Japan FSA to categorize algorithmic stablecoins similar to Bitcoin

Japan’s financial regulator, the Financial Services Authority (FSA), plans to categorize algorithmic stablecoins in the same bracket as Bitcoin. Stablecoin issuers will also need licenses that consider it a bank, money transfer service provider or trust company.

The FSA aims to categorize algorithmic stablecoins under the same bracket as Bitcoin. The regulator released a report showing how it intended to handle stablecoins.

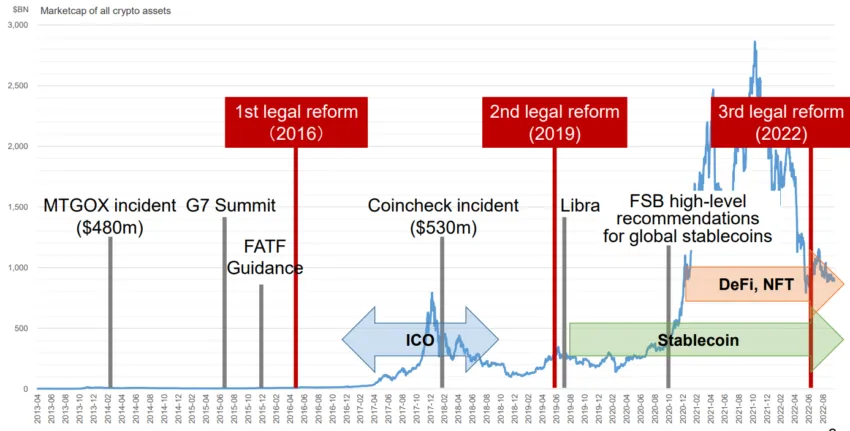

Titled “Regulating the Crypto Asset Landscape in Japan,” the report also discusses the three eras of legal reform that Japan has undertaken. One of the main points in the report concerns stablecoin regulation.

The report says that self-claiming stablecoins, such as algorithmic stablecoins such as TerraUSD, and unredeemed stablecoins will be categorized in the same way as Bitcoin. It also states that banks can issue stablecoins as deposits.

The first of the three legal reforms took place in 2016 and mainly concerned investor protection and anti-money laundering (AML) and Combating the Financing of Terrorism (CFT) regulations. The second took place in 2019 and was expanded to cover derivatives trading, investor protection and advertising and solicitation.

The third, taking place this year, covers a regulatory framework for banks and, most importantly, stablecoins. Its priorities for stablecoins are financial stability, investor protection and AML/CFT.

Stablecoin issuers will face major changes

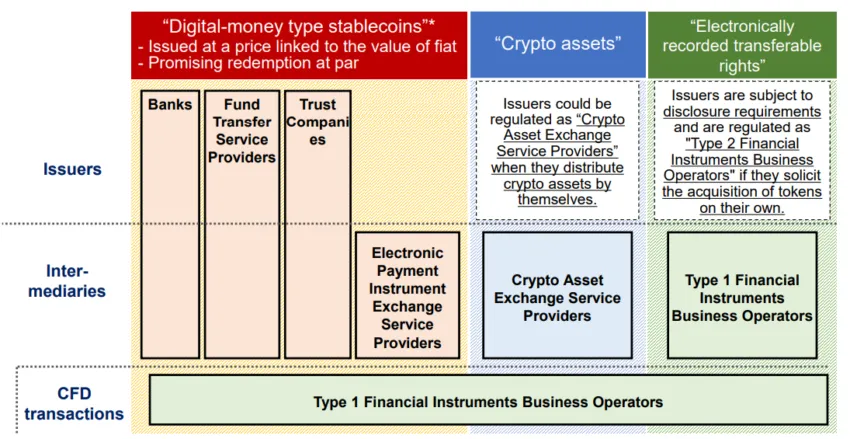

In particular, the third era of legal reforms will bring a good deal of changes to the stablecoin market. The reform covers issuers, intermediaries and CFD transactions (Contract for Differences).

Issuers are likely to see classification as “crypto asset exchange service providers” and must comply with disclosure requirements. Intermediaries will take the classification as “service providers for electronic payment instrument exchange”. Issuers will also need licenses that consider it a bank, money transfer service provider or trust company.

Algorithmic Stablecoins not approved

The reforms introduce some sweeping changes to stablecoins in Japan. The country’s regulator is clearly concerned with ensuring that stablecoins follow the rulebook. After the collapse of TerraUSD earlier this year, many governments have been working on the same.

In its concluding section, the report discusses a way forward in terms of regulation. It recommends the Financial Stability Board’s view on algorithmic stablecoins. It advises against using them.

It is likely that Japanese lawmakers will take the FSA’s recommendations heavily into account when establishing policy. Japan has increased its regulatory actions and is also keen to cooperate at an international level. The Digital Ministry will even launch a DAO to understand the technology.

Disclaimer

The information provided in independent research represents the views of the author and does not constitute investment, trading or financial advice. BeinCrypto does not recommend buying, selling, trading, holding or investing in any cryptocurrencies