Manipulation power of crypto whales

by Arthur · August 6, 2022

Sometimes, when the BTC price falls or rises, traders called bitcoin whales believed to pump or dump the crypto market. Bitcoin whales are groups or individuals who have huge amounts of BTC and are believed to be manipulate market prices with huge buy and sell transactions. Although the market power of whales has decreased as more people own Bitcoin and the value of the cryptocurrency market has risen over the years, whales are still important in this market. Whales’ crypto moves are still newsworthy.

Whales are generally dangerous as they are the largest fish in the sea and eat small marine animals. Crypto whales is likewise notorious for eating small traders, so to speak. The more a whale owns the total supply of a cryptocurrency, the greater its sphere of influence. For example, if a crypto whale owns 15% of the total LINK supply and is determined to sell these tokens, the LINK price will definitely be greatly affected.

Bear whale

In 2015, just a few years after Bitcoin was invented, a huge BTC whale hit the market. As we mentioned, earlier effects of whales were very high in low liquidity markets. The whale probably hoped that selling 30,000 BTC at $300 each would lower the price. Other investors, taking advantage of this sell order, bought the BTCs sold by the whale and continued to buy for a while. As a result, the Bitcoin price rose as high as $400 in the same month.

Whales can manipulate the market without trading BTC

Bitcoin whales are also notorious for bluffing. On cryptocurrency exchanges, buy and sell orders can be created at different prices apart from the spot price. Whales who want the Bitcoin price to go up or down can build a wall to a target price by placing a very hefty trade order on very high volume exchanges such as Binance, FTX, OKX or Coinbase. For example, placing a buy order of 3,000 BTC at a price lower than the spot price can create a support point for Bitcoin. If the whale is indeed bluffing, it will cancel the trade order when the BTC price approaches the order level.

How much crypto do whales hold?

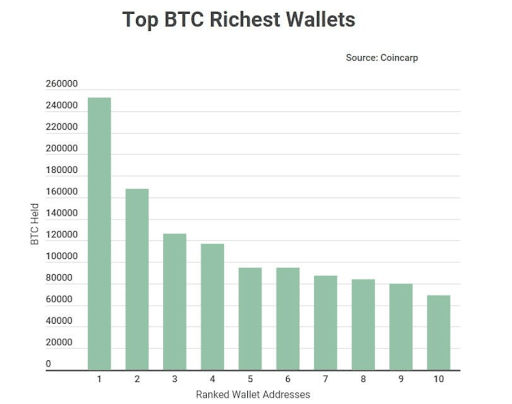

Cryptocurrency whales often have huge amounts of crypto. 85 Bitcoin wallets currently hold around 15% of the BTC in circulation. 8 million BTC, which is almost 42% of the circulating BTC amount, is also found in 2200 wallets that hold the most BTC. That’s $185 billion.

Whales like to buy and sell manipulative and volatile cryptocurrencies like Doge and Shiba Inu for short periods. While 27% of the total amount of Doge in circulation is held in a single wallet, the 15 wallets with the most Doges hold 50% of the circulating supply.

Is Tesla a Bitcoin Whale?

Bitcoin traded at $38,800 when Tesla announced on February 8, 2021 that they had purchased $1.5 billion worth of Bitcoin. Following Tesla’s public announcement, the Bitcoin price surged nearly 50% in just 14 days, rising as high as $57,650.

On July 21, 2022, Tesla announced data for the second quarter of 2022. According to this statement, Tesla sold 75% of its BTC holdings in the last three months. Although Tesla’s statement caused an immediate price drop, the market recovered to the same level afterwards. Tesla is a Bitcoin whale, but Elon Musk’s speculative posts using many meme tokens, especially Doge and Shiba Inu, have reduced Tesla’s influence in the crypto market.

Transaction with change to wallet

Bitcoin whales use cold wallets to store their money as it is a much safer and more secure solution. The large amount of crypto sent from the exchange to the wallet indicates that the whale does not want to sell that crypto in the short term. If the crypto withdrawn to the wallet is a stablecoin, this is negative for the Bitcoin price because the whale chose to stay in cash instead of buying Bitcoin.

Wallet to exchange transaction

This is also important if a Bitcoin whale sends BTC from the wallet to the exchange. Cryptocurrency exchanges are most popular platforms for crypto trading. If a whale sends their BTCs to the exchange wallet, it can be considered that they intend to trade them in the short term. And again, it’s a different situation for stablecoins. The sending of a large number of stablecoins to the exchange wallet suggests that a whale is preparing to buy another crypto.

How to track whales

Whale Alert is a Twitter account known to crypto followers. This account will be shared immediately large crypto transfers which happens within blockchains. If the sender or recipient has a known owner of the wallet, the account tags him in the tweet.

If you have analytical skills in the chain and know how to use blockchain explorers, you can follow large crypto whales and their transactions using explorers.

Conclusion

The crypto market does not yet have the controls and regulations that traditional markets are subject to. Although the market is less volatile than before, it is still volatile. Market manipulation is a common problem for whales. You should watch whales and track their transactions, but you shouldn’t act solely on those transactions. You should always make investment and trading decisions after doing enough research and using technical and fundamental analysis methods.