JPMorgan report predicts crypto will move to signature banking

JPMorgan Chase said the crypto industry would struggle to replace the services offered by collapsed banking partner Silvergate Capital Corp.

In a new report, a research team at Wall Street Titan said crypto firms would be hard-pressed to replace Silvergate Exchange Network’s 24/7 payment rails quickly.

Silvergate competitors face mount pressure

As Silvergate goes into voluntary liquidation, JPMorgan predicts customers will migrate to Signature Bank’s Signet payment network. Cryptocurrency firms can incorporate the Signet network into their platforms using application programming interfaces.

However, Signature is also facing pressure to minimize crypto risk and recently announced it would cut crypto deposits by $10 billion. Coinbase recently switched to Signature for its Prime customers.

Customers can also move to Customers Bancorp, which offers tokenized B2B settlements on the Tassat payment network using the CBIT token. JPMorgan also cites Metropolitan Bank as a potential destination.

The extent to which Metropolitan Bank would be willing to assume new crypto business is unclear, as the bank recently announced the shutdown of its crypto vertical in 2023. It attributed the shutdown to “recent developments” in the crypto industry. Crypto-related firms made about six percent of all deposits.

Silvergate announced on March 8 that it would “wind down” operations and refund 100% of customer deposits. The bank was hit hard by several customer withdrawals at the end of last year.

Last week, it discontinued the Silvergate Exchange Network (SEN) payment rail for “risk” reasons following the departure of several major crypto firms, including Coinbase and Galaxy Digital Holdings. The bank emphasized that deposit-related functions are still operational. Crypto investors used SEN to move dollars between their bank accounts and crypto exchanges, provided both banked with Silvergate.

Rising interest rates pose a liquidity risk for smaller banks

The collapse of Silvergate and the financial troubles indicate a deeper problem with the Federal Reserve’s tightening policy.

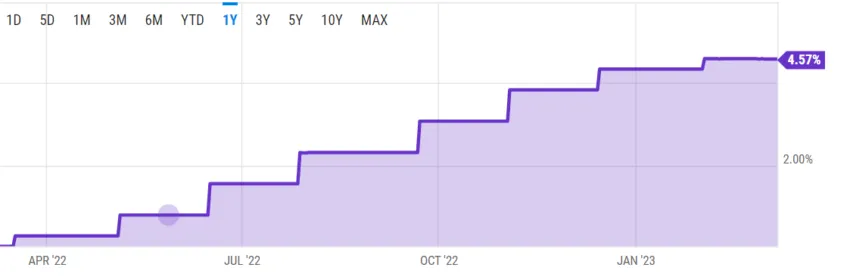

The central bank raised interest rates by around 4.5% in the past year.

These increases have made it challenging for banks to sell high-quality low-yield bonds quickly.

Faced with a bank-driven scenario, the banks have been forced to find more ways to raise capital to honor withdrawals.

Before the collapse, Silvergate Capital tried to do just this. There was a rush to sell a boatload of securities at huge losses that undermined investor confidence.

Silicon Valley Bank, a company that has done business with top US technology firms, announced a reported realized tax loss of $1.8 billion from a recent preemptive sale of securities from struggling portfolios. It then announced a hasty fundraising to raise liquidity. The company’s stock has fallen 60% since Thursday.

Smaller institutions face the challenge of falling Treasury yields and increasing pressure from the Fed to adequately manage risk.

In particular, many of the Federal Reserve have, until recently, allowed them to operate with less scrutiny than titans like JPMorgan. But the failure of Silvergate could mean that these banks come under a stricter risk regime that could stifle the crypto industry.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.