Japan Securities Clearing Corporation’s use of blockchain technology

This is to announce that, with the cooperation of the stakeholders, starting from January 2023, Japan Securities Clearing Corporation, CCP under Japan Exchange Group, Inc., is implementing a blockchain technology in the settlement of rubber futures delivery as described below, as the first image of the use of a blockchain technology.

Subject

- Settlement on delivery of Rubber (RSS3) Futures* at Osaka Exchange, Inc.

- Futures Contracts on RSS (Ribbed Smoked Sheet) No.3 which is the most standard natural rubber graded by international organizations or public authorities in the producing countries.

Usage details

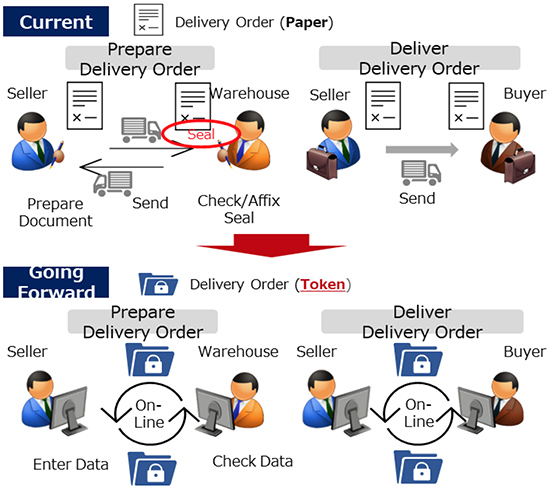

- Currently, a settlement on delivery of Rubber Futures is made through an exchange of a document called a “delivery order”, which allows the holder to receive a delivery of rubber. Going forward, the delivery method will migrate to an online exchange of a token that records the delivery order information using blockchain technology.

Start time/number of users

- From delivery for January 2023 contract month contracts (date of settlement on delivery: 31 January 2023 (Tuesday))

- A total of 13 companies consisting of sales/purchases of clearing participants and customers in the settlement for the delivery of rubber, and warehouses that take care of the rubber to be delivered

Expected effect

- From this, the delivery order process, such as preparation and delivery, which has been carried out between the seller/buyer/warehouse at each time of the settlement for the delivery of rubber, will no longer be necessary, and the settlement for delivery will be completed online, thus streamlining the settlement upon delivery is improved.

Future prospects

Extension to precious metals

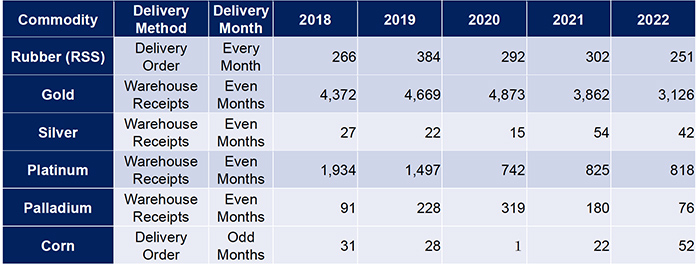

- A settlement for the delivery of precious metals, such as gold, silver and platinum, which are more liquid than rubber, is currently carried out through an exchange of the securities called “warehouse receipts”.

- Unlike delivery orders, warehouse receipts are securities that can also be used as collateral for various trades. Digitization is expected to be discussed in the legislative council in the Ministry of Justice in the future. So we will keep our eyes on a status of such discussions and study the feasibility of digitization as the next step.

Further improving settlement efficiency and strengthening response capacity for the future

- Digitization of assets using blockchain technology has already been realized in securities with small lots, such as less liquid real estate or bonds.

- The Japan Securities Clearing Corporation decided on the use of Blockchain technology this time as an initial trial period in trading Japanese listed products. It will strive to streamline the settlement efficiency through the implementation of new technologies as well as strengthening the response capacity for the future with a view to a possible expansion of the utilization of new technologies such as this in trading and clearing/settlement of more liquid listed companies. products and OTC products.

| CCP’s use of blockchain technology – Implement for Rubber Futures settlement on delivery as a first shot – |

|---|

Consult

Japan Securities Clearing Corporation Clearing Planning Department

TEL:+81-3-3665-1234 (Main telephone number)