Long-term owners of Bitcoin now own almost 80% of the realized chapter

Data on the chain show that the share of Bitcoin-realized ceilings held by long-term owners has increased and is now at almost 80%.

Long-term owners of Bitcoin own almost 80% of realized chap

As explained by an analyst in a CryptoQuant post, the crypto has historically tended to form a bottom when the long-term ownership share of realized ceilings has exceeded 80%.

The “long-term holders” (LTHs) are all the Bitcoin investors who have held on to their coins without selling or moving since at least 155 days ago.

The realized ceiling is a way of assessing the capitalization of the crypto where the value of each circulating coin is taken as the price at which it was last moved or sold, instead of the current BTC price.

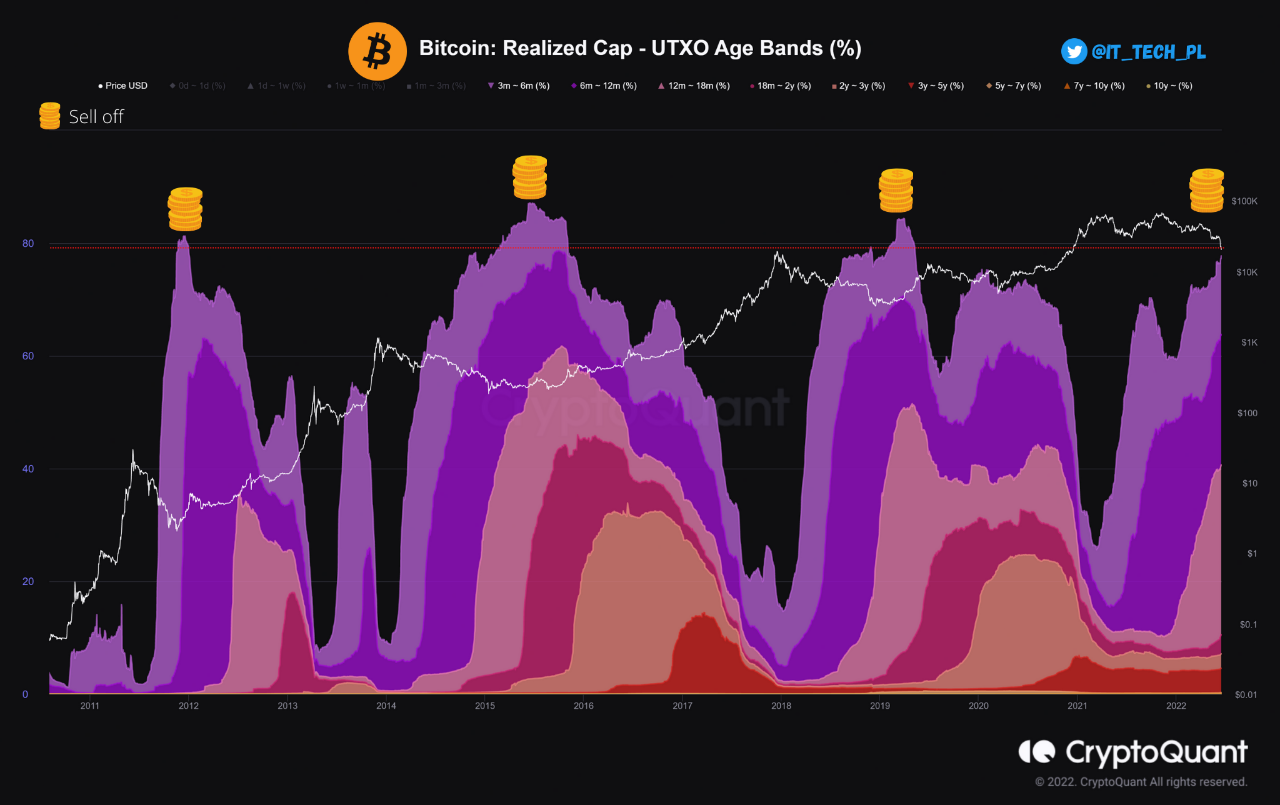

Now the relevant chain indicator here is “realized cap – UTXO age bands (%)”, which tells us which part are the different groups in the Bitcoin market that contribute to the total realized cap of the coin.

Related reading | Bitcoin Exchange Reserve Increases, Sales Are Not Over Yet?

The different age groups indicate how long investors belonging to a group have held on to their coins.

As mentioned earlier, LTHs include all cohorts that have held since at least 155 days ago. Here is a chart showing how the contribution to the realized value of these investors has changed throughout the history of Bitcoin:

Looks like the value of the metric has observed rise recently | Source: CryptoQuant

In the graph above, the quantum has marked all relevant trend points related to Bitcoin realized cap percent of the LTHs.

It seems that every time the value of the indicator has crossed the 80% mark, a bottom in the price of the crypto has taken place.

Related reading | Bitcoin funding rates remain negative, but open interest tells a different story

At the moment, the value of the metric has increased in recent weeks, but it has still not crossed the threshold yet.

Still, the indicator is almost there. If the value continues to rise and the historical pattern holds this time as well, Bitcoin may see a bottom soon.

BTC price

At the time of writing, Bitcoin’s price is floating around $ 21k, down 30% over the last seven days. Over the past month, the crypto has lost 30% in value.

The chart below shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have been moving sideways over the last few days | Source: BTCUSD on TradingView

Since the crash a few days ago, Bitcoin has largely consolidated around $ 21k. It is currently unclear whether the decline is over, or whether there will be more.

If the LTH share of the realized ceiling is something to go by, BTC can first see a little more decline before the bottom is finally in.

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com