Mastercard, UNICEF, Walmart and more The Block

Umar Farooq, CEO of Onyx, JP Morgan’s digital asset business, made an interesting comment at a recent seminar held by the Monetary Authority of Singapore. Most crypto, he argued, was “still junk.” “With the exception of a few dozen tokens, everything else that has been mentioned is either noise or, frankly, is just going to go away,” Farooq added.

Couple this with a recent statistic from S&P Global Market Intelligence that global private equity and venture capital investments in blockchain and cryptocurrency fell 48.1% quarter over quarter, and one could be forgiven for thinking the outlook was bleak.

But for evangelists these can be seen as good signs. As blockchain technologies mature and use cases become clearer, opportunists and scammers are more likely to disappear – although not foolproof – and genuine business and consumer problems to be solved.

There is also a reverse to each coin. A Ripple report published in August found that a majority of financial institutions planned to start using crypto within the next three years. Despite the bear market, more than three-quarters (76%) said they were interested, provided regulations allowed. Alongside this, asset manager BlackRock launched a spot Bitcoin trust, along with exploring permissioned blockchains, stablecoins, cryptoassets and tokenisation.

Blockchain Expo Europe event, held at RAI, Amsterdam 20-21. September, will showcase many brands exploring DLTs, digital assets and related web 3.0 technologies in an innovative way. Keynote speakers include:

