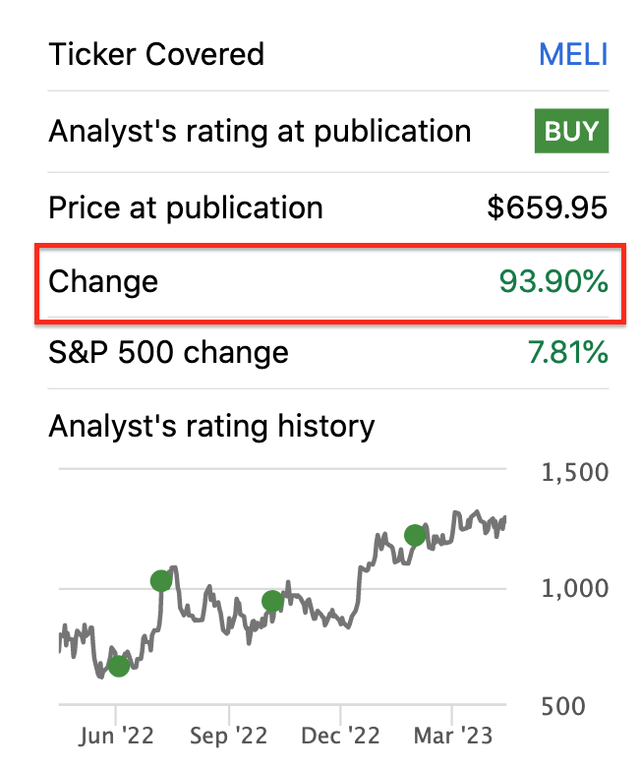

B4LLS

MercadoLibre (NASDAQ:MELI) is referred to as the “Amazon of Latin America”, due to its strong e-commerce business in the region. In my July 2022 post on the stock I discussed its “Value, Growth and Outstanding Execution” and the stock has delivered a return of ~94% for investors. Since that time, the company has continued to realize the latter two goals, increasing revenue by 35% year over year, and management has continued to perform exceptionally well. In this post, I will break down the company’s first quarter financial results for 2023, before revising and revealing my valuation model and forecasts for the business. Is MercadoLibre now too spicy a price for investors? or is it still worth uploading on? We’ll find out in this post, let’s dive in.

MELI (MercadoLibre)

Roaring economy

MercadoLibre reported strong financial results for the first quarter of 2023. Revenue was $3.04 billion, which was up 35.1% year over year.

It should be noted that this growth rate has slowed from the 41% level reported in Q4.22 and the brisk 63% YoY growth reported in Q1.22. However, this pattern of slowing earnings growth has been a common occurrence across many tech stocks I’ve covered (see my other posts). Therefore, I believe this is mainly driven by macroeconomic factors and not a long-term inherent business problem. In addition, revenue still beat analysts’ forecasts by $150.79 million.

The business also reported solid operating income of $340 million in Q1.23, which increased by a brisk 144.6% year-over-year, and stabilized at ~11% operating margin.

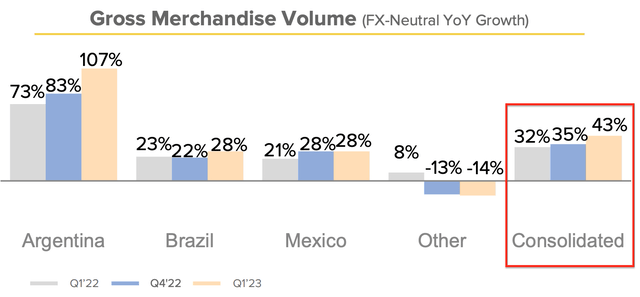

Another positive for MercadoLibre is its gross trading volume [GMV], has continued to grow at a brisk 43% rate, which is faster than the 35% reported in Q4.22 and the 32% reported in Q1.22. This is on a currency neutral basis, so its clear exchange rates still affect growth, which again I think is more of a cyclical occurrence. The main growth was driven by Argentina which reported a staggering 107% annual growth in GMV. Given Argentina is the second largest country in Latin America and the third largest economy (after Brazil and Mexico), this is a positive sign.

GMV (Q1.23 data with author comments)

Strong growth was also reported in Latin America’s largest economy, Brazil, which reported 28% year-on-year growth, which was faster than the 22% reported in Q4.22. Mexico GMV growth was 28% YoY, which was flat from Q4.22. In my eyes, this was expected as Mexico offers much tougher competition with the “real” Amazon (AMZN) competing heavily in the market.

