Japan’s FSA issues warning to Bybit and 3 other crypto exchanges

Bybit and three other crypto exchanges received warnings from Japan’s Financial Services Agency (FSA) related to the fact that they were unregistered. It is not the first time Bybit has received this warning.

Japan’s financial regulator, the Financial Services Agency, has taken steps forward to regulate crypto exchanges in the country. The regulator sent a warning to four crypto exchanges, including the popular exchange Bybit.

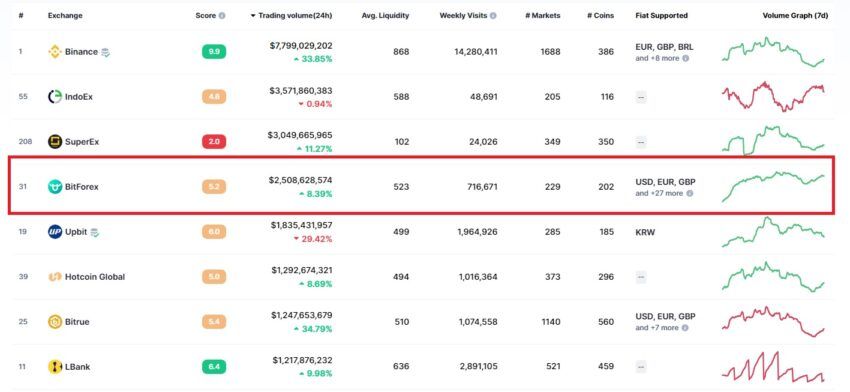

The notice states that the exchanges must register as cryptocurrency exchanges in order to conduct business. The other three relevant exchanges are MEXC Global, Bitforex and Bitget. They have all received similar warnings.

It is not the first time Bybit has received a warning from Japan’s FSA. The exchange received a warning from the regulator in May 2021, which also stated that it was operating without a licence. The UK regulator had also raised similar issues with the exchange around that time.

The public warning about the exchange is a sign that Japan is increasing its focus on regulation. Recent weeks have included several developments in this regard, as the country focuses on preventing problems that lead to events like the Terra crash.

Japan focuses on crypto regulation

Among the developments taking place in Japan is the fact that the country’s authorities have asked the US and EU to regulate crypto-like banks. Officials believe the crypto market is large enough to warrant scrutiny comparable to that of banking institutions.

Perhaps the most important development related to regulation is the fact that a new stablecoin law will soon come into effect. At the same time, the banks are working with Progmat Coin, a yen-backed stablecoin focused on streamlining settlement processes.

Bybit on the regulator’s radar

Bybit has been on the radar of regulators for some time, after receiving warnings from authorities in Canada. The exchange does not work in the US; The exchange has suspended USD deposits for national and international customers from 10 March.

The market downturn in 2022 has also affected the stock exchange, with the company forced to reduce staffing by 30%. The fact that regulators are intensifying their vigilance over the exchange may force even more change, but the exchange appears to be business as usual for now.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.