JPMorgan Brings Blockchain to India, Predicts $45,000 for Bitcoin

[gpt3]rewrite

JPMorgan has partnered with Indian banks to settle dollar transactions using the blockchain. Meanwhile, the bank also believes there will be an increase in demand for Bitcoin (BTC), as the halving event is less than a year away.

Publicly, JPMorgan has been one of the biggest critics of Bitcoin. But the bank has used blockchain technology and served its customers with related products.

JPMorgan aims to bring 24/7 transaction settlement with Blockchain

According to Bloomberg, JPMorgan has partnered with six Indian banks for a blockchain-based solution to settle interbank transactions in dollars. The pilot project that went live today will use JPMorgan’s Onyx platform.

The American bank launched the Onyx platform in 2020.

The traditional system takes a few hours to settle transactions. Also, the traditional economic system takes a break during weekends and public holidays. But blockchain technologies allow transactions to be facilitated 24/7.

Kaustubh Kulkarni, vice president of the Asia Pacific region at JPMorgan, said:

“By leveraging blockchain technology to facilitate transactions on a 24×7 basis, processing is instantaneous and enables GIFT City banks to support their own time zone and operating hours,”

GIFT stands for Gujarat International Finance Tec-City, a city being built with the vision of becoming a trade hub.

Bitcoin to $45,000: JPMorgan

According to Barron’s, JPMorgan analysts believe that the rise in gold prices, at around $2,000/ounce, could result in strong demand for Bitcoin. The analysts expect BTC to hit the $45,000 price zone.

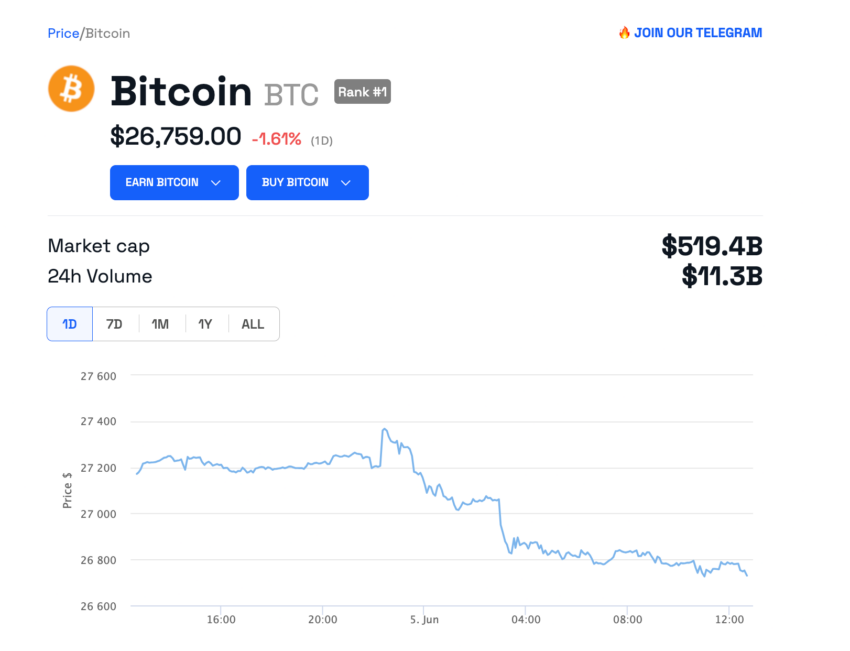

This is due to the fact that Bitcoin and gold are considered safe havens and a hedge against inflation in times of financial crisis. At the time of writing, the price of Bitcoin is at $26,759, down 1.61% in the last 24 hours.

Read our Learn article about how inflation can affect you.

Furthermore, JPMorgan believes that the next halving event could act as another catalyst for a Bitcoin rally. During halving, the block rewards are reduced by half, and as a result, the production cost of Bitcoin doubles.

After the next halving, the cost of producing Bitcoin is estimated to reach $40,000 per Bitcoin. Historically, the cost of production has acted as a strong support for the BTC price.

According to NiceHash, the next Bitcoin halving is about 302 days away.

Pause in interest rate increases

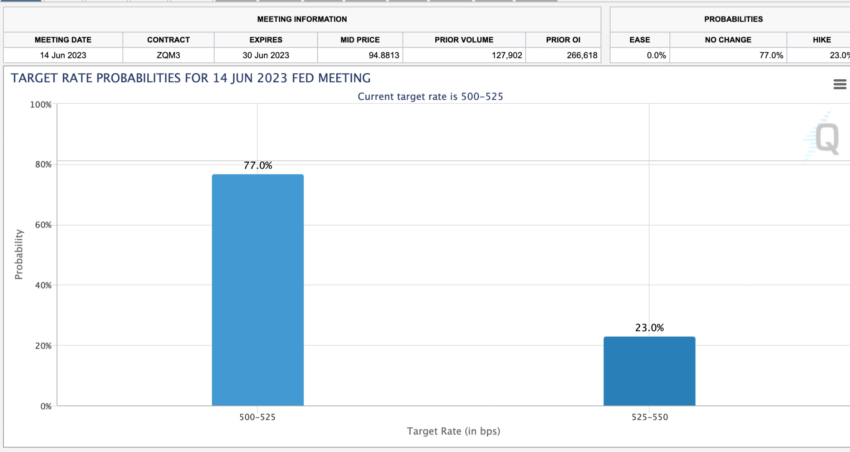

Since last year, the Federal Reserve (Fed) has aggressively raised interest rates to 5.25%, the highest in 16 years. The next meeting of the Federal Open Market Committee (FOMC) is scheduled for June 14.

JPMorgan CEO Jamie Dimon predicts a pause in rate hikes. But he expects harsher consequences in the market and advises people to prepare for it. In a Bloomberg interview, Dimon said:

“My simple view is that they are entitled to take a break at this point. Take a break, but I think it’s possible that they need to increase a little bit more, that inflation is a little bit stickier.”

According to the CME Group, there is a 77% probability of a pause in interest rate increases. In contrast, there is a 23% probability of another rise of 25 basis points.

Got something to say about JPMorgan Bitcoin or something else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.

[gpt3]