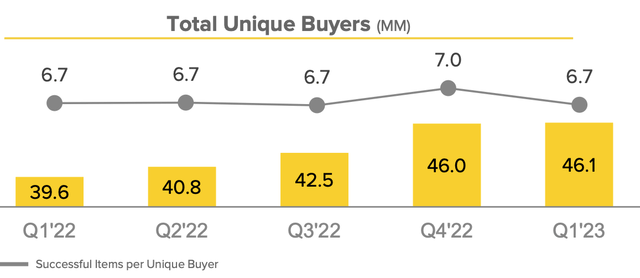

Overall, MercadoLibre’s total unique buyers continued to grow from 39.6 million in Q1.22 to 46.1 million by Q4.22. This is a hugely positive sign given that the global e-commerce market is going through a cyclical downturn.

Unique buyers (Q1.23 data)

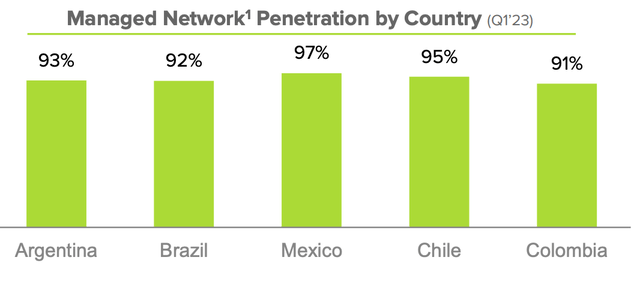

In my previous post on MELI, I discussed its main competitive advantage against foreign competitors (Shopee and even Amazon) was its huge penetration of fulfillment networks. This moat continued to expand in Q1.23 with its total managed network penetration reaching an all-time high of 93.4%. This of course varies from country to country with the most mature markets such as Argentina and Brazil reporting 93% and 92% respectively. Colombia and Chile also have surprisingly high penetration of 91% and 95%.

Managed network penetration (Q1.23 data)

The real importance of this penetration is that it enables a more efficient network (economies of scale) and much better customer service due to faster delivery. About 77% of shipments were delivered within 48 hours. In comparison, competitor Shopee doesn’t have the huge infrastructure (with ~5% market share) and while orders can be cheaper, they can take several weeks in certain countries. This makes complete sense as I previously covered a UK-based e-commerce (fashion company) called boohoo (OTCPK:BHOOY). This business struggles to maintain competitiveness in places like the US due to long shipping times and has therefore made it a strategic priority to open a US-based distribution center. Hence the power of already built logistics infrastructure, especially as inflation has increased the cost of construction materials and labor. For rental properties, rental prices are usually linked directly to inflation, which has been sky high.

Fintech continues to thrive

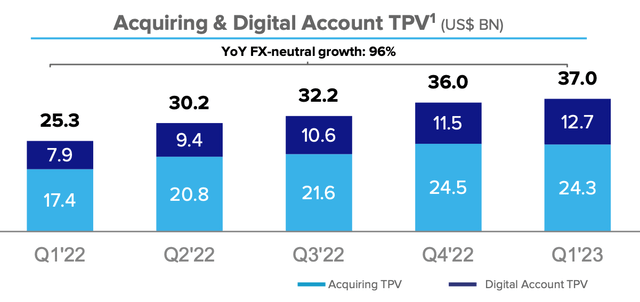

MercadoLibre’s Fintech business has continued to thrive with its overall payment volume [TPV] increases by as much as 96% from year to year. Studies indicate that approximately 70% of the Latin American population is unbanked, without a checking account or “underbanked” without access to credit, MercadoLibre has a huge market opportunity.

Total payment volume (Q1.23 data)

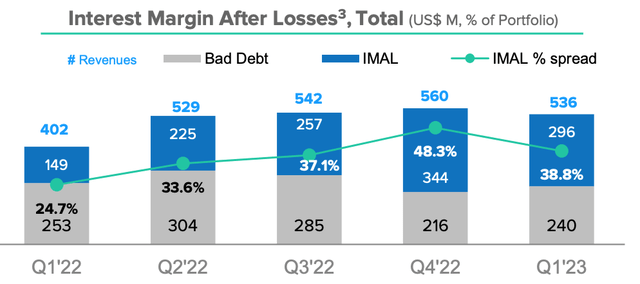

MercadoLibre has also continued to grow its credit portfolio with originations increasing from $2.3 billion in Q1.22 to $2.688 billion by Q1.23. In addition, the interest margin after losses has begun to stabilize at 38.8% as of Q1.23. This is a positive sign as a major concern I highlighted in my previous posts was the “recessionary environment” that could cause a large increase in loan defaults.

