Jerome Powell contradicts the Federal Reserve – Bitcoin Magazine

“Fed Watch” is a macro podcast, true to bitcoin’s insurgent nature. In each episode, we question mainstream and Bitcoin narratives by examining macro current events from around the world, with an emphasis on central banks and currencies.

Watch this episode on YouTube or Rumble

Listen to the episode here:

In this episode, CK and I cover Jerome Powell and the FOMC’s policy decision in depth, analyzing statements from the Federal Reserve, Powell and other financial experts. Next, we move to charts, starting with bitcoin and the dollar, then moving on to Treasury rates. Finally, we discuss the shortage of diesel on the East Coast of the United States

Federal Reserve FOMC raises rates again

CK and I agree that the importance of the Federal Reserve and the FOMC’s policy decision to the market is a sign of a very unhealthy economy, where central bank decisions are the only game in town.

The Fed raised interest rates by 75 basis points (bps) to a new Fed Funds target range of 3.75% to 4%. This was no surprise. The market had predicted that the Fed would not veer off course in this meeting, despite the global liquidity concerns emerging in the financial system.

The central bank maintained its policy path, but the statement contained some softening of its hawkish tone. The sentence that jumps out is the following:

“In setting the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

“Cumulative” is the word people focus on. What does “cumulative” mean in this context?

The Fed places its meeting-to-meeting decisions within the broader scope of its tightening program as a whole since March 2022, as well as considering its globally important role. The reasoning Powell describes in the press conference that followed is mixed. They want to place their decisions within an entire program, but also want to be data-dependent on a meeting-to-meeting basis.

Overall, I think their intent is to create uncertainty. Uncertainty is key at the end of a tour cycle. The Federal Reserve’s intention is to cause an economic downturn to bring demand down to match supply, but they can’t do that if the market is ahead of the end of the tour cycle.

That is exactly what we have seen in recent months. I’m sure Powell has mixed feelings about the stock market remaining resistant to their hikes, with the S&P 500 above where it was at the time of the June rally. There were three meetings with 75 bps rises, yesterday there were four, and yet the stock market was higher. He wants a “soft landing” – to achieve his political goals without major damage to the economy – but at the same time the aim is to damage the economy. It’s a contradictory tightrope they’re trying to walk.

The intentions of the latest increases in the austerity program cannot be achieved if the market goes ahead with its decline, the pause and then the eventual reversal. This is where the targeted uncertainty comes in. If the Fed can send mixed messages and keep the market uncertain, the effects of their recent hikes could be more significant.

Diagrams

The cards on Fed Day moved quickly. I put off taking snapshots until 30 minutes after the Fed’s announcement, but the mixed messages from Powell sent them swinging wildly. I won’t post them here because they’re already out of date, but you can look at them on the slide deck for this episode.

The initial reaction was consistent across the board. Markets took the written statement, including the new language about cumulative effects, as a dovish pivot. Bitcoin rose along with stocks and the dollar fell.

However, as soon as Powell started taking questions at the press conference, and with his mixed messages described above, the markets turned. Bitcoin and Stocks Down, Dollar Up.

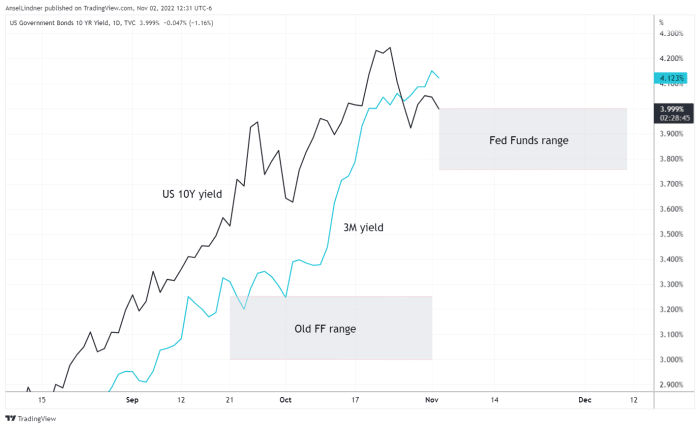

The one chart I will include in this companion post to the podcast is the one for the 3-month and 10-year Treasury yields that shows the most important inversion in the curve.

What you can notice on this chart is that the 3-month yield is going higher than the 10-year yield. Also, the 10-year yield is very close to being within the Fed Funds target range.

What I have been saying for months is that the Fed will continue to raise interest rates until the market forces them to stop. That power used by the market will show as long-term interest rates simply don’t obey the Fed anymore and go lower, as we can see with the 10-year yield here.

The Fed is admittedly “data dependent”. They tell us they are supporters, but if you want to know where the Fed is going, all you have to do is look at the yields. If government security yields begin to fall into the Fed Funds target range, their choices at the next meeting will be: raise interest rates again and lose confidence that they have control over anything, or take a break, or even make a “mid-cycle adjustment ” and lower them. Powell has done what he calls a mid-cycle adjustment before. Back in 2019, the first interest rate cut in July was downplayed as just such a move. Of course, that was then followed by massive cuts in the following months.

Diesel shortage

There are other things going on in the economy than the Federal Reserve. There is concern about diesel shortages in the US. Reports are flying that there are only a couple of weeks of diesel left in stock, and with winter the demand for diesel and heating oil will increase.

To cover this story, I read from a great article by Tsvetana Paraskova. She covers the shortage and the reasons behind it in detail.

In short, US refinery capacity is down due to some plants switching to making biofuels, and our imports from Russia are non-existent due to insane sanctions.

At the show we get derailed because I personally am not too worried about the diesel shortage. It will cause some pain, but the solution is through that pain. Higher prices will cause one of two things to happen – or both: higher prices will stimulate more production or higher prices will cause policy changes to allow higher production.

There is an almost universal fear of higher prices, and they are demonized as “inflation” every time. Of course, high prices are not bad if you are a producer. They are not bad in general either. The prices must be neutral and give you information about the economy. The only price changes that are net negative are those due to changes in the money supply. Since our current economic condition is not due to money printing, but instead to supply crises and bad government policies, the price increases are necessary to fix the problems today.

This is a guest post by Ansel Lindner. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.