Meet the NFT platforms where not just anyone can sell their collections

A curated NFT marketplace is one where access to sell an item is limited. Only approved creators (invited by an existing member or accepted by the platform curator) can offer their items there.

While this helps build a strong community around the artists on the platform, it can also reduce the reach of the overall market. In this article, we will cover the features of Foundation and SuperRare and compare them to OpenSea, the leader among NFT marketplaces.

Foundation

Foundation is an invite-only NFT marketplace. Launched in February 2021, Foundation is one of the largest NFT marketplaces on the web. The platform is known for having notable NFT auctions, such as Edward Snowden’s first NFT and the Nyan Cat animation.

NFT creators must obtain an invitation code to be able to mint NFTs on the platform. The invitations can only be sent by members who have already sold at least 1 NFT on the platform.

When an artwork is sold on the primary market, creators receive 85% of the final sale price. If an NFT is listed and collected again on the secondary market, a 10% royalty is automatically sent to the creator who originally minted the artwork.

Foundation has four sales options:

- Buy Now: This option is a direct buy, accepting the sale price of the NFT you like.

- Offers: This allows the buyer to send an offer directly to the creator.

- Reserve Auctions: A minimum price is set and when this condition is met, a 24-hour auction starts.

- Private sale: A direct transaction between two users.

The Foundation collects a 5% marketplace fee on all transactions, meaning creators receive 95% of the total sale price when collectors purchase the NFT(s). If it’s a secondary market sale, the seller will get 85% of the total sale, as 5% goes to the Foundation, and 10% royalties go to the creator.

SuperRare

SuperRare is an NFT marketplace for collecting and trading unique digital artwork in one edition. The artist must be approved in order to sell a collection on the platform.

In the event of a primary sale (the first time a work of art is sold, also known as a mint sale):

- The artist receives 85% of the sale price

- The SuperRare DAO Community Treasury receives 15% of the sale amount.

On secondary sales (which are any sales after the primary sale):

- The seller receives 90% of the sale price

- The original artist receives 10% of the sales amount as a royalty

On all sales, a 3% marketplace fee is added to the sale price paid by the buyer – this goes to the SuperRare DAO Community Treasury.

The SuperRare DAO Community Treasury is responsible for establishing artist and developer grant programs and ad-hoc expenditures of proprietary assets deemed necessary to support the continued growth and success of the SuperRare Network.

SuperRare Token ($RARE)

SuperRare introduced a token ($RARE) to send the curation on the platform to the community (to SuperRare DAO). A part of the supply was airdropped to former users who, together with the core team, are now part of the DAO that carries out the actions on the platform.

$RARE token holders collectively govern the SuperRare DAO – a decentralized organization that will monitor key platform parameters, allocate funds from the Community Treasury, and implement proposals submitted through community governance related to improvements to the network and protocol.

Besides curation and partnerships, another SuperRare DAO initiative is a magazine where it shares more information about collections and artists and provides news about the NFT sector.

