Marathon Digital: Bitcoin’s Bears Can Still Win (NASDAQ:MARA)

artiemedvedev

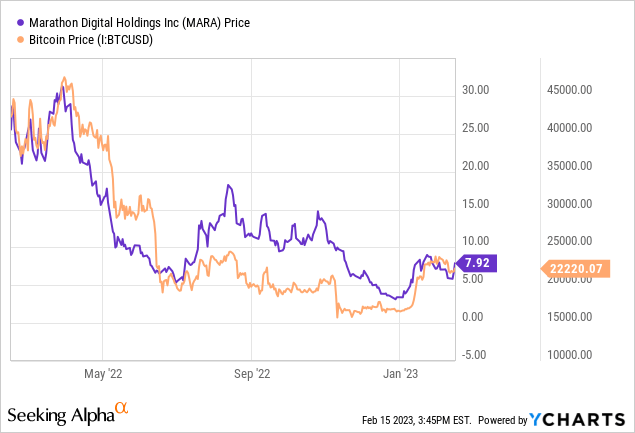

Marathon Digital (NASDAQ: MARA) is up over 100% year-to-date as the 2023 stock market completely sheds worries about last year’s high-profile stock market crash. In my opinion, the sentiment is clear, Bitcoin (BTC-USD) winter is thawing and its institutional infrastructure from miners to exchanges and banks now stands to reverse more than a year-long decline in their commons.

The increase has come on the back of what remains a nearly 44% short interest in Marathon. While some of Bitcoin’s use cases face headwinds, the bears face material risks here. The current rally could be extended, especially as the positive macroeconomic news that catalyzed the current rally was fueled by positive inflation numbers. This has set the stage for the end of the current Fed Funds rate hike cycle and has come along with an increased potential for a soft landing.

What the bulls should be worried about

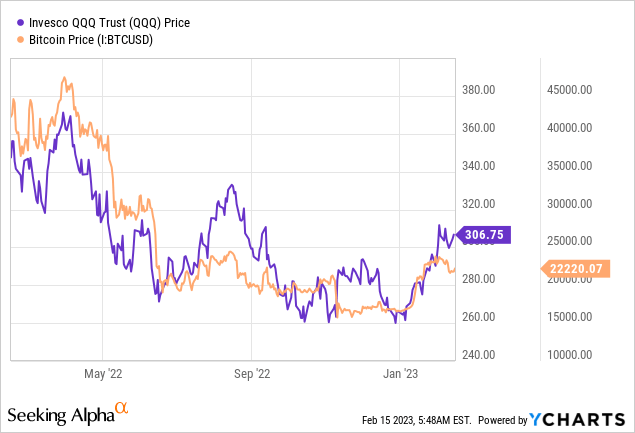

Acting as a proxy for a direct Bitcoin investment, Marathon has been buoyed by enthusiasm surrounding an imminent end to rising Fed funds rates. It is likely that there will be two more 25 basis points to close the chapter. Marathon tracks Bitcoin which again moves in parallel with the technology-heavy Nasdaq 100 index (QQQ).

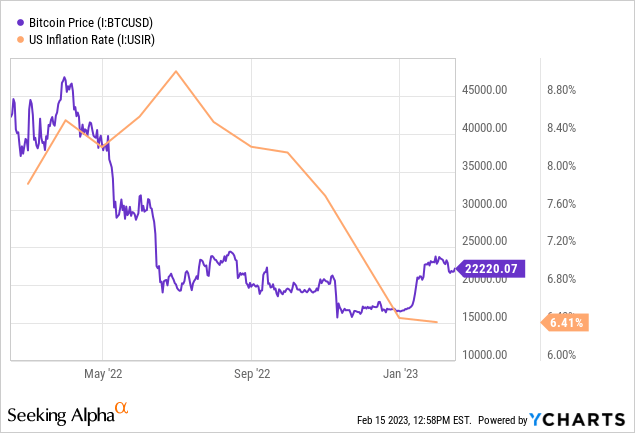

To be clear, Marathon’s recent outperformance has not been built on an improvement in the underlying fundamentals of the cryptocurrency, but on broader macroeconomic conditions that have put the company on par with more traditional tech stocks. Why do I think this is worrying? A relevant argument from Bitcoin maximalists was that the digital asset represents a stark break from financial orthodoxy and a hedge against inflation.

But Bitcoin has performed out of proportion with inflation over the past year, and the asset fell as a capital flight from stocks and bonds to crypto was supposed to take place to reflect the dominant crypto narrative. That this did not happen limits the scope of use of Bitcoin and its relevant investment proxies like Marathon in my opinion. It adds to bearish arguments that Bitcoin is mainly a speculative asset whose previously insatiable animal spirits now appear to be returning on the back of the end of the current Fed rate hike cycle.

Marathon recently released its Bitcoin mining update in January. The company produced 687 Bitcoins, a 45% increase compared to the previous month and a record number of Bitcoins produced in a single month. This total recovery is currently valued at over $15 million and sets the company up for a decent recovery for the first quarter of fiscal 2023 if the high prices are sustained. Cash at the end of the month stood at $133.8 million with Marathon’s balance sheet further bolstered by unlimited Bitcoin holdings increasing to 8,090.

Why 2023 offers more uncertainty

The current bearish rally may ultimately be divorced from the improving fundamentals of the US economy to reflect what remains a collapsing crypto ecosystem that now faces significant headwinds to mainstream adoption and whose catalysts have increasingly been placed beyond the horizon. The latest setback was the SEC rejecting the second application by ARK 21Shares for a spot Bitcoin ETF. The ETF would be partially managed by Cathie Wood’s ARK Invest and comes on the back of ongoing litigation filed by Digital Currency Group’s Grayscale Bitcoin Trust (GBTC) to convert to a spot bitcoin ETF. The continued failure of efforts to create a spot Bitcoin ETF reflects the barriers Bitcoin will continue to face to wider adoption.

With the direction of Bitcoin now being driven by broader economic factors, 2023 will bring uncertainty in response to the monthly falls in macroeconomic numbers that communicate whether Fed funds rates may halt their rise. A return of animal spirits is now hanging on pending a dovish pivot by the Fed as the US economy looks set to grow this year, avoiding earlier forecasts for a recession. Therefore, even if we see an increasingly aggressive SEC take an aggressive stance against Bitcoin, the digital asset may still come out on top.

Fundamentally, the bears could still win if inflation remains high longer than the current rally expects. This would force the Fed to initiate more hikes and keep interest rates at higher levels for longer. While I don’t think 2023 will bring a return to Bitcoin’s pandemic-era highs, the bulls are currently ahead with the asset and the broader stock market now in the middle of a bull run. Bitcoin is still down year-over-year, so Marathon’s first-quarter fiscal 2023 results will be poor, albeit a significant improvement from its fourth-quarter fiscal 2022 earnings. I expect this will lead to Marathon reporting a record net loss and a significant write-down. I am now neutral on the stock.