Kenyan fintech Pezesha raises $11M backed by Women’s World Banking, Cardano parent IOG – TechCrunch

Access to finance remains a key growth constraint for small businesses, with data showing a $330 billion financing gap for the small businesses that make up 90% of Africa’s businesses.

This is the gap that Kenya’s embedded financial fintech Pezesha is seeking to bridge as it expands into Nigeria, Rwanda and Francophone Africa following an $11 million pre-Series A equity debt round led by Women’s World Banking Capital Partners II with participation from Verdant Frontiers Fintech Fund , cFund and Cardano blockchain builder Input Output Global (IOG). The round also included $5 million in debt from Talanton and Verdant Capital Specialist Funds.

The fintech’s new growth strategy follows its plan to drive its embedded financing offering beyond its current markets, including Uganda and Ghana, to bridge the financing gap affecting millions of micro, small and medium enterprises (MSMEs) across those markets.

Founded in 2017 by Hilda Moraa, Pezesha has built a scalable digital lending infrastructure that allows both traditional and non-traditional financial institutions to offer working capital to MSMEs.

“The opportunity and impact to solve working capital issues for small and medium-sized businesses is enormous. [We are] solve the root cause, which is information asymmetry problems, to ensure quality and responsible borrowing. Pezesha solves this through our robust API-driven credit scoring technology, says Moraa, also CEO, to TechCrunch.

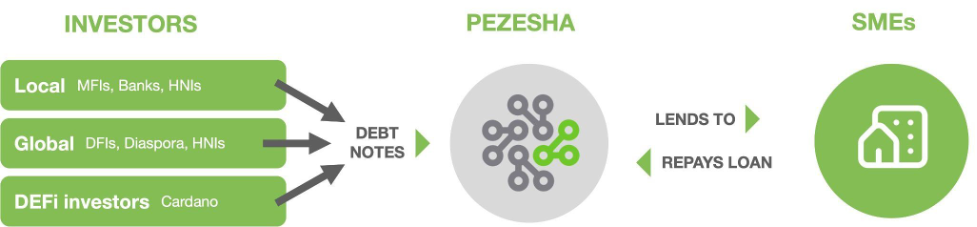

Pezesha uses local and international banking institutions, HNWI and DeFi for additional liquidity for further lending. Image credit: Pezesha

The fintech works with partner companies such as Twiga and MarketForce, who integrate their credit scoring APIs into their platforms to enable their customers to get real-time loan offers.

Pezesha said it currently works with over 20 partner companies that have enabled it to extend loans to over 100,000 businesses to date. It expects that number to grow before the end of the year as another 10 companies integrate with its infrastructure. Fintech is able to extend loans of up to $10,000 at single-digit interest rates, and a one-year repayment period.

Pezesha plans to create a $100 million financing opportunity each year for businesses by leveraging local and international banking institutions, high-net-worth individuals, and decentralized finance.

“We are building for the future, and this means leveraging new innovations for additional liquidity that allows us to offer affordable loans to small and medium-sized businesses,” said Moraa, a two-time founder, who started Pezesha after leaving Weza Tele in 2015 .

Charles Hoskinson, co-founder of IOG and Cardano, while commenting on their investment in Pezesha said in a statement that “Facilitating the movement of capital to emerging markets to support economic growth and job creation is a core promise of blockchain and cryptocurrencies. Our vision is centered on to use technology to make it easier for people around the world to borrow and lend to each other in a regulated way. This investment in Pezesha is an important milestone and we are excited to be part of their growth story.”

IOG’s investment in Pezesha follows a previous announcement that the two companies had partnered to build a peer-to-peer financial operating system for Africa.

Image credit: Pezesha

Moraa said that working with strategic partners like Cardano will open up the debt liquidity market and offer the affordable capital that is essential for the growth of all sectors of the economy.

Fintech plans to open up more lending opportunities for female entrepreneurs who are still excluded from the formal banking sector.

“Pezesha is dedicated to solving Africa’s working capital problem through its robust lending infrastructure, and this investment will allow them to deepen the range of financial products offered specifically to women-owned MSMEs,” said Christina “CJ” Juhasz, Chief Investment Officer of Women’s World Banking Asset Management.

Pezesha did not disclose how much it has raised previously, but Moraa noted that 20% of its first pre-seed investment in 2017 was from local angels. The fintech, which raised seven figures last year, counts Seedstarts, GreenHouse Capital and Consonance Investment Managers among its several investors.

“We have the right business model, are profitable and continue to pursue the type of investors that align with our goals and values,” Moraa said.