Macroguru Raoul Pal says Bitcoin (BTC) and crypto markets controlled by one big driver

Real Vision CEO and macro expert Raoul Pal says that Bitcoin (BTC) and the crypto markets are largely affected by one macroeconomic factor.

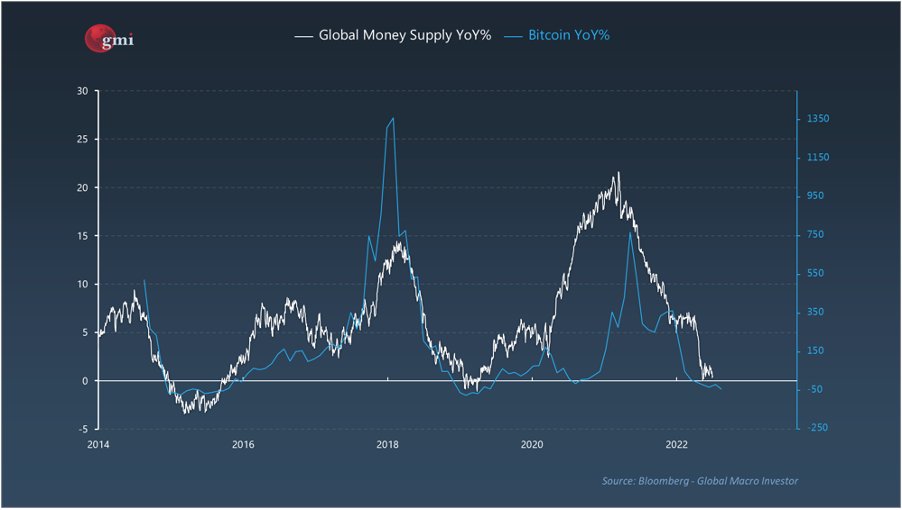

Pal says his 965,100 Twitter followers believe he Bitcoin and the rest of the crypto markets are closely following the global money supply or M2.

M2 is a measure of the current money supply that takes into account cash, check / savings deposits, money market securities and other easily convertible assets.

“So, I like growth technology, but love ties, but it’s clear that there’s always a risk associated with this view. This is how I see the balance of probabilities. What about digital assets? From a macro perspective, the big driver is global M2 growth.”

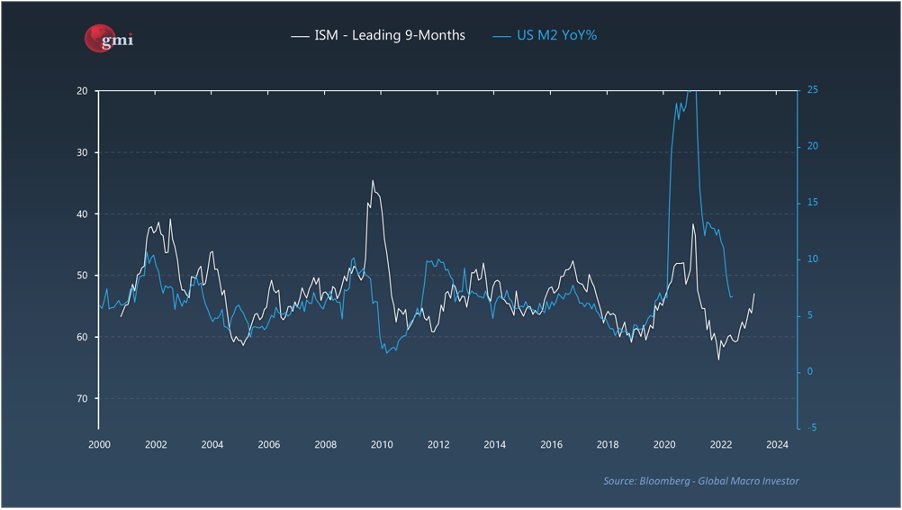

Pal, a former Goldman Sachs director, also notes that M2 growth is roughly inverse to the ISM Manufacturing Index. The index is seen as an indicator of the health of the US economy.

Sier Pal,

“When ISM falls, M2 should start to grow …. ISM at 38, according to the model, puts M2 growth back at 13%.”

Looking at Pal’s chart, the US M2 year-on-year is currently below 10%.

Pal too tracks there will be a recession in the next 12-18 months.

“Monetary conditions will be much weaker. Just to be clear – I think risk assets are likely to be lower before reversal, but not 100% safe. Yes, there is a risk of an extended recession like 2001/2 or 2008/9, but I do not really see that there are higher odds. I still use 1947, 1974 and 2018 as my mixed hypothesis. “

Macro strategist Lyn Alden has also highlighted the connection between Bitcoin and M2 growth.

“There are different types of inflation. It is monetary inflation and then there is inflation that often comes with a lag behind monetary inflation, and what we have actually seen for the most part is that Bitcoin is very strongly correlated with money growth, global M2 especially measured in dollars, and so in the course of In the last couple of years, when we saw the huge surge in the money supply around the world, Bitcoin did very well. “

Check price action

Don’t miss a beat – Subscribe to have crypto email alerts delivered directly to your inbox

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed by The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment adviser. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock / Ico Maker