MARA, COIN or RIOT: Which crypto stock does Wall Street still find compelling?

The cryptocurrency market bounced back nicely this year after a disastrous run last year. Especially Bitcoin (BTC-USD), the largest cryptocurrency by market cap, has risen over 80% so far in 2023 due to improved investor sentiment. Meanwhile, concerns remain about the risks associated with the crypto market and the need for strict regulations. Against this backdrop, we used Tipranks’ Stock Comparison Tool to set Marathon Digital (NASDAQ: MARA), Coinbase Global (NASDAQ:COIN), and Riot Platforms (NASDAQ:RIOT) against each other to pick the most attractive crypto stock according to the Wall Street pros.

Marathon Digital (NASDAQ:MARA)

A sharp decline in Bitcoin prices due to macro pressures, FTX collapse and high energy costs negatively affected crypto miner Marathon Digital’s performance in 2022. The company’s loss per share increased to $6.05 in 2022 from $0.37 in 2021.

Nevertheless, Marathon is taking the necessary steps to strengthen its financial position and increase productivity. The company aims to provide energy to its previously purchased mining rigs, aiming to reach its target capacity of 23 exahashes per second (EH/S) by the middle of this year.

In Q1 2023, the company’s operational hash rate increased by 64% from 7 EH/s to 11.5 EH/s. The improved hash rate helped increase Bitcoin production by 41% from Q4 2022 to 2,195 Bitcoin in Q1 2023, including 825 BTC in March.

Marathon is also focused on being energy efficient through the use of S-19 XP mining equipment. Once all previously purchased miners are installed, Marathon expects approximately 66% of the hash rate to be generated by S19 XPs, which are nearly 30% more energy efficient than the previous generation of mining rigs.

Are MARA shares a buy or a sell?

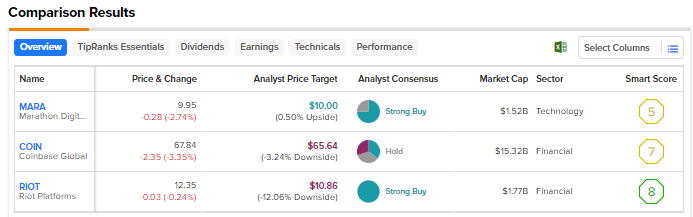

Wall Street’s Strong Buy consensus rating for Marathon Digital stock is based on three buys and one hold. The average share price target of $10 suggests that the stock may be in range. Marathon stock is up nearly 191% year to date.

Coinbase Global (COIN)

The turmoil in the crypto market last year dragged down the performance of the leading US crypto exchange Coinbase. The company fell to a loss of $2.46 per share in Q4 2022 compared to EPS of $3.32, due to a 75% decline in revenue to $629 million. However, both calculations were better than analysts’ expectations.

Nonetheless, Coinbase’s shrinking customer base and decline in trading volume in the fourth quarter were worrisome. Meanwhile, the company’s efforts to diversify its revenue base are paying off, given the traction of products like Staking, Earn and Custody. Coinbase is also taking initiatives, including reducing its workforce, to reduce costs.

What is the price target for Coinbase stock?

This week, Needham analyst John Todaro reiterated a sell rating on Coinbase stock ahead of its first-quarter results. Todaro noted that transaction volumes remain at a fraction of peak levels, although they have risen modestly since the turn of the year.

The analyst believes that the company’s actions to “right size the expense base” will provide better results this year. Nevertheless, he feels that “significant retail price compression is only a matter of time” and finds it difficult to expect the company to move towards significant long-term profitability.

Todaro also feels that the SEC Wells notice received by Coinbase in the first quarter reflects the “massive regulatory risks” facing the company’s business model.

Wall Street is sidelined on Coinbase, with a Hold consensus rating based on seven buys, seven holds and seven sells. After the staggering 92% year-to-date gain, the average price target of $63.40 suggests a possible downside of 6.5%.

Riot Platforms (RIOT)

Bitcoin Miner Riot Platforms’ net loss widened significantly in 2022 to $3.65 per share from $0.17 per share in 2021, primarily due to non-cash impairments of $538.6 million related to goodwill, Bitcoin and miner write-downs triggered by the downturn in the market prices of miners due to the decrease in Bitcoin price.

Nevertheless, the company’s hash rate capacity increased by 213% to 9.7 EH/s as of December 31, 2022. Severe winter storms in late December damaged two of the company’s buildings at the company’s Rockdale facility, causing a delay in its plan to achieve confidence -mining hash rate capacity of 12.4 EH/si Q1 2023 to second half of this year.

By the end of Q1 2023, Riot’s hash rate capacity improved to 10.5 EH/s, even after excluding 17,040 miners who were offline due to the damage to Building G from the severe winter weather in late December 2022.

Are Riot platforms a good buy?

Following the Q1 2023 Bitcoin production update, Needham’s Todaro raised its 2023 revenue and adjusted EBITDA estimates, driven by higher Bitcoin prices due to “1) banking-related concerns; 2) recent global trade agreements suggesting a weakening of USD reserve status; and 3) BTC new emission cut after the halving in Q1 ’24.

Todaro reiterated a Buy rating on Riot Platforms with a $15 price target. The analyst believes Riot deserves a premium valuation to its peers, given its operational scalability, liquidity and solid balance sheet.

Wall Street’s Strong Buy consensus rating on RIOT stock is based on eight consensus buys. After a 264% jump in the stock so far this year, the $10 average price target suggests a possible downside of 19% from current levels.

Conclusion

Analysts are very bullish on the Marathon Digital and Riot platforms, but remain on the sidelines on Coinbase. Riot Platforms shares have outperformed the other two stocks so far in 2023. However, Wall Street’s average price target does not indicate more upside in Riot from current levels. Meanwhile, analysts’ average price target suggests Marathon shares may be in range. The highest price target for the most bullish analyst is $12 for Riot and $15 for Marathon, which means there is more room to run.

While several crypto stocks have delivered impressive returns so far this year, investors must be aware of the highly volatile and risky nature of the crypto market.

Mediation