Long-term Bitcoin holders dump as BTC plunges below $17k

On-chain data shows that long-term holders of Bitcoin are dumping their coins as BTC plunges below the $17,000 level.

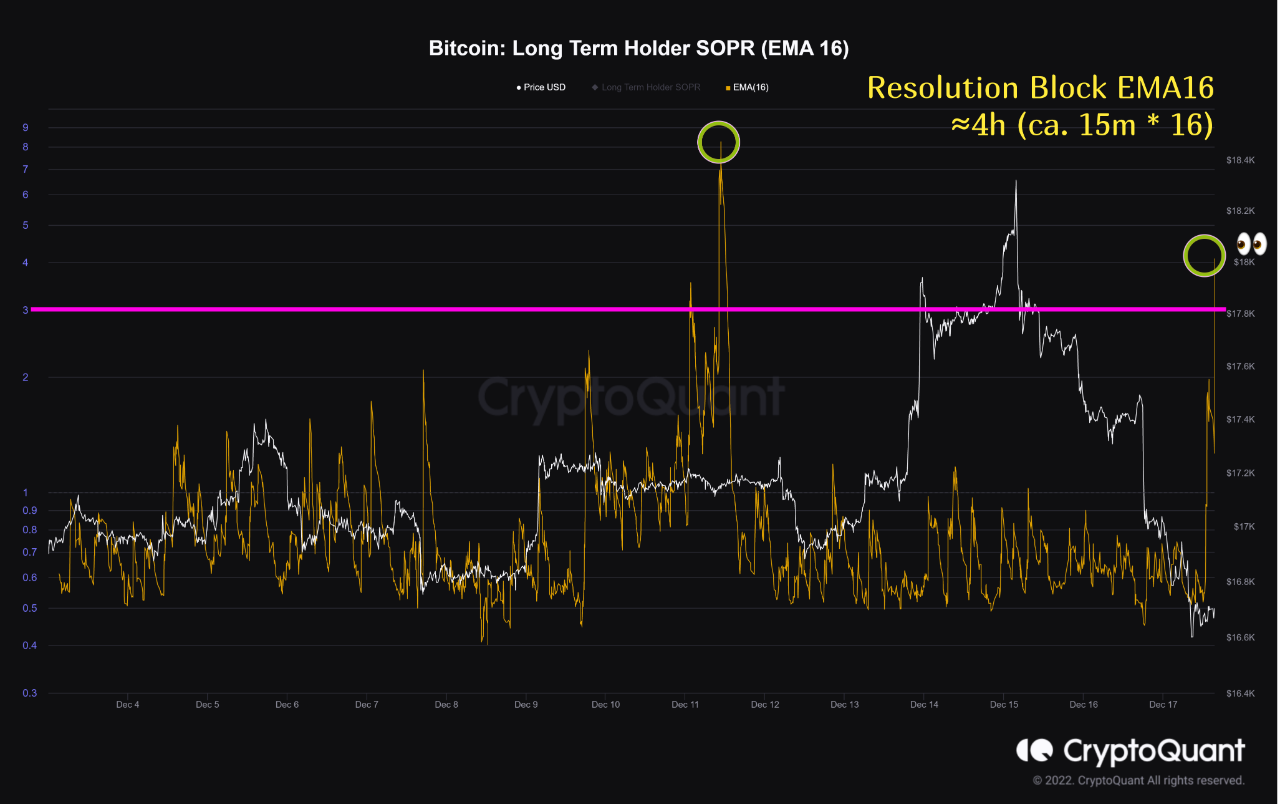

Bitcoin Long-Term Holder SOPR Spikes Today

As pointed out by an analyst in a CryptoQuant post, some long-term BTC holders appear to have taken profits in the last day. The relevant indicator here is the “Spent Output Profit Ratio”, which tells us whether Bitcoin investors as a whole are selling their coins at a profit or a loss right now.

When this metric has a value greater than 1, it means that the average holder has moved their coins with some profit recently. On the other hand, values below the threshold suggest that the overall market has lost something. Naturally, SOPR exactly equal to 1 means that investors only break even with sales.

The “Long-Term Hold” (LTH) group is a Bitcoin cohort that includes all investors who have held their coins since at least 155 days ago, without moving or selling them from a single address. Here is a chart showing the trend of Bitcoin SOPR specifically for these LTHs over the last 15 days:

Looks like the EMA16 value of the metric has shot up in the last few hours | Source: CryptoQuant

As the graph above shows, Bitcoin LTH SOPR (EMA16) has observed a sharp peak above 1 over the past 24 hours. This means that these holders have reaped some profit today. Statistically, LTHs are the least likely investors to sell at any point, so any dumping by them could have noticeable ramifications on the BTC market.

From the chart, it is clear that when the indicator last saw such a large increase in value, the price of the crypto had dropped shortly after. Interestingly, the recent peak has only come after BTC has plunged below $17k. Usually, such holders sell for profits during rallies, but here the dumping has come after the bullish momentum has already passed.

This could be a sign that with all the FUD going around the market right now, these supposed diamond hands have also broken down and are feeling bearish about the prospects of Bitcoin at the moment. Such a trend is likely to be negative for the price, and could take the crypto even further down.

BTC price

The price of the coin seems to have slid down over the last few days | Source: BTCUSD on TradingView

At the time of writing, Bitcoin’s price is hovering around $16.7k, down 2% in the last week. The chart above shows the trend in the value of the crypto over the last five days.