Launch of Bitcoin Ordinals Triggers Demand for Yuga Lab’s NFTs

Hours after Yuga Labs launched its TwelveFold non-fungible token on the Bitcoin blockchain, other NFTs from the issuer are seeing a push.

Meanwhile, Yuga Labs ended the TwelveFold auction with $16.5 million in revenue in a single day.

Yuga Labs ends auction

The TwelveFold auction, which featured a limited collection of 300 generative works encoded in satoshis on the Bitcoin network, was closed by YugaLabs on March 6.

NFT influencer tropoFarmer took to Twitter to call the sale a “financial success.” The highest bidder reportedly paid $161,000 among 288 bidders who took home collections from the NFT auction. The sale netted a total of 735 BTC or $16.5 million in 24 hours.

Yuga Labs’ collections dominate the NFT market

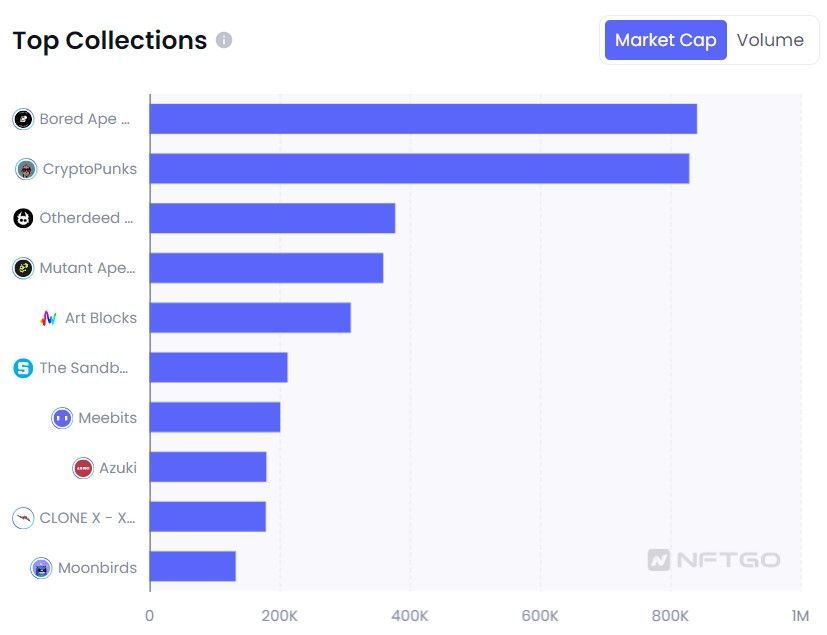

NFTs from Yuga Labs dominate the top selling list on DappRadar. Collections from Bored Ape Yacht Club (BAYC) and CryptoPunk NFTs are repeated in the last at least 40 sales on the platform. DappRadar had previously noted that Yuga Labs’ BAYC, MAYC, BAKC, Otherdeeds, and Sewer Pass collections had given the issuer an advantage.

Not only have they been among the top 10 NFT collections, but the company also managed to dominate 30% market share of the total NFT trading activity on Ethereum through them.

Over the past seven days, BAYC (8.17%), CryptoPunks (8.05%), Otherdeeds (3.66%), and MAYC (3.49%) were the top four NFTs by market cap on NFTGo.

Six of the top ten NFT purchases in February, according to DappRadar, were by CryptoPunks. They are said to have earned a total of 5.3 million dollars. Meanwhile, the Golden Key Sewer Pass sold for 1000 ETH was the largest NFT transaction of the month.

TwelveFold’s launch aimed to strengthen the company’s revenues on the royalties side. However, many from the community, including creator Casey Rodarmor, criticized the bidding process due to its complexity. Conversely, others were excited about the marriage of NFTs and BTC.

That said, while sales volume has brought good news for Yuga Labs, floor prices have remained weak. According to recent research from Delphi Digital, peak pools such as BAYC and MAYC have failed to recover since their 2022 peaks. This coincides with the bear crypto market since the high-profile bankruptcies.

Yuga Labs’ top two collections have reportedly had a 20% reduction.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.