Jerome Powell’s Trust Erodes, Bitcoin Rises as America’s Hope

At a time of shaky faith in economic leadership, the American public’s confidence in Jerome Powell, the chairman of the Federal Reserve, is declining. Is this just a symptom of a volatile economy or a more profound shift in public sentiment towards Bitcoin?

As central bank strategies come under scrutiny, the potential for alternative financial systems, such as Bitcoin, is drawing increased attention. Can this digital currency reshape the nation’s economic landscape and provide stability amid uncertainty?

The Declining Trust in Jerome Powell: An Unprecedented Shift

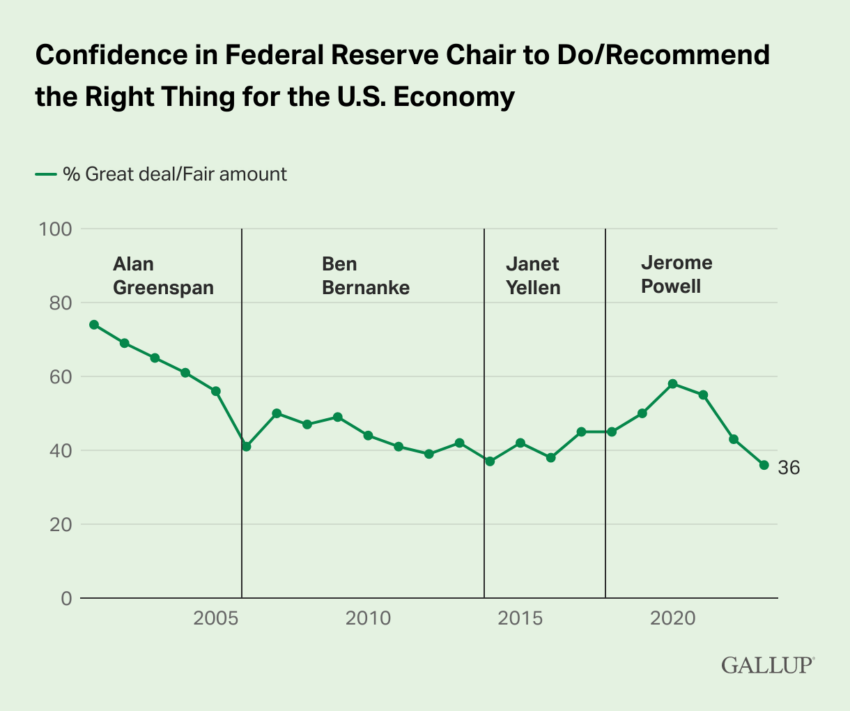

In a striking twist, the American public’s confidence in Jerome Powell is rapidly eroding. Gallup’s recent poll reveals that 36% of Americans believe in Powell’s economic acumen.

This figure represents the nadir of Powell’s six-year reign. It is the lowest confidence rating Gallup has recorded for any central bank governor since data tracking began with Alan Greenspan in 2001.

Interestingly, 28% of Americans profess almost no confidence in the Republican central bank, originally nominated by former President Donald Trump.

The importance of this development cannot be underestimated. The Federal Reserve, often envisioned as an unshakable bastion of wisdom, relies heavily on public trust for its operational effectiveness. The institution’s success depends on its perceived trustworthiness and ability to shape policy effectively, free from political interference.

The strength of the belief in the Federal Reserve’s commitments is significant. Should Jerome Powell commit to reducing skyrocketing inflation rates, for example, the American public’s belief in the promise could provoke behavioral change, effectively setting in motion a self-fulfilling prophecy.

Recent turbulence in the banking sector only reinforces the need for such unwavering confidence. The Federal Reserve must persuade the public about the stability of regional banks. The future welfare of the economy may hang in the balance.

However, public perceptions and reality often diverge, and the Federal Reserve is not immune to the unpredictable swings in economic sentiment. The growing unease among Americans about the economy is increasingly reflected in their views of key government officials responsible for economic policy.

The Federal Reserve’s Fight Against Inflation: A Slow and Steady Approach

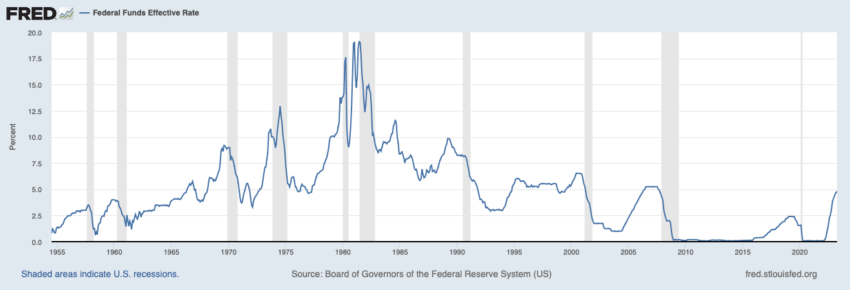

The Federal Reserve has tried to curb inflation by implementing a series of interest rate increases in just over a year. This aggressive action has taken a toll on the economy. Despite some easing in inflation rates, they remain well above the Federal Reserve’s 2% target.