Calculations

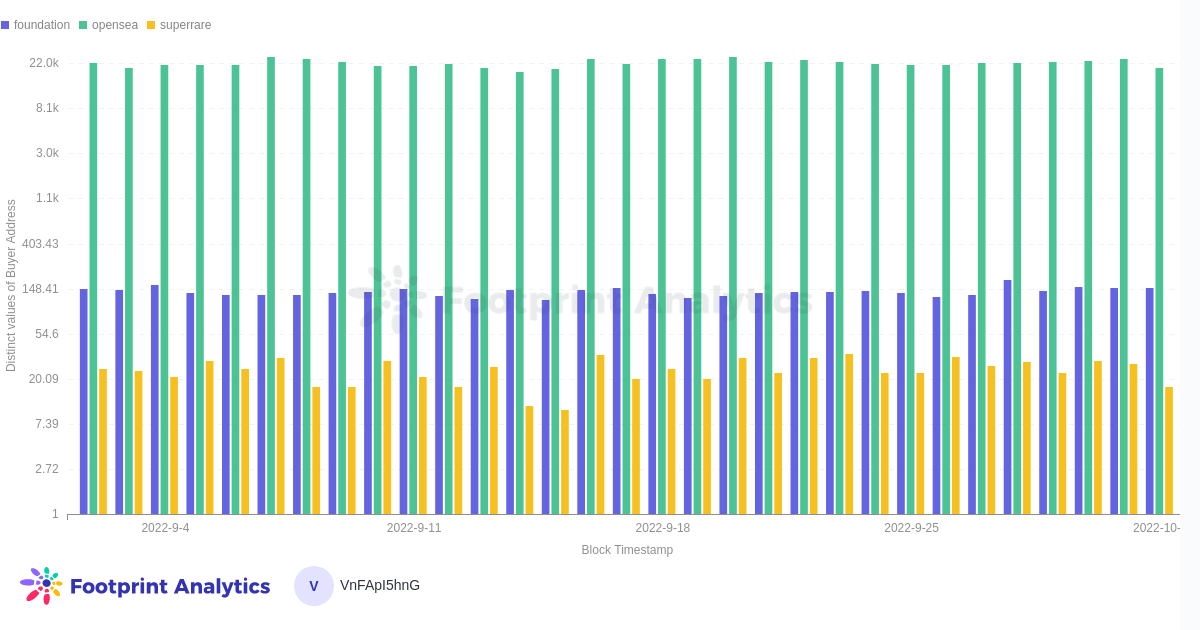

This section will present metrics for the curated NFT marketplaces and compare them to a benchmark – OpenSea.

Since they offer exclusive collections, the curated NFT marketplaces may charge a higher fee than open marketplaces. SuperRare also provides a token that is used to manage the platform (curation, fees, treasury), giving the community an additional incentive to participate.

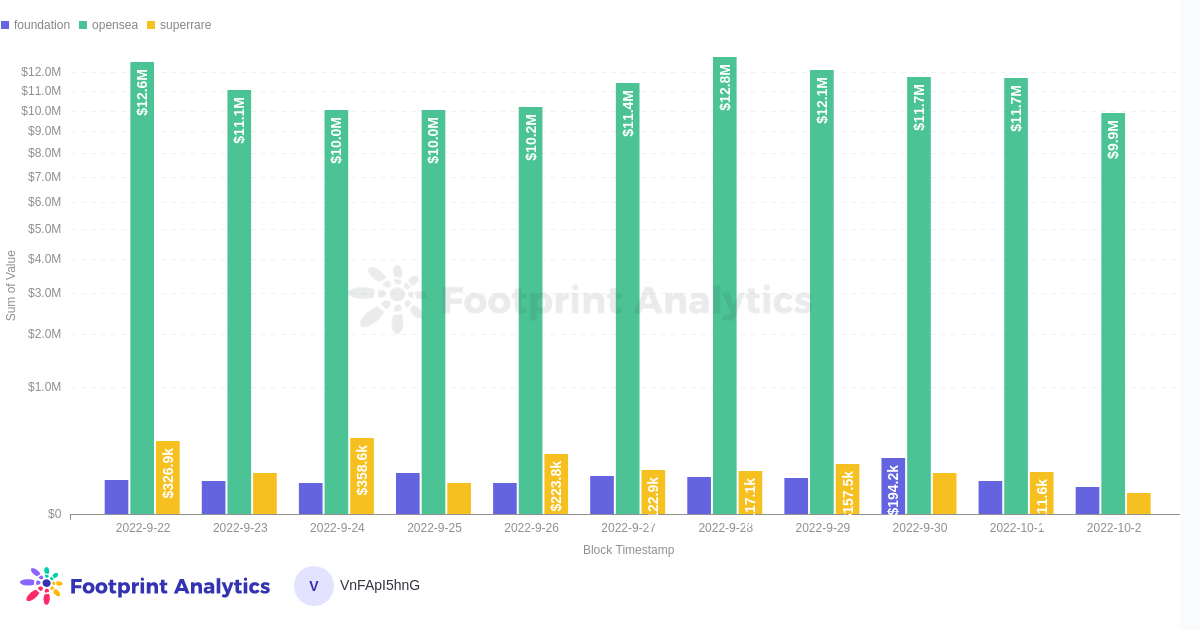

The option to only work with exclusive collections makes the daily trading volume of the curated NFT marketplaces lower than the benchmark.

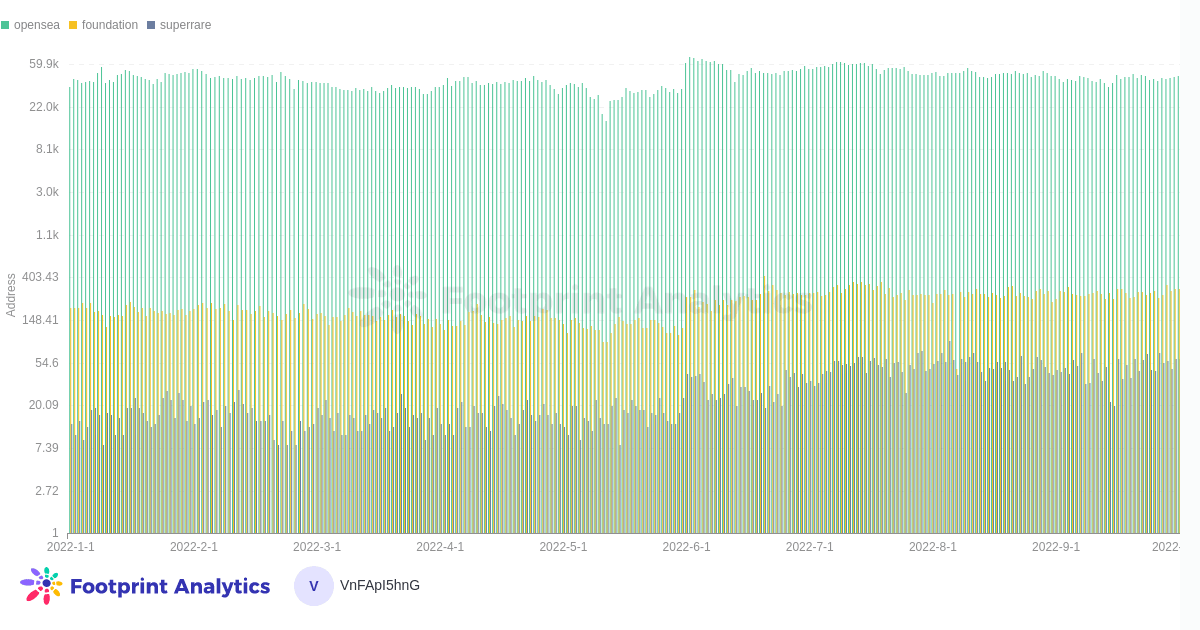

This difference in the daily volumes is explained by the number of users, as OpenSea has no restrictions on collections being traded there.

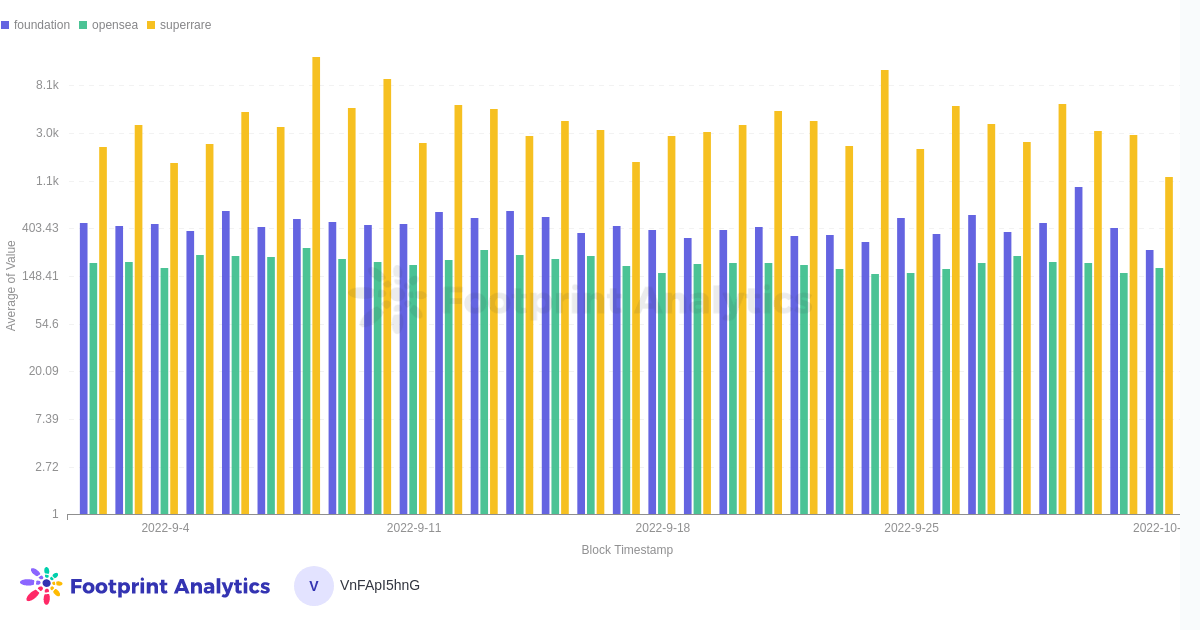

However, as the collections are curated, the average selling price is higher on the selected markets (Foundation and SuperRare) than on the benchmark.

The average selling price is over $2000 on SuperRare, $400 on Foundation and around $200 at OpenSea.

October 2022, Thiago Freitas

Data Source: Footprint Analytics – Overview of curated NFT marketplaces

Main takeaways

Curated NFT marketplaces established themselves in a niche where their community drives the adoption of the collections. Because of their value proposition, they can close partnership with other companies, which increases the uniqueness of the collections. In addition, SuperRare offers an additional incentive with their token ($RARE) which is used for management (treasury management and curation on the platform).

This piece is contributed by Footprint Analytics society.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

Footprint website: https://www.footprint.network

Disagreement: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data