Interest margin after loss (Q1.23 data)

Valuation and forecasts

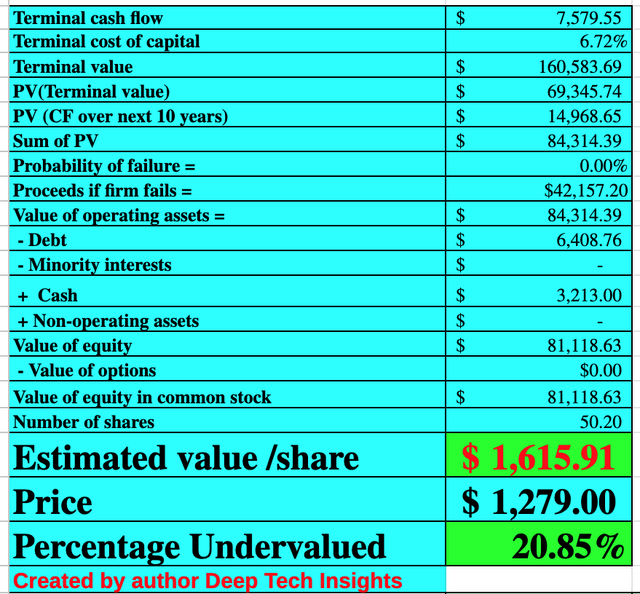

To value MercadoLibre, I linked the latest financial data to my discounted cash flow valuation model. I have increased my previous forecast for the next four quarters from 22% to 25%, which is still quite conservative given that the business has grown revenue by 35% this year as of Q1.23. For years 2 to 5, I have revised up my growth estimate by 2% to 30% per year. Again, this is quite conservative given the large unbanked population in Latin America, and a boom in the e-commerce market that is expected. MercadoLibre also has the ability to grow its loan portfolio more aggressively in “good times” as management is currently conservative, which I believe is prudent to maintain stable margins and lower default losses.

MercadoLibre Stock Rating 1 (created by author Ben at Deep Tech Insights)

Turning to margins, I’ve adjusted the operating margin to 12% for the “next year” or the next four quarters. This is based on an extrapolation of the trailing 12-month margin of 11% plus a 1% adjustment for R&D expenditure. Over the next 8 years I have predicted an operating margin of 19%. This may seem high for an e-commerce company, but I expect the main margin driver to be the fintech business which contributes ~50% of total revenue. In comparison, a mature fintech such as PayPal (PYPL) has averaged a margin of 16%-17% over the past couple of years. Although this can be improved by reducing R&D etc.

The business also has a solid balance sheet with $3.2 billion in cash and short-term investments. The company has total debt of ~$5.5 billion, but the vast majority of $2.46 billion is long-term debt and thus manageable.

MercadoLibre Stock Rating 2 (created by author Ben at Deep Tech Insights)

Given these factors I get a fair value of $1,616 per share, the stock trades at about $1,279 at the time of writing and is thus surprisingly still 20.85% undervalued.

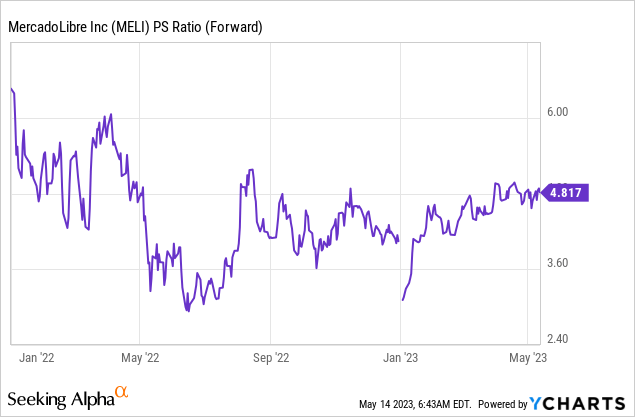

The company also trades on a price-to-sale basis [P/S] ratio equal to 4.82, which is 55.41% cheaper than the 5-year average.

Risks

Competition

As mentioned earlier, MercadoLibre faces stiff competition from major players such as Amazon (AMZN), Wall Mart and even Shopee. Additionally, I previously did a report on one of the fastest growing (but still little-known) e-commerce apps in the US called Temu, owned by Chinese e-commerce company PDD Holdings (PDD). In my report I stated that this company offers cheaper prices than Amazon for certain products that I researched due to direct shipping from China. The business has also announced plans to expand into Latin America and thus could disrupt MercadoLibre due to cheap prices. One positive is that MELI has a huge infrastructure which I discussed earlier is its competitive advantage due to fast delivery times etc. China may be cheap but it is certainly not fast.

Final thoughts

MercadoLibre is a huge company whose two main growth engines are its leading e-commerce business and its thriving fintech arm. The business has a huge total addressable market to continue doing what Amazon has achieved in the US, but in Latin America. In addition, the Fintech potential is even greater due to the huge unbanked population. Usually, such great companies often have a high price. The good news is my valuation model and forecasts indicate that the stock is still undervalued and may therefore offer a long-term investment opportunity.