The American public’s awareness of inflation, which is generally unwelcome, is a clear indicator of the Federal Reserve’s challenges. If the public loses faith in Powell’s messages, it could herald more significant concerns.

Given his role, public skepticism about Powell may be par for the course. But interestingly, they seem to believe that he will fulfill his promises.

For example, the Federal Reserve has hinted at a likely pause in rate hikes at its upcoming meeting. Market predictions agree with this forecast, showing a 90% chance of it happening.

However, to maintain public confidence, the Federal Reserve must convincingly demonstrate its ability to meet its 2% inflation target before easing policy. This suggests that interest rates may remain high, and potentially increase further if inflation does not fall in line.

The credibility of the Federal Reserve will soon face another significant test. Essentially how the American public perceives its regulation of the banking industry. This brings one to a crucial question: could Bitcoin, the decentralized crypto, be the answer?

Bitcoin: The Beacon of Hope in a Trust-Deprived Economy?

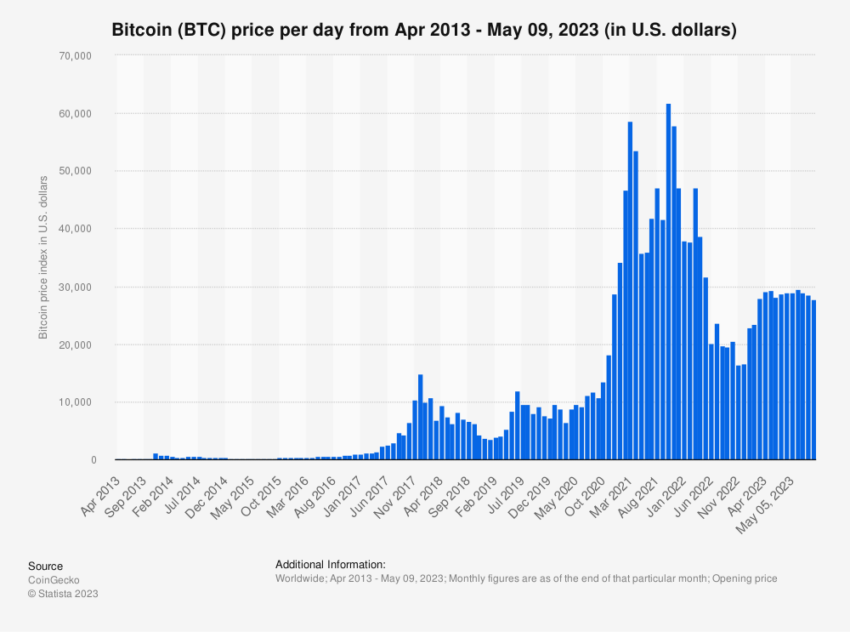

Bitcoin, with its peer-to-peer transaction system, offers a potential alternative. As the public’s trust in centralized institutions declines, the appeal of a decentralized, transparent and tamper-proof system increases.

The leading digital currency provides an alternative economic landscape without the influence of individual personalities and political decisions. As such, it may be just the beacon of hope that America needs, reshaping the nation’s economic landscape and restoring confidence in a time of uncertainty.

Bitcoin can offer an alternative solution that does not rely on the trustworthiness of a single person or institution, but operates on a transparent, immutable ledger. With the power to validate transactions and store value, Bitcoin could become a central part of a more decentralized, robust financial system.

In these challenging times, the Federal Reserve’s mission to moderate inflation seems slow and steady. As annual inflation cooled last month to the lowest level since April 2021, the question remains whether the Federal Reserve’s approach will be effective in the long run.

Although the consumer price index (CPI) has gradually declined, inflation is still uncomfortably high. This has led to speculation about whether the Federal Reserve may pause rate hikes.

While the answer lies in the uncertain future, the potential for Bitcoin as a safe haven is becoming increasingly plausible. Bitcoin’s decentralized nature makes it immune to the whims of policy changes, making it a more stable store of value.

As trust in traditional institutions like the Federal Reserve continues to erode, the lure of innovative, decentralized alternatives like Bitcoin is becoming increasingly irresistible.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.