Malaysia can lead the global Islamic Fintech industry, experts say

Malaysia can lead the global Islamic Fintech industry, say experts (Photo by Mohd RASFAN / AFP)

- Industry leaders from around the world met at the Islamic Fintech Leaders Summit 2022 held in Kuala Lumpur two weeks ago.

- Experts reckon Malaysia has a strong ecosystem to support the industry.

- The technology community also considers Malaysia as an ideal place to establish an Islamic financial technology company.

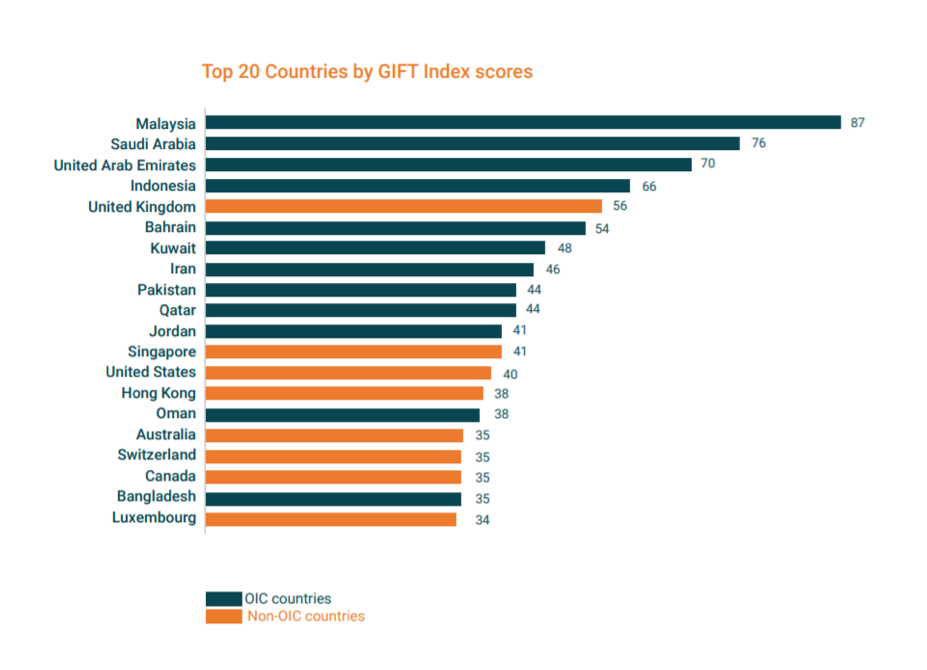

Malaysia has been the undisputed regional leader in the Islamic fintech industry. Based on the annual Global Islamic Fintech (GIFT) report, over the past few years the country has been named a leading Islamic financial technology hub, as it has consistently ranked first in Islamic fintech market and ecosystemtalent, regulation, as well as infrastructure and capital.

Experts now believe that the country is poised to lead the global Islamic financial technology industry as Malaysia is poised to tap into and serve the international market. At a recent Islamic Fintech Leaders Summit 2022 held in Kuala Lumpur, chairman of the Shariah Advisory Council for both the country’s central bank and the securities commission, Dr Mohd Daud Bakar in his keynote address reckons that it is looking up for the industry as Islamic. financial players are catching up with their conventional peers.

“Today, Malaysia remains the global leader in Islamic finance and is ranked first among 81 countries for the ninth consecutive year, according to the Global Islamic Economy Indicator. There is no doubt that Islamic fintech is growing exponentially in Malaysia, with 33% of the world’s Islamic fintech companies headquartered here,” he said.

Resonating with him, Malaysia Digital Economy Corp (MDEC) director of fintech and Islamic digital economy Ruslena Ramli also believes that Malaysia is a “potential leader in the fast-growing Islamic digital economy landscape”. She also noted that there are ongoing talks between authorities, regulators as well as market players, in an effort to further strengthen the country’s small but high-potential Islamic fintech market.

Traditionally, Islamic fintech companies in Malaysia have made slow progress in a booming Islamic finance market, amid competition from large local banks and a lack of funding and product offerings. But in recent years, especially after the pandemic, there has been a dramatic increase in the digitization of the sector as spending on technology and new digital financial services increases.

Top 20 Countries by GIFT Index Score — Global Islamic Fintech Report 2021

What is Islamic Fintech and how is Malaysia mastering it?

Based on Sharia principles, Islamic financial technology emphasizes the use of technology to deliver Shariah-compliant financial solutions, products, services and investments. Recognizing the potential inherent in the market, the Malaysian government and regulators have taken initiatives to stimulate the growth of this industry.

Through the country’s Shared Prosperity Vision 2030 (SPV 2030), the Malaysian government has identified Islamic Finance and Islamic Digital Economy as Key Economic Growth Activities (KEGA) and aims to position the country as an Islamic Finance Center 2.0. Apart from this, the Malaysia Digital Economy Corporation (MDEC) has also introduced a dedicated unit which has been task to support the Islamic digital economy and fintech space.

Even the Ministry of Science, Technology and Innovation (MOSTI) has separately established one fund to support Islamic fintech while both the International Center for Education in Islamic Finance (INCEIF) and the International Shariah Research Academy for Islamic Finance (ISRA), which were established by Bank Negara Malaysia, have also introduced initiative to support capacity building as well as research and development in the field.

In addition, SC, together with the United Nations Capital Development Fund (UNCDF), has also launched FIKRA. This is an Islamic fintech accelerator program aimed at identifying and scaling relevant fintech solutions in Malaysia. FIKRA also aims to create a fintech talent pipeline in Malaysia by raising awareness of Islamic financial technology.

As of 2019, there were a total of 26 financial Halal technology providers operating in Malaysia, higher than the United Kingdom (19), the United Arab Emirates (16), Indonesia (12) and the United States (10). Despite tough competition from banks, the sector in Malaysia is expected to grow at a compound annual growth rate of 23% to US$8.5 billion by 2025, according to the GIFT Report 2021 published in May.

“Malaysia provides the perfect platform for Islamic fintech companies to roll out their product offerings before tapping into other Muslim-majority countries,” said the report, which noted that the government has been instrumental in providing support for Islamic finance and digitization .