Kenya Drops Fraud Charges Against Nigeria’s Fintech,…

If there is one person who is currently over the moon over the latest happenings regarding his company, that person would be Gideon Orovwiroro, Chief Operating Officer of Kora, a pan-African fintech company headquartered in Canada, with offices in Nigeria and United States Kingdom.

During the week, Kenya’s Asset Recovery Agency (ARA) dropped the fraud charges it had brought against the payment infrastructure company. ARA is the Kenyan agency that identifies, tracks, freezes, seizes, confiscates and recovers the proceeds of crime in the East African country. The agency filed documents with the High Court of Kenya at the Nairobi Anti-Corruption and Economic Crimes Division and withdrew its case in its entirety.

Similarly, another document issued by the Kenyan Directorate of Crime (DCI) earlier this week cleared Kora of any wrongdoing in the ARA application. The DCI said it could not file any case against the company following the investigations.

In July, when ARA began cracking down on some of Nigeria’s Fintechs operating in the country, accusing them of money laundering and fraud, Kora was one of the companies targeted by ARA. It accused the company of allegations of money laundering and card fraud.

The agency filed two separate lawsuits, leading to the freezing of Kora’s account along with that of Kandon Technologies Limited, another Nigerian fintech company. Both fintechs were alleged to bring in Sh6 billion ($51 million) into Kenya. As such, the court froze $249,990 (Sh29.5 million) in Kora’s Equity Bank account, and $126,841 (Sh15 million) in Kandon Technologies Ltd’s two UBAs accounts until the ARA should complete investigations within six months.

ARA also connected them with five other Nigerian companies and a Kenyan businessman. The companies are Flutterwave Ltd, Elivalat Fintech Ltd, Hupesi Solutions, Boxtrip Travels and Tours, Bagtrip Travels Ltd, Cruz Ride Auto Ltd, and businessman Simon Karanja – whose combined 62 bank accounts contain over Sh6 billion. was frozen over similar allegations. But just under four months later, the case was closed with Kora being ready.

It will be recalled that earlier this year, ARA began cracking down on some of Nigeria’s Fintechs operating in their country. For over two months, it investigated a series of cash transfers from Nigeria without realizing that they could hold the key to unlocking the whereabouts of the Sh25 billion. at the center of the local and international money laundering rings.

In May, ARA, together with Interpol, targeted Eghosasere Nehikhare, founder of Boltpay and CEO of Multigate Limited and Bukunmi Olufemi Demuren, founder and chairman of Multigate Limited. The fintech tycoons who allegedly have a history of using tax havens to avoid taxes were at the center of investigations by the Assets Recovery Agency, Kenya and Interpol into a series of suspicious transfers of $221 million (N128 billion) from Nigeria in local currency, which is worth Kenya Sh25 billion.

Interpol attempted to solve the puzzle behind the laundered money, which was linked into Kenya from Nigeria between October and November 2020. In July, Flutterwave, Africa’s leading payment technology company with operations across thirty-three countries on the continent, was also targeted. in a money laundering investigation by the ARA. The Central Bank of Kenya even issued a notice instructing all commercial banks in the country not to engage with it as previously reported by THEWILL.

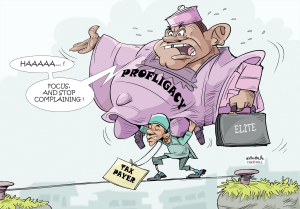

While Flutterwave rejected allegations of financial improprieties and insisted that Kenyan authorities specifically targeted Nigerian Fintechs, some analysts expressed the view that the Kenyan government was trying to use the ARA to score cheap political points and mask allegations of public service corruption, with non- indigenous people. Fintechs as easy targets.

While they believe that fintechs may not be completely free of the fraud charges, they also believe that fintechs are not as guilty as charged, citing Kora’s acquittal as an example.