Market Wrap: Bitcoin Climbs Above $24K

Bitcoin (BTC) continued its ascent on Monday, rising 3% in average volume. The largest cryptocurrency by market capitalization crossed $24,000 earlier in the day and remained above that threshold in the afternoon.

BTC’s hourly charts (below) show that the bulk of the push up occurred between 10:00 and 12:00 UTC time before the price stabilized.

This article originally appeared in Market WrapCoinDesk’s daily newsletter that dives into what’s happening in today’s crypto markets. Subscribe to get it in your inbox every day.

Bitcoin’s gains have mostly kept pace with traditional markets. On Monday, the Dow Jones Industrial Average rose 0.09 percent. Meanwhile, the tech-heavy Nasdaq Composite Index fell 0.10% and the S&P 500 fell 0.12%. Correlations between BTC and the three indices remain above 0.60, indicating a strong relationship between BTC price movements and stocks.

Correlations range between -1 and 1, with higher numbers signaling a stronger relationship. Investors often consider these correlations when the price movement in one group of assets exceeds the price movement in another.

Because BTC’s spike occurred outside US trading hours, traders can see if the cryptocurrency’s price continues to match stocks.

Ether (ETH) was recently up 3.5%. Most of the increase also came during nighttime hours in the United States

Altcoins also rose, with lavanche (AVAX) up 2% and chainlink (LINK), up 9%.

●Bitcoin (BTC): $23,929 +3.1%

●Ether (ETH): $1784 +4.1%

●S&P 500 daily close: 4,140.06 -0.1%

●Gold: $1,806 per troy ounce +1.9%

●Ten-year Treasury yield daily close: 2.77% −0.07

Bitcoin, Ether and Gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the spot price for COMEX. Information on CoinDesk indices can be found at coindesk.com/indices.

Bitcoin’s hourly chart moves into overbought territory, reverses course intraday

Investors continued to look to hourly and daily charts for signs of the crypto market’s future direction, which remains across mixed economic data. BTC’s hourly chart showed significant trading activity from 10:00 a.m. to noon (UTC) with above average volume.

During that period, bitcoin rose by about 3%, and US markets opened for bitcoin trading above $24,000. The 10-period relative strength index (RSI) rose to 83 as bitcoin’s price rose. RSI is a technical indicator that measures price momentum.

Readings below 30 mean an asset is oversold, while a reading above 70 means an asset is overbought. BTC prices seem to have pulled back after the RSI reading of 83 that occurred during the light at A candle is a visual image on charts to describe a price increase.

Bitcoin’s daily chart provides additional context to today’s moves

BTC prices should continue to advance along a trendline noted in the August 3rd Market Wrap. BTC’s price could crack $28,000, although investors should not interpret that market as a price target.

Trendlines can be useful for traders to determine the direction and strength of a price movement, especially when used in conjunction with other technical indicators.

The trend line here is used in conjunction with the RSI. The overbought reading (see chart above) showed an overbought reading of 70, but the daily chart shows a reading of 60, which falls below the overbought limit.

BTC prices appear to have pulled back from their sharp rally in early morning trading, while maintaining what appears to be a general uptrend that began around July 13.

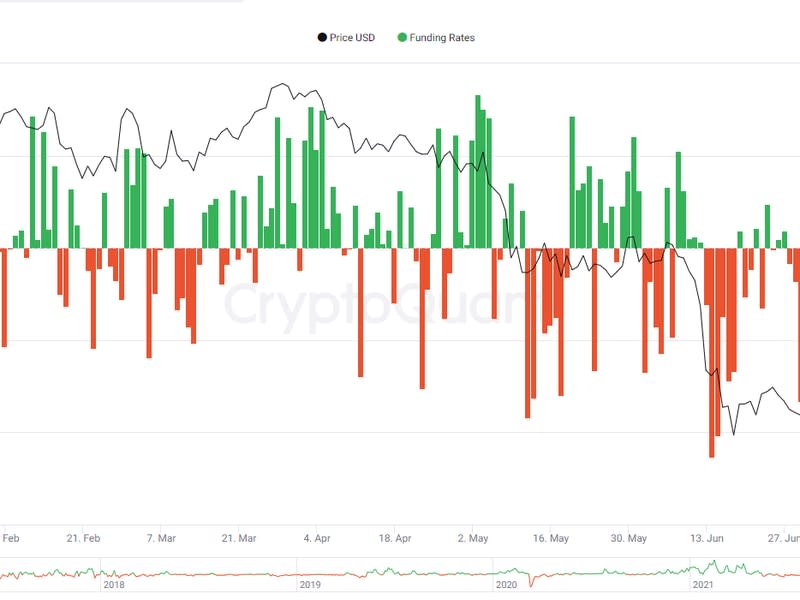

The derivatives markets also indicate a positive sentiment

BTC funding rates have turned positive again, after a brief trip negative on August 3rd. Funding rates represent payments to traders who are long or short bitcoin. These payments act as a proxy for market sentiment.

A positive funding rate means that traders who want to be long BTC (have a positive view of the digital currency) are willing to pay traders who are short (have a negative view). Negative financing rates imply the opposite.

All in all, positive funding rates often suggest that crypto traders are bullish. BTC funding rates have been positive for all but five days since July 1st.

Altcoin roundup

-

Vitalik Buterin plays down the impact of post-merger Ethereum forks: Blockchain’s co-founder said the platform is unlikely to be “significantly damaged by another fork.” Read more here.

-

Ether’s Deepest ‘Backwardation’ Since 2020 Crash Shows Traders Preparing For Ethereum PoW Split: Traders have bought ETH in the spot market and sold ether futures to resist volatility. Read more here.

-

Dragoma supporters fall victim to $3.5 million carpet-pulling: The funds from the polygon-based Web3 game have been taken out of the project and into centralized exchanges. Read more here.

Relevant insight

Other markets

Biggest winners

Biggest losers

Sector classifications are provided via Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk 20 is a ranking of the largest digital assets by volume on trusted exchanges.