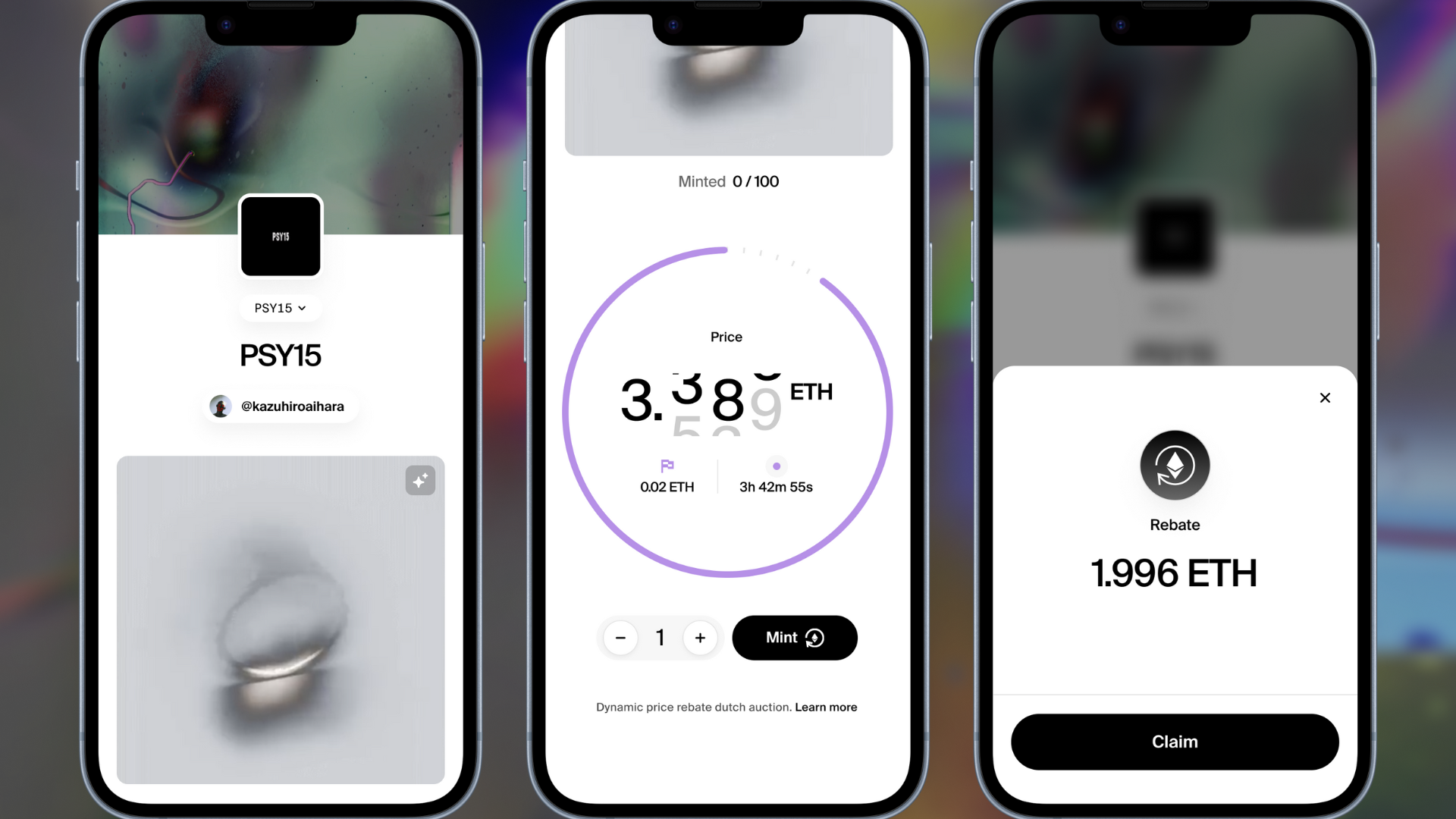

- Mia Van, EMEA Head, Blockchain & Digital Assets at Mastercard, will discuss the history of NFTs, what can be tokenized and who benefits

- David Palmer, blockchain manager at Vodafone Business, will participate in a panel discussion around the metaverse

- Mariana Gomez de la Villa, Program Director Distributed Ledger Technology at ING, will talk about business expansion through the lens of blockchain tools

- Gerben Kijne, Product Manager Blockchain at UNICEF (GIGA) will explore his work on how NFTs can give more children the chance to learn online

For many stakeholders, regulation is the name of the game right now. Farooq mentioned that in passing, suggesting that this was why the financial services industry in general was “a bit slow to catch up.”

Others have different views. Alex Reinhardt, founder of PLC Ultima, and one of the industry’s biggest evangelists, gave advice from the consumer perspective. Reinhardt told The block: “If you make a mistake today, it is not easy to defend your rights because they are not yet fully regulated. So it would be best if you didn’t try to make money where it might get you into trouble later.”

PLC Ultima is also attending Blockchain Expo Europe as a main partner, with Reinhardt keynoting on day one to discuss the process of blockchain evangelism. So don’t mind a bear market; there are plenty of green shoots to be found, as Reinhardt explains. “I have no doubt that cryptocurrencies will continue to live on and grow in spite of that,” he says. “Nothing can destroy their attractiveness because it is objective.”

The Tokenization & Digital Assets track features the important issue of regulation heavily. A panel, at 1540 local time, will ask why regulators are so nervous about approaching the crypto world, and explore future potential for a governed space. Representatives from the European Central Bank, the European Blockchain Association and the London Stock Exchange Group (LSEG) will share their insights.

From a corporate blockchain perspective, where proponents are somewhat shielded from the splinter of fluctuating crypto markets, there may well be cause for optimism. Senior executives still have time to get things right if, for example, they want to adopt a blockchain for their global supply chain, but the use cases are evolving.

At Blockchain Expo North America, held in Santa Clara on 5-6 October, there are various interesting examples of companies looking to make the right moves. Chris Johnson, director, head of international data governance at Walmart, will discuss how to give managers what they want and create an ecosystem of systems thinking, while Philip Silitschanu, research director of IDC Financial Insights, will explore the need for enterprise blockchain, bottlenecks to adoption, and predictions for 2023 and beyond.

Several major enterprise software vendors, from IBM, to Oracle, to VMware, will also participate. Mark Rakhmilevich, senior director of blockchain product management at Oracle, will look at the progress being made in the market with regards to partnerships, sponsorships and disputes.

Blockchain Expo Europe – 20-21 September, RAI Amsterdam. Order tickets here

Blockchain Expo North America – 5-6 October at the Santa Clara Convention Center, California. Order tickets here

Whether you’re looking at enterprise use cases, or innovative examples of brands using digital assets and tokenization, Blockchain Expo Europe and North America will have interesting and important content for those looking to take the next step. Find out more about the